Carbon-intensive debt securities tend to be larger with a longer tenor and attract higher credit ratings than other non-financial corporate debt, according to analysis from a recently released report.

With a total of US$5.5 trillion outstanding as of June 2023, carbon-intensive debt remains an important feature of global fixed-income markets, accounting for 29.5% of total non-financial corporate debt and, in aggregate, will surpass the size of any other non-financial sector, finds the Tracing Carbon Intensive Debt: Identifying and Calibrating Climate Risks in Corporate Fixed Income (March 2023) report published by FSTE Russell.

Compared with listed equities (where the same carbon-intensive sectors accounted for 19.6% of global market capitalization, excluding financials), this also makes corporate fixed income significantly more carbon-intensive as an asset class, notes the report, which investigated the debt financing of carbon-intensive companies by examining approximately 7.8 million securities issued between 2000 and June 2023 and identifying over 480,000 carbon-intensive corporate debt instruments.

And while approximately US$1.9 trillion of carbon-intensive debt is owed by listed companies – whose transition plans are often closely tracked by investors and other stakeholders – almost two-thirds of carbon-intensive debt, the report points out, is owed by privately held companies (US$2.1 trillion) or state-owned enterprises (US$1.5 trillion), both of which are often subject to much less scrutiny.

Refinancing challenges

Against the backdrop of an accelerating low-carbon transition, the report argues, refinancing carbon-intensive debt presents issuers and investors with increasingly urgent and complex challenges, as over half of carbon-intensive debt is set to mature before the end of this decade, with global fixed-income markets needing to refinance approximately US$600 billion each year.

At the same time, carbon-intensive issuers have increasingly relied on shorter-term debt to finance their activities – with the weighted average tenor of annual carbon-intensive debt issuance dropping from 7.4 years in 2010 to 4.2 years in 2022.

Faced with growing regulatory pressure and an uncertain long-term demand outlook, carbon-intensive businesses, the report suggests, may choose to pursue varying refinancing strategies.

Notably, green debt (including both labelled and de facto green bonds) still plays a limited role in carbon-intensive sectors, the report finds, accounting for 8.2% of 2022 issuance and 7.7% of the sectors’ total outstanding debt.

Carbon-intensive sectors’ green debt, the report adds, is mainly concentrated in electric utilities and autos – with a combined approximate 85% share by outstanding amount. By contrast, in sectors like oil and gas, aluminium and airlines, where the transition is less advanced, green debt plays a much smaller role, making up less than 1% of each sector’s total outstanding debt.

Our other key report findings include:

● In 2022 alone, US$1.4 trillion of carbon-intensive debt was raised through over 35,000 individual debt securities.

● Energy companies account for roughly two-thirds of carbon-intensive debt, with electric utilities at the top (with US$1.9 trillion outstanding), followed by oil and gas (US$1.1 trillion).

● The share of emerging markets (EMs) in annual issuance of carbon-intensive debt has increased from 4% in 2000 to 41% in 2022, and EMs now account for a third of the outstanding debt.

● Only 20% of carbon-intensive debt issued in 2022 was US dollar-denominated (down from 54% in 2000). Meanwhile, yuan-denominated debt now accounts for one-third of the total new issuance in the same year.

● US and Chinese corporates account for approximately US$2.6 trillion of outstanding carbon-intensive debt, but the share of carbon-intensive debt in their respective corporate bond market is below the global average. In contrast, carbon-intensive debt makes up over two-thirds of the non-financial corporate debt in Saudi Arabia, Russia and Indonesia.

● The outstanding carbon-intensive debt is dominated by an investment-grade rating with US$3.2 trillion (or 59%), while the US$0.6 trillion worth of high-yield debt accounts for 10%, and the remaining US$1.7 trillion (or 31%) is not rated.

● Carbon-intensive sectors have a greater concentration of long-term debt, with 46% of the outstanding carbon-intensive debt issued having a tenor longer than 10 years and 16% exceeding 30 years, compared with 39% and 12%, respectively, in other non-financial corporate debt.

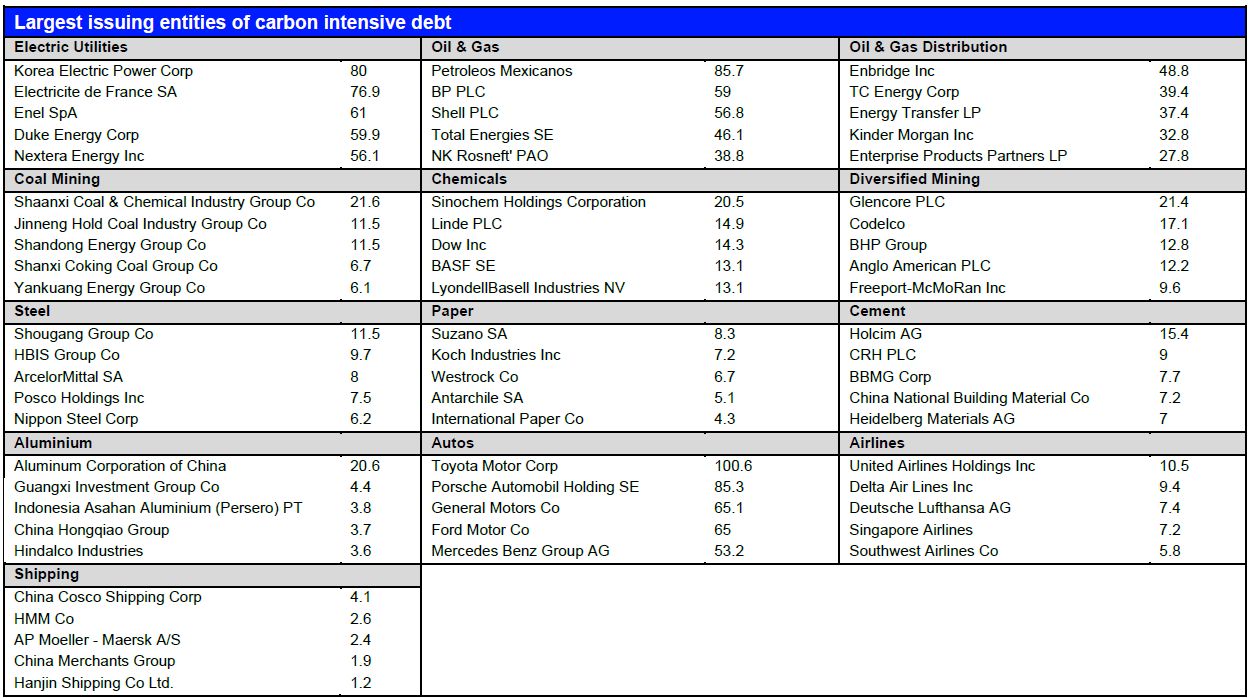

Table: Top five borrowers with most outstanding debt in carbon-intensive sectors

(in US$ billions, as of June 2023)

Source: LSEG, 2024