Traditionally a paper-based process, the world of trade finance has been going through a digital transformation over the past several years. From bank payment obligations (BPO) to e-documentation, technology vendors have been pushing hard to onboard more trade finance banks onto their platforms.

The journey of trade finance digitization got a boost early in 2017, when Bank of China became the first of China’s “Big Four” banks to use Bolero’s electronic trade document platform, aimed at benefiting its exporters. According to Bolero, the move by Bank of China was the result of its clients demanding better visibility and control over documents, such as letters of credit, when transacting with international partners.

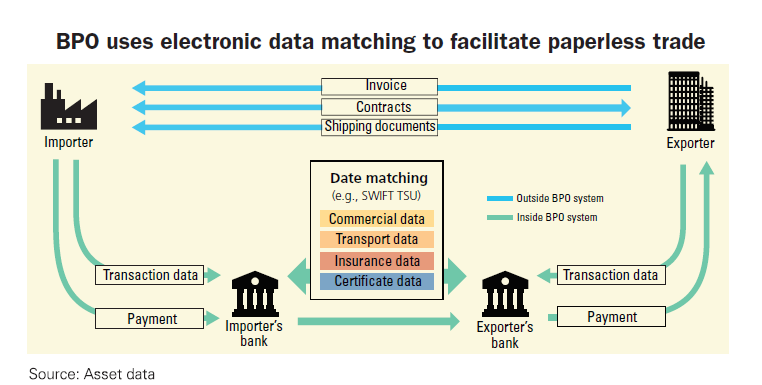

Swift’s BPO solution, which has been around since 2013, is still gaining favour with businesses and banks. The key for this market to grow further will depend on the support of multilateral development banks such as the Asian Development Bank in encouraging local banks and small and medium enterprises (SMEs) to transact on this platform. Much like a traditional letter of credit, both commercial banks involved in the deal will gain full visibility on transactional details.

Swift’s BPO solution, which has been around since 2013, is still gaining favour with businesses and banks. The key for this market to grow further will depend on the support of multilateral development banks such as the Asian Development Bank in encouraging local banks and small and medium enterprises (SMEs) to transact on this platform. Much like a traditional letter of credit, both commercial banks involved in the deal will gain full visibility on transactional details.Other trade transactional solutions based on the blockchain principle have developed over the past few months. Earlier this year, Postal Savings Bank of China together with IBM, developed an internal blockchain asset custody system to help with credit verifications on prospective customers. The bank said they had conducted around 100 transactions on the system.

“It [blockchain] essentially is a mechanism for imposing requirements on a network of validating computers to prove the information that is being transacted. The bigger the number of users and holders of that ledger, the safer it is. If one ledger goes down there will be multiple other ones. That also means that the bigger it is, the harder it is to attack,” says Michael Casey, senior adviser, blockchain opportunities at MIT Media Lab. In other words, blockchain’s security strength lies in its decentralized nature.

In Europe, banks including Deutsche Bank, HSBC, KBC, Natixis, Rabobank, Société Générale, and UniCredit have signed a trade finance agreement to develop a shared blockchain platform called Digital Trade Chain. The solution aims to simplify trade finance processes for SMEs by reducing administrative paperwork and by maintaining secured records on a digital distributed ledger.

Yet despite the prospects, challenges still remain for blockchain usage in overall documentation verification. “The (blockchain) key is effectively being used as a password for me to access my data. Once we push data like this on the end user they have control of it. However, we do also have to think hard about how we manage those keys. If you lose the key you lose access to your data,” says Casey.

Other obstacles around blockchain usage stem around trying to get all market stakeholders, from the banks to the financial regulators, involved in a common blockchain-based system. The consortium R3, which works with over 70 banks in blockchain experiments recently saw the departure of Goldman Sachs, Santander, Morgan Stanley and the National Australian Bank.

Electronic supply chain platforms, in addition to electronic trade documentation solutions, are another area that could evolve. One type of supply chain technology solution involves dynamic discounting on a shared platform. Aside from offering buyers additional payment flexibility, dynamic discounting also allows buyers to earn risk-free returns on their available liquidity.

While these various technological trade solutions are exciting to see in the marketplace, they are only solving specific needs within the entire trade network. Whether there will be a system that integrates all the information of a supply chain, from financing to procurement, will be the next interesting development in trade technology.

.jpg)

.jpg)