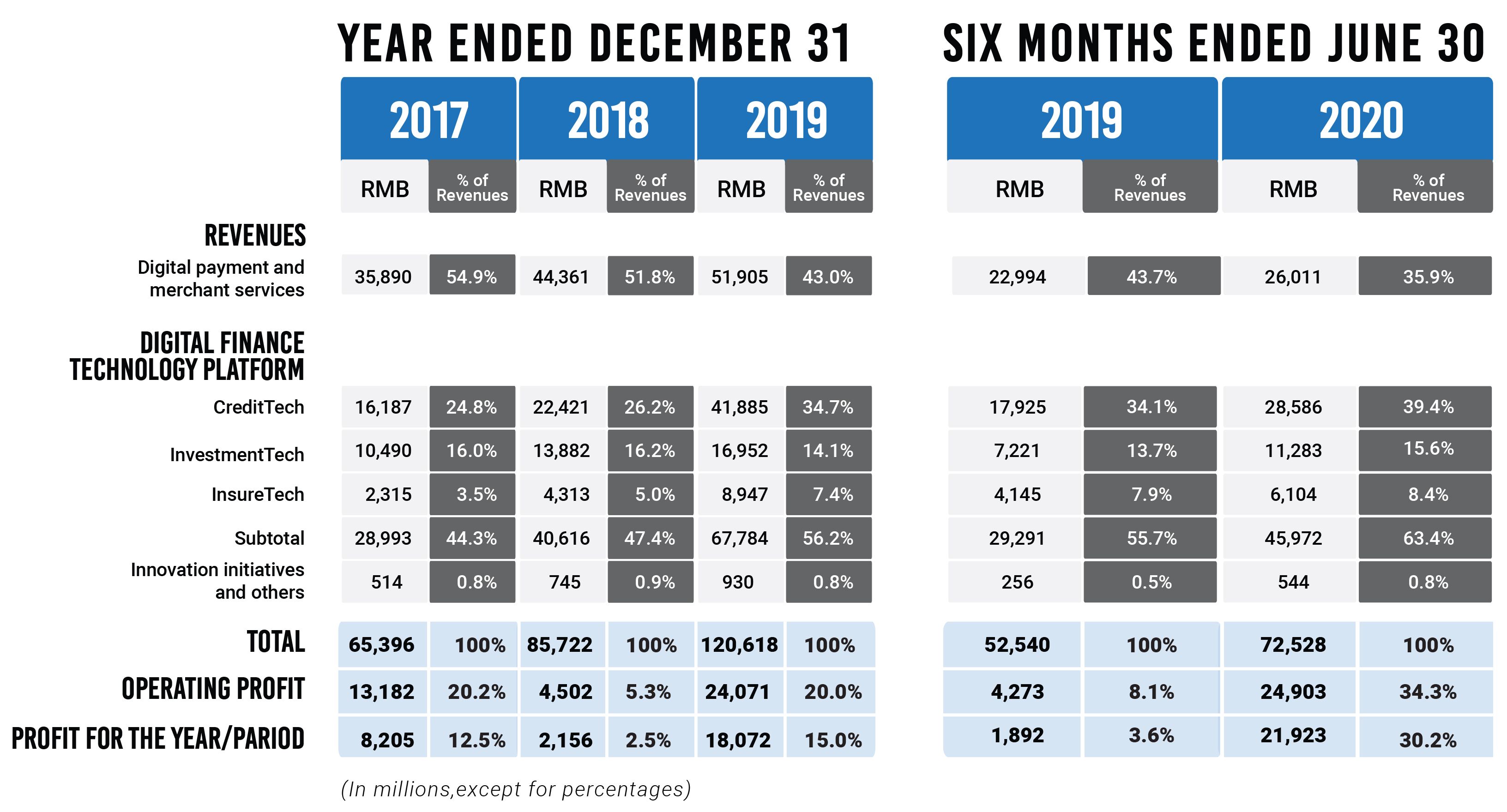

AS Ant Group filed for dual listing in Shanghai and Hong Kong, the deal is set to become the largest IPO globally in 2020. While Ant Group’s high profit margin was well-anticipated, the latest income statement and profitability still surprised most investors.

According to the prospectus, as of the end of June, Ant group recorded revenue of 72.5 billion yuan (US$10.5 billion) and net profit of 21.9 billion yuan, representing 38% and ten times year-on-year growth, respectively. The 30.2% net profit margin of Ant Group is much higher than its parent Alibaba’s 26.4% in the same period.

As a cash cow and profit machine for Alibaba Group, Ant has two major revenue streams including digital payment & merchant services (Alipay) and CreditTech (SME loans and consumer loans). The two businesses constituted 75.3% of total revenue.

As of June, over 500 million users have obtained consumer loans from Ant Group over the past 12 months. In contrast, China Construction Bank, China’s second largest bank, only exceeded 100 million credit card users in May.

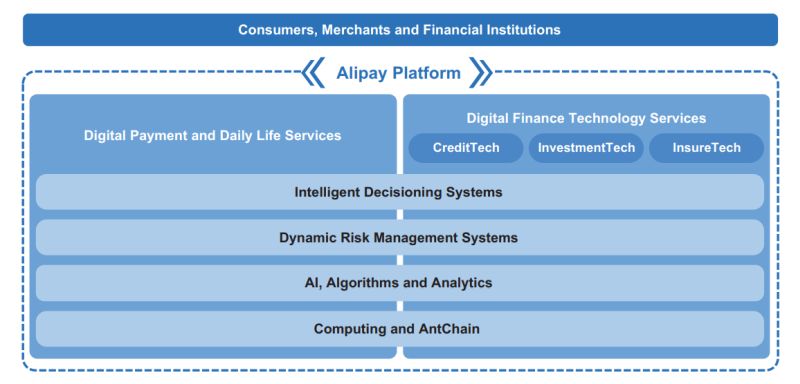

While consumer loan is a major driver of Ant’s growth, the business model, however, is entirely different from financial institutions as the loans do not consume Ant’s balance sheet. In other words, Ant Group only acts as an intermediary in a loan transaction.

In a typical consumer loan transaction, Ant will only charge a technology service fee of 2.08% per transaction from a partner bank that ultimately provides loans and charges interest. Ant also has its own credit scoring system. Based on past user transactions and activities, Ant is able to generate a personal credit score, which indicates the risk profile of its customers.

According to the prospectus, Ant Group has granted over 2.1 trillion-yuan loans outstanding. Ninety-eight percent of the funding came from banks and asset backed securities. As of June 30, Ant Group has partnered with 100 banks to provide loans to its customers.

The other driving force of Ant is its flagship product Alipay. As of the end of June, Alipay has 711 million monthly active users and is servicing over 80 million merchants. For each payment transaction, Alipay only charges 0.05% service fee to the merchants based on the transaction volume. According to Iresearch, Alipay had a 55.4% market share in China in the first quarter.

The explosive growth and profitability has put Ant Group at a hefty valuation of over US$200 billion, which also led to a revaluation of its parent Alibaba Group. Since Ant’s official announcement of its IPO plan on July 20, the share price of Alibaba has surged over 16%.

Citi, J.P. Morgan, Morgan Stanley and CICC were appointed as the joint sponsors of the Hong Kong IPO. For the Shanghai IPO, CICC and China Securities acted as the joint sponsors.