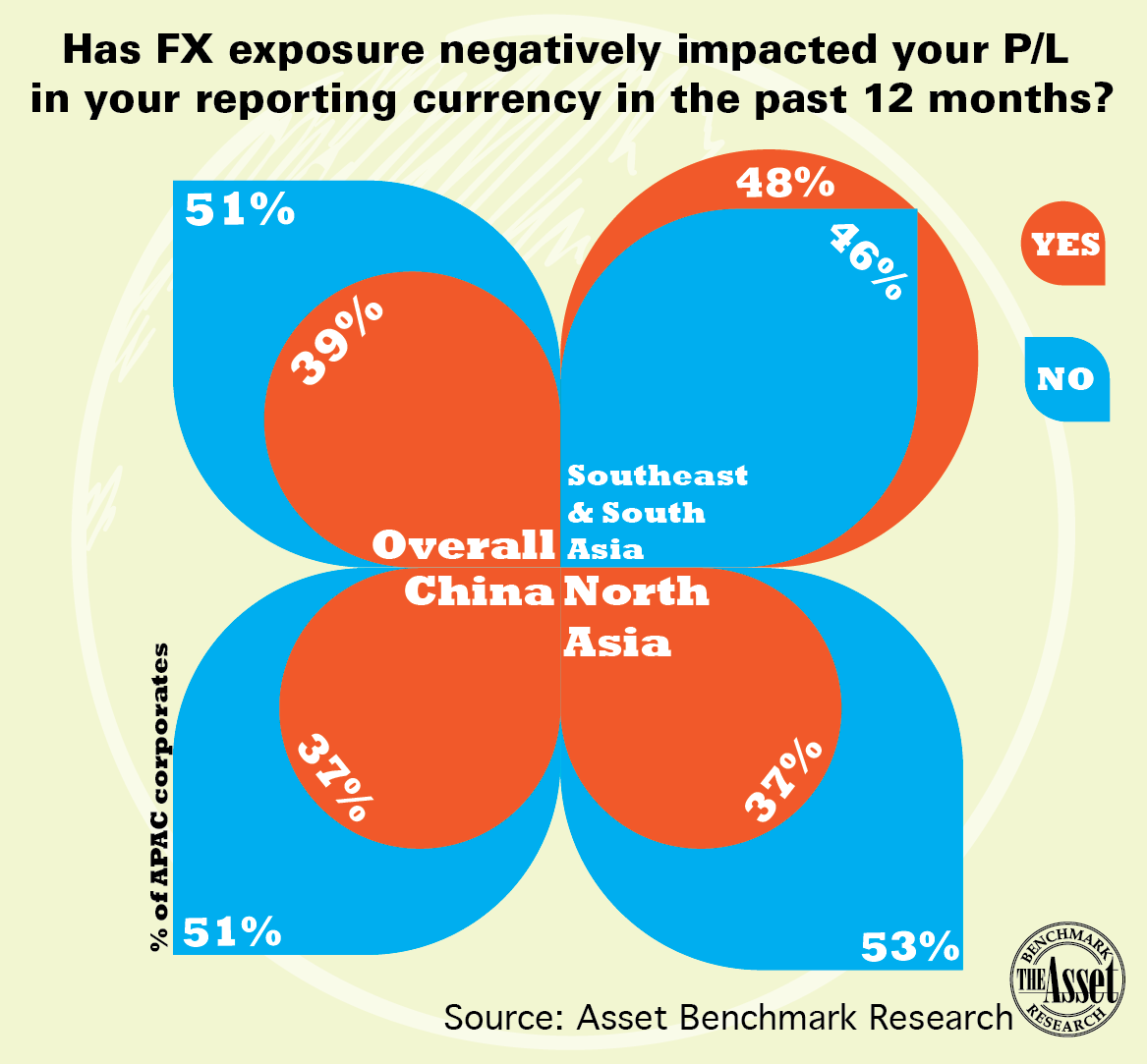

Nearly half of corporates in Southeast Asia (48%) state bottom line performance has been impacted negatively by FX exposure in 2015, a survey among 1,123 corporate treasurers by Asset Benchmark Research has found.

Southeast Asian corporates are the region’s most exposed companies to FX exposure, suffering from illiquid hedging markets, low penetration of their home currencies in international trade and their (growing) export focus. Overall in Asia, 39% of corporate treasurers and CFOs had to communicate hits to profitability due to FX exposure, arising from transactional, translational and/or economic exposure to currencies.

The negative impact was lowest among Chinese enterprises, likely a reflection of the higher predictability of the exchange rate (on most days) and the growing use of the renminbi in international trade finance.

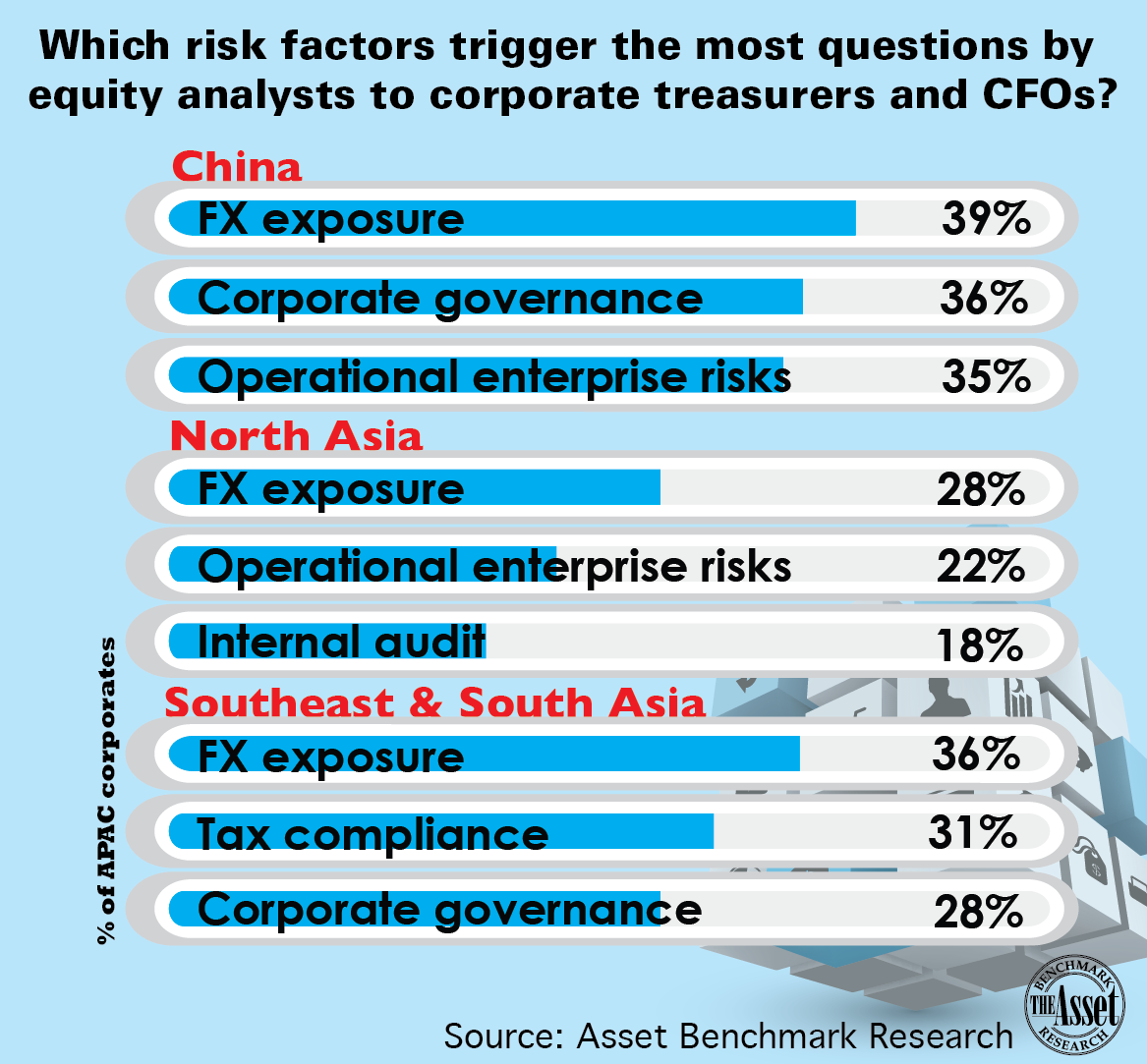

Asset Benchmark Research also asked corporate treasurers which risk factors raised more enquiries by stock and credit analysts covering their business. FX exposure ranks first in all regions of Asia. Chinese enterprises also fielded more questions on corporate governance (36%) and operational risks (35%), while companies in North Asia outside China were concerned with operational risks (22%) and internal audit processes (18%). In Southeast and South Asia, analysts posed more questions on tax compliance (31%) and corporate governance (28%).

Click here to learn more about Asset Benchmark Research and learn how Asia’s corporates deal with rising risks in this new report, published in cooperation with Thomson Reuters.