Amid the coronavirus pandemic, global sustainable lending declined 2% year-on-year to US$79.1 billion in the first half of 2020, and plunged 32% to US$31.9 billion in the first quarter, making it the slowest quarter for the category since the first three months of 2019, financial market data provider Refinitiv said in its latest “Sustainable Finance Review”.

However, while sustainable lending in the Americas fell 24% year-on-year in the first half, it increased 3% in Asia Pacific during the period. Sustainable loan activity in Japan and Africa/Middle East rose by double-digit percentages compared to 2019 levels, the report says.

Sustainable loans for the period reached US$49.8 billion in Europe, US$14.2 billion in the Americas, US$9.4 billion in Asia Pacific, US$3.3 billion in Japan, and US$2.4 billion in Africa and the Middle East.

Mergers and acquisitions involving sustainable companies rose to a two-year high in the first half of 2020, Refinitiv says. China accounted for 20 percent of the total sustainable M&A activity during the period, followed by the United States (9%), India and Italy (7% each). Asia Pacific was the busiest in deal-making activity under the category, representing 40% in terms of value, followed by Europe (38%) and the Americas (21%).

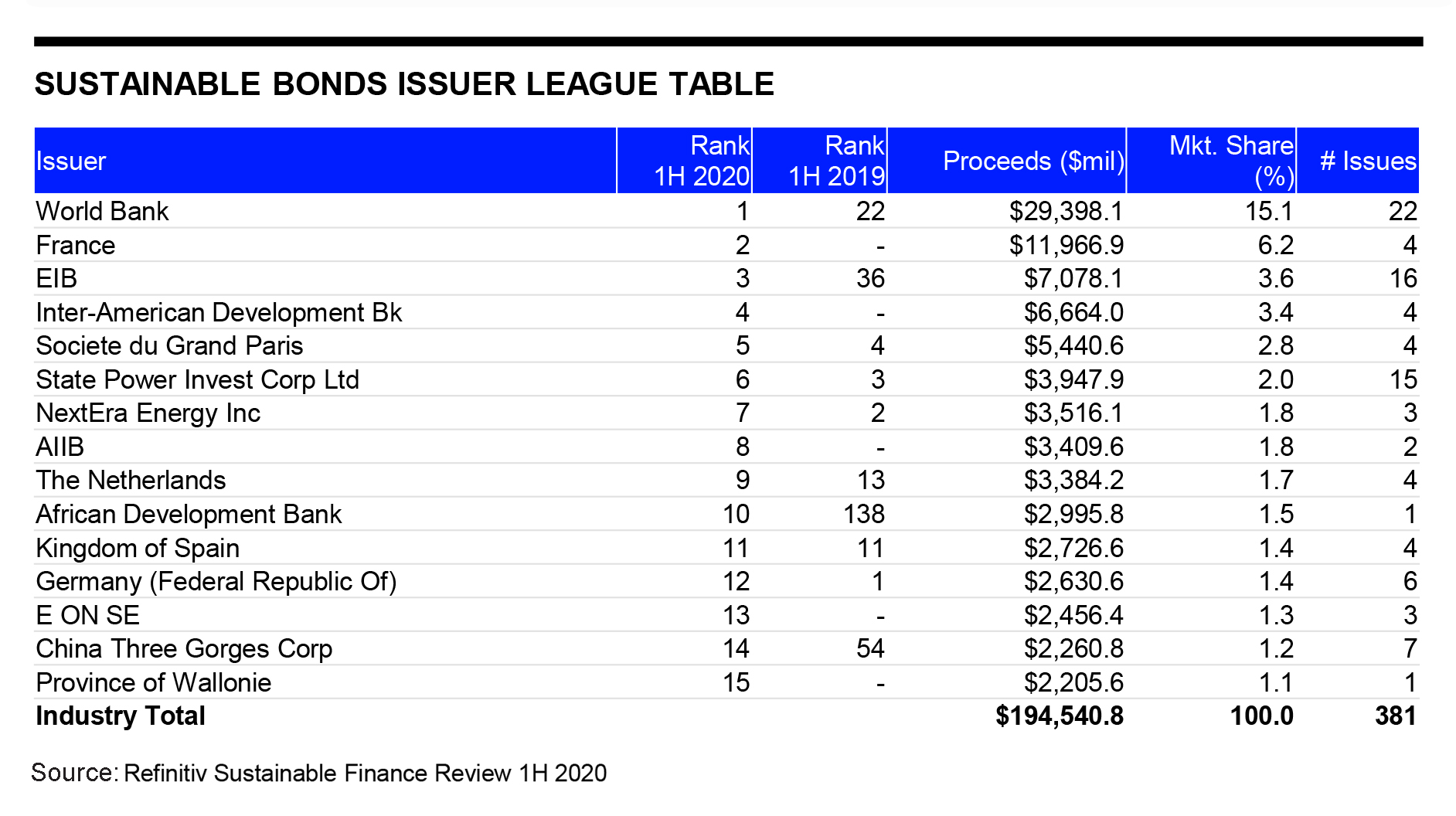

Globally, issuance of sustainable bonds reached US$130.9 billion in the second quarter of 2020, more than double the value recorded in the previous three months and marking the highest quarterly total since 2015, Refinitiv says. For the first six months, sustainable bonds totalled US$194.5 billion, up 47% from the same period in 2019 and more than double the value recorded in the first half of 2018.

The issuance of social bonds accelerated in the second quarter, driven by an increase in capital raising by sovereigns, multilaterals and banks for Covid-19 relief and recovery efforts. Social bonds worth US$44.8 billion were recorded globally during the first half of 2020, more than double the total raised for the whole of 2019. Social bond issuance accounts for almost one-quarter of the sustainable bond market in the first half of 2020, compared with less than 5% during the same period in 2019, the report says.

Strong demand for responsible investment continued to drive green bond issuance, which totalled US$49.5 billion during the second quarter of 2020, the third highest quarterly total since 2015. For the first half of 2020, green bonds worth US$77.7 billion were issued, 13% less than the value recorded during the same period in 2019.

Sustainability bond issuance reached US$56.7 billion in the first half of 2020, more than double the levels seen in the same period in 2010. The number of sustainable bonds increased 94% from a year ago.

Europe is the largest regional market offering sustainable bonds with 46% market share so far in 2020, compared to 32% in the Americas and 16% in Asia Pacific.

HSBC maintained the top spot for sustainable bond underwriting with 6.3% market share, an increase of 0.3 market share points compared to a year ago. Barclays and JP Morgan rounded out the top three underwriters during first half 2020.

Meanwhile, equity capital markets activity for sustainable companies reached US$4.0 billion in the first half of 2020, down 21% from a year ago. Amid increased volatility due to the Covid-19 pandemic, equity issuance in the second quarter totalled US$1.5 billion, a 43% decline from the first three months of this year and a 59% drop from the second quarter of 2019.

The Americas accounted for 79% of overall equity capital markets activity during the first half of 2020, followed by Europe with 16%, Refinitiv says. BofA Securities, JP Morgan and Wells Fargo topped the list of bookrunners for sustainable equity offerings during the period, each with more than 20% market share.