Over 60% of retail investors in the Asia-Pacific region recognize the importance of sustainable investing, continuing a positive trend that has developed over recent years. However, more than a third (36%) feel there is a trade-off between investing sustainably and achieving a good return, according to a recent survey.

The survey, conducted annually by Fidelity International, had more than 12,000 respondents from across six Asia-Pacific markets – mainland China, Hong Kong, Taiwan, Singapore, Japan and Australia – with the aim of analyzing the sentiment of individual savers and investors towards environmental, social and governance (ESG) and sustainable investing.

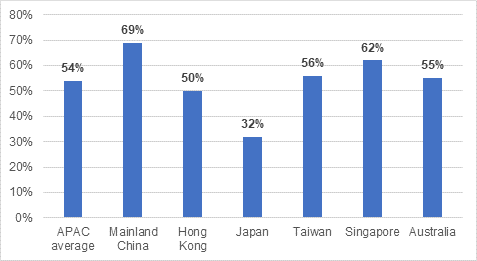

Asia-Pacific investors, the survey finds, are becoming increasingly positive towards the concept of sustainable investing, continuing a trend noted in 2021. More than half (54%) of respondents express their desire to use their money to make a positive change in the world, with 56% believing that investors have the power to change corporate behaviour through their own investing actions.

Of the six markets surveyed, mainland China and Singapore are the two markets where investors are most interested in realising positive change through investing.

Percentage of respondents interested in having their money make a positive change

Source: Fidelity International, 2022

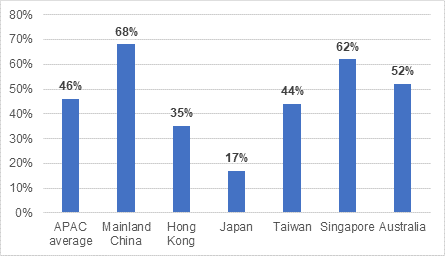

However, respondents also indicate some concerns when it comes to the promises being made on sustainable investing at its current stage of development. Almost half (46%) of investors feel the definition for what qualifies as sustainable investing seems subjective, with a lack of clear definitions for investment managers to follow.

And 49% feel sustainable investments and their providers lack regulatory oversight in relation to the promises they make. Interestingly, in mainland China and Singapore where there is the highest level of interest in sustainable investing, there is also the greatest level of concern over the lack of clear guidelines.

Percentage of respondents who feel sustainable investing seems subjective and lacks clear guidelines of providers to follow

Source: Fidelity International, 2022

Among the range of ESG-related issues where investors are most keen to make a positive change, climate change tops the list in all surveyed markets, followed by sustainable consumption and broader social issues.

“Sustainable investing is becoming a mainstream investment theme across the Asia-Pacific region, and we are encouraged to see retail investors’ interest in sustainability continue to grow,” says Jenn-Hui Tan, global head of stewardship and sustainable investing at Fidelity International. “Clearly, there are concerns about how ESG-related financial products are living up to their promises, which the financial services industry needs to address.”