Japan’s manufacturing new orders have surged!

They have risen over 25% since June 2014. The rise since this January has been almost vertical. So how is it that investors are seemingly overlooking this huge increase? With current developments in China and US, investor attention may simply have been diverted.

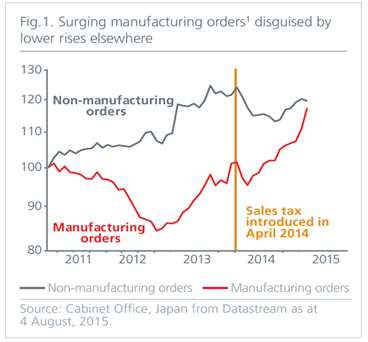

Figure 1 below provides another possible, more intriguing, reason, which, if correct, suggests some strong sales and profit figures in the not too distant future.

Strong order rebound disguised

Non-manufacturing new orders, until recently, were falling; these had surged in 2013 in anticipation of the new sales tax in April 2014. Not unexpectedly, they declined after the introduction of the tax. But their fall dampened total headline figures and so disguised the strong rebound in manufacturing orders. (These too had been impacted by the arrival of the sales tax, but to a much lesser extent). With non-manufacturing orders again rising, total headline new orders could be strong in the coming months.

Strong orders equals strong sales

Corporate sales forecasts in Japan have been relatively strong compared with other major markets (see Fig.2). But sales growth forecasts stalled in 2014 presumably reflecting the post sales tax pause in actual sales. The overall impression one gets is that the underlying surge in manufacturing orders has escaped the notice of many analysts. The recent uptick in forecasts suggests that some analysts are beginning to see the bigger picture.

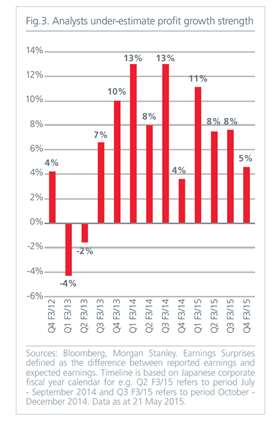

Profit growth underestimated

If we are correct in our reasoning, we have a very good explanation as to why the actual profits announcements have exceeded the consensus profit forecasts for the past ten straight quarters – analysts have missed the upswing in manufacturing orders and so are lowballing their profit forecasts! With the reporting season underway, we would be surprised if we did not see further profit outperformance.

Domestic orders are in the driver's seat

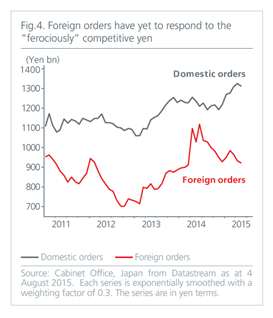

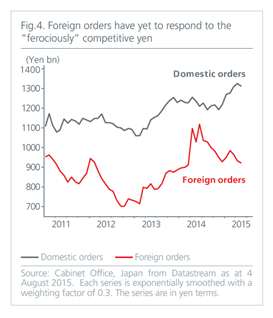

The encouraging news is that rising domestic demand seems to be driving the surge in new orders. As domestic activity accounts for around 88% of Japan’s economy, the bounce back in domestic orders should be a harbinger of good news – especially as export growth resulting from the weak yen has still to cut in. Refer to Fig.4.

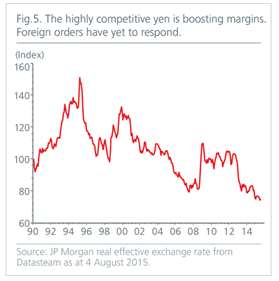

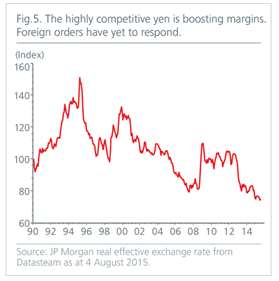

The ferociously competitive yen

With the yen already at a 40 year low3, it is just a matter of time before exports begin to respond.

It also seems that the Bank of Japan does not want to see the yen weaken much further on a trade weighted basis according to Governor Kuroda4. Fears of further currency losses seem less likely to be realised.

The Japan story is heating up

All in all, Japan’s underlying corporate growth looks stronger than given credit. More significantly, growth is forecast where it will benefit investors i.e. in rising corporate sales (and ultimately profits). Better still, this bullish outlook has only been partially discounted as Fig.6. below illustrates.

The contrast with the US is stark. Japan looks poised to have a good second half.

Robert Rountree is director, global market strategy of Eastspring Investments