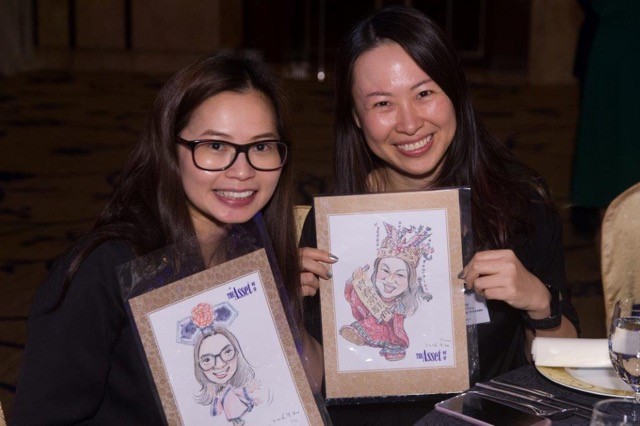

The lower-for-longer interest rate outlook did not dampen the evening as the best private bankers, wealth managers, structured product and ETF providers celebrated a new high in another year of The Asset Triple A Awards.

A total of 145 bankers and clients from 41 banks and institutions attended the The Asset Private Banking, Wealth Management, Investment and ETF Awards 2016 gala dinner, where the industry's remarkable achievements, both on a corporate and individual basis, were recognized.

Growing demand for advisory services and long-term strategies has emerged as one of the themes in the private banking and wealth management landscape in recent years. With the region’s rapidly growing wealth, clients’ focus is shifting towards wealth preservation and transition. Meanwhile, generating decent returns with interest rates at rock-bottom levels is a constant concern.

“It is in these difficult times when investors and clients really need their private bankers, wealth managers and product manufacturers as they search for yield in what seems to be a hopelessly low interest rate environment. They say its lower-for-longer, but for HNWIs (high-net-worth individuals) it’s more like lower forever," says Bayani Cruz, The Asset executive editor in his opening remarks at the awards dinner on September 20 at the Four Seasons Hotel Hong Kong.

The participation in the awards has grown exponentially in the past few years as industry participants responded to the rapid growth in Asian wealth.

In 2015, the assets of HNWIs in the region more than doubled the global average of 4%. Asia recorded US$17.4 trillion in HNWI wealth in the period, according CapGemini's World Wealth Report.

Honoured as Private Banker of the Year, Asia was Thomas Meier, former chief executive officer Asia and head corporate sustainability at Bank Julius Baer, who flew in from Geneva to receive his award. As part of The Asset tradition last year’s Private Banker of the Year, Hong Kong awardee Mignonne Cheng, chairman and chief executive officer, Asia Pacific of BNP Paribas Wealth Management Asia Pacific handed the award to Meier.

Also honoured with the Industry Leadership Award – Cross Assets, Asia was Frank Drouet former head of global markets for Asia Pacific and head of global markets at Société Générale. Drouet flew in from Paris to receive his award.

Also honoured with the Industry Leadership Award – ETFs was Julian Liu Tsung Sheng, president and CEO of Yuanta Securities Trust Co in Taiwan.

This year The Asset received almost 100 submissions from 52 banks, double the number compared to seven years ago. Processing the submissions took six weeks of intense pitch meetings, teleconferences and clients calls.

“This (strong participation) tells us that private banks and wealth managers have been responding well to the challenges and requirements of servicing their HNWI clients,” says one banker who attended the dinner.

For a complete list of awardees, please click here.