Singapore will introduce mandatory climate-related disclosures (CRD) in a phased approach, in line with the recommendations of its Sustainability Reporting Advisory Committee, as part of the government’s efforts to help companies strengthen their sustainability capabilities.

The announcement was made by Chee Hong Tat, the city-state’s second minister for finance, while Singapore’s Accounting and Corporate Regulatory Authority (ACRA), which is responsible for violations of disclosure laws, and Singapore Exchange Regulation (SGX RegCo), which regulates capital markets, provided the details for mandatory climate reporting by listed issuers and large non-listed companies (NLCos) – defined as those with annual revenue of at least S$1 billion (US$743 million) and total assets of at least S$500 million.

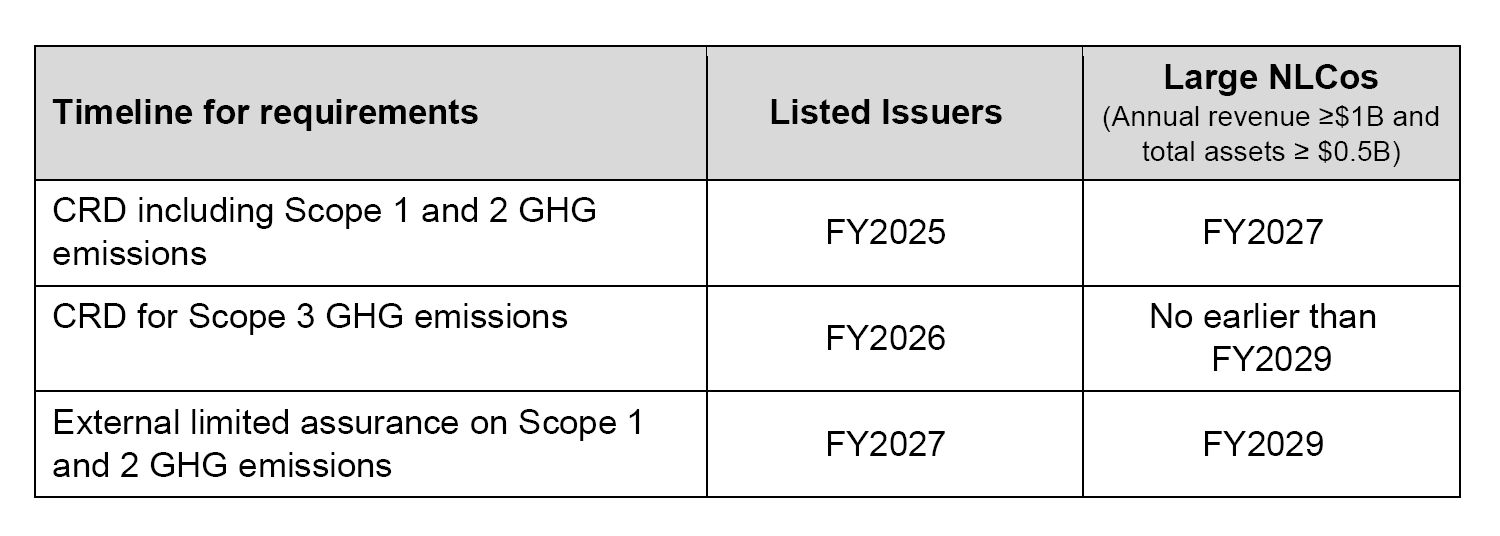

Notably, from FY2025, all listed issuers will be required to report and file annual CRD using requirements aligned with the International Sustainability Standards Board; and, from FY2027, large NLCos will be required to do the same.

ACRA will review the experience of listed issuers and large NLCos before introducing reporting requirements for other companies. More time will be given for companies to report CRD on Scope 3 greenhouse gas (GHG) emissions and conduct external limited assurance on Scope 1 and 2 GHG emissions.

The timeline for the implementation of mandatory CRD is summarised below:

“ACRA is committed to sustainability and environmental responsibility, and to making Singapore the best place for business,” say Ong Khiaw Hong, the authority’s chief executive. “That is why we are working actively with SGX RegCo and the business community to advance climate reporting in Singapore, a crucial step in addressing the pressing challenges of climate change.”

Tan Boon Gin, chief executive officer of SGX RegCo, adds: “SGX-listed issuers have had a head start in climate reporting and many have seen its benefits. Companies are better equipped to meet demand from their lenders, customers and investors for sustainability-related information. They can also more readily access the growing pool of sustainable capital. These position Singapore well as a green economy.”