China’s securitization market has seen a number of innovative deals from the likes of Volkswagen and BMW over the past few years, thanks to China’s move to further liberalized the market. This year, while international car makers remain active in the issuance of asset-backed securities (ABS), technology firms such as Ant Financial and JD Finance are emerging as its strongest players.

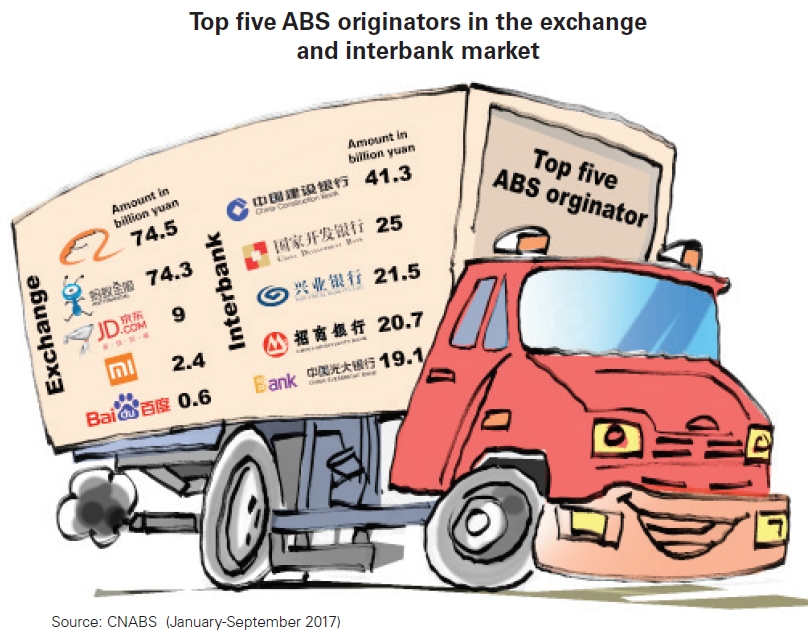

Until recently, the origination of China’s securitization market was dominated by banks. But Alibaba and Ant Financial together originated consumer finance-related ABS of 148.8 billion yuan (US$22.4 billion) in the first three quarters of 2017, making them China’s largest ABS originators in the securitization market, data from China Securitization Analytics (CNABS) show.

The market for consumer finance ABS has seen a dizzying rise in 2017. For the first three quarters, the total issue size of ABS was 823.8 billion yuan. Consumer finance accounted for 26% of total or 214.3 billion yuan. That segment represented a four-fold increase from a year ago.

On the back of massive consumption originating among China’s young population, the role of China’s e-commerce companies such as Alibaba and JD.com have evolved. From the mere trade of goods, the companies have started extending consumer loans to retail customers, helping them amass a huge amount of loan assets.

“When you have the assets, making an ABS is just a matter of course,” says Chi Zhang, rating director, structured finance at China Lianhe Credit Rating in an interview with The Asset. “Consumer loan is a good underlying asset for ABS. They’re in small amounts, diversified and likely to obtain high return. This can be calculated under the law of large number.”

According to Zhang, consumer finance ABS comprises thousands of loans, and mostly are in small amounts – a negligible portion of the asset pool. Most investors regard a widely diversified asset pool to be less risky.

In addition, with new technology involved in ABS structures, it becomes easier for issuers and originators to be able to track data and integrate with other participants in the transactions. In September, Baidu originated its first blockchain-based ABS amounting 400 million yuan on the Shanghai Stock Exchange.

Booming exchange market

Currently, four ABS schemes are available in China, namely, Credit Asset Securitization Scheme (CASS), Asset Back Securitization Plan (ABSP), Asset Backed Notes and Insurance ABS. About 98% of new ABS were issued under the first two schemes in 2016.

Currently, four ABS schemes are available in China, namely, Credit Asset Securitization Scheme (CASS), Asset Back Securitization Plan (ABSP), Asset Backed Notes and Insurance ABS. About 98% of new ABS were issued under the first two schemes in 2016.

While CASS is the gateway for financial institutions such as banks, the exchange market is the most favourable platform for corporates to originate ABS. In 2016, ABSP saw an 115% growth in issuance, for the first time surpassing CASS, according to China Central Depository & Clearing Co.

Just like banks that turn to the securitization market to meet regulators’ capital requirements, an increasing number of large Chinese corporates are taking certain assets off their balance sheets to help retain liquidity in their daily operations. This has given rise to the dramatic growth of the ABSP scheme.

In August 2016, Ant Financial completed its first consumer loan ABS on the Shanghai Stock Exchange where Tebon Securities acted as a special purpose vehicle (SPV), marking the first consumer loan ABS issuance by a technology company in an exchange market. According to Ant Financial, its debut ABS was oversubscribed by asset managers, insurance companies and banks.

On top of loans, eligible underlying assets of ABSP also include traditional transaction-banking-type of assets such as corporate receivables and debt obligations. In 2016, loans accounted for 16% of the total underlying assets in ABSP, while transaction-banking-type of assets took up over 75%.

Unlike CASS where a trust company acts as an SPV, a securities company is required to purchase the assets and issue the securities as an SPV under the ABSP. In addition, the China Securities Regulatory Commission regulates the exchange market (ABSP), while the China Banking Regulatory Commission and the People’s Bank of China oversee the interbank market (CASS).

The securitization industry is seeing a boom at a time when China is moving toward a consumption-led economy. In 2016, retail consumption accounted for over 20% of China’s GDP. In particular, 17.9% of total consumption was driven by short-term loans, according to local firm Iresearch.

Data from China Merchants Securities estimate the country’s outstanding consumer loans reached 5.4 trillion yuan in 2016, growing by an average 16.4% from 2011 to 2016.

Zhang said a number of bankers are now jumping ship to join consumer finance companies. As of August 2017, there are 153 registered small loan companies and 24 consumer finance companies in China.

The proliferation of consumer finance firms, however, meant many of them don’t have the operating track record nor the consumer data that bigger finance companies have, making credit assessment a challenge.

Industry leaders like Alibaba and JD.com are adopting a more mature internal credit assessment system based on big data analysis of their customers.

“As a rating agency, we require static pool data, but not all of them can offer that because they just started their business,” explains Zhang. “New companies and new businesses – these are the two challenges facing the industry.”

During the global financial crisis in 2008, mortgage-backed securities were blamed for the near-collapse of the global financial system. Looking at China and its burgeoning securitization market, Zhang believes that the risks behind the consumer finance ABS sector remain manageable.

“If there is no sub-prime like crisis in China that can cause a significant detriment to the domestic economy, it is unlikely that the structure of the consumer finance ABS will be damaged.”

To learn more about China's securitization markets, please visit here

.jpg)

.jpg)