With a total notional amount of 109 trillion yuan (US$16.3 trillion), China’s bond market is now the world's second largest1 and its international appeal continues to grow.

It offers an increasingly diverse range of bonds: corporate (28 trillion yuan), local government (24 trillion yuan), policy bank (17 trillion yuan) and China government (17 trillion yuan).

.png)

China's bond market returns outperform and exchange rate-adjusted returns remain attractive2. From January 2014 to June 2020, the cumulative return of the ChinaBond New Composite Index was 39.78% (before exchange rate adjustment) and 20.54% (after exchange rate adjustment), making it a better performer than bond markets in other major developed countries and elsewhere in the Asia-Pacific region.

.png)

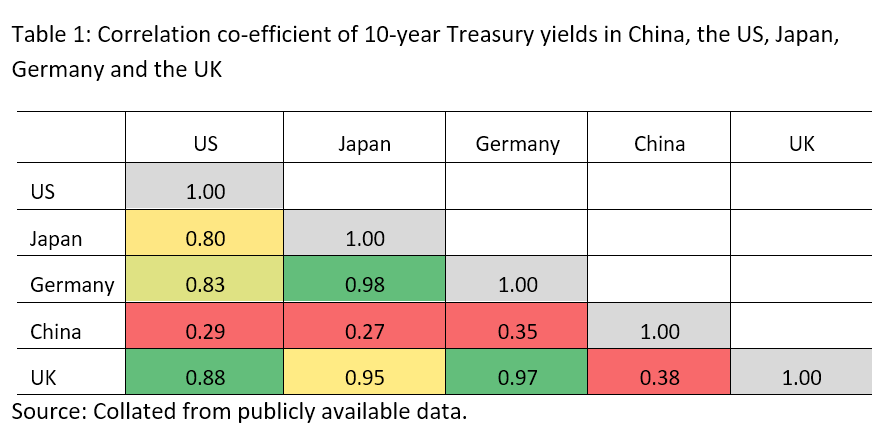

China's bond market has a low correlation with longer established bond markets and could serve as an ideal asset class in global asset allocation. The correlation of 10-year Treasury yields between the US, Japan, Germany and the UK is above 0.8, whereas the correlation between China and other countries is less than 0.43.

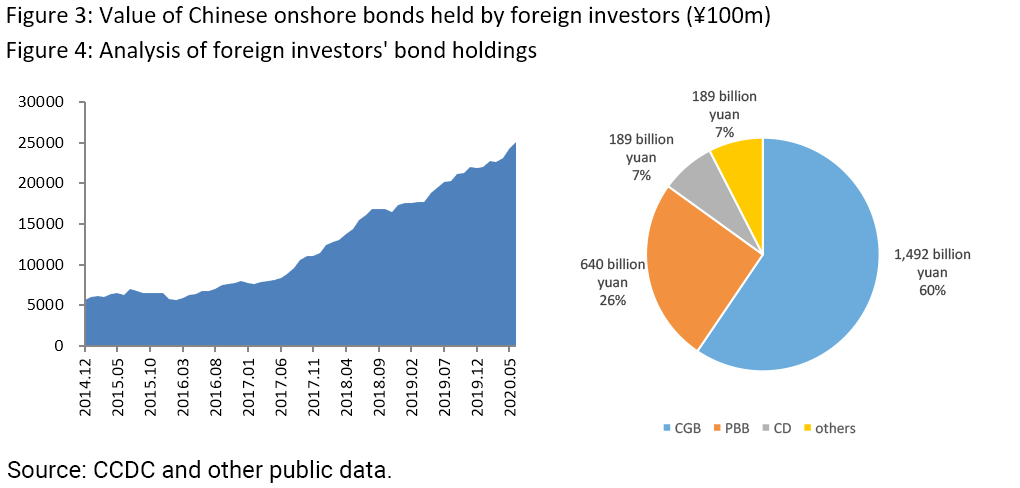

Since 2015, RMB bond holdings by foreign investors have grown by 30% per annum. At the end of June 2020, foreign investors held 2.51 trillion yuan in onshore Chinese bonds, representing 2.7% of the total interbank bond market. About 60% of foreign-held bonds were Chinese government bonds and 26% are policy bank bonds. In recent years, China's bond market has benefited from a series of policies on access, taxation, settlement, capital flows and foreign exchange hedging, which show the vitality of China’s bond market to investors and enable them to capitalize on its opportunities.

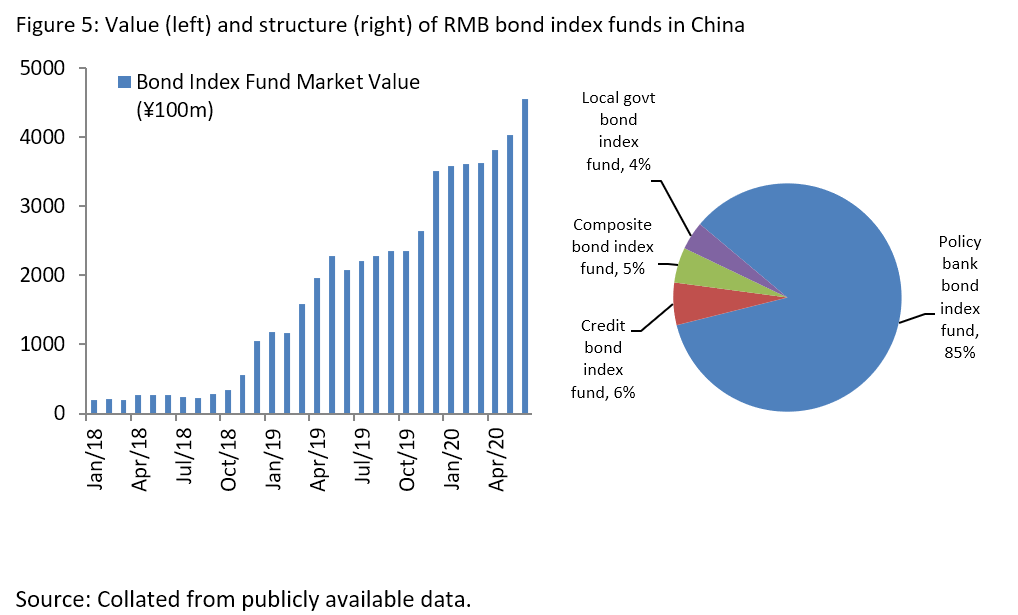

Indexed investment in RMB bonds is booming. While global fixed income ETFs grew rapidly, RMB bond index funds have shown explosive growth in the past three years. By the end of June 2020, there were 133 domestic bond index funds in China with a total value of 455.5 billion yuan, 23x greater than in 2018. Bond index funds represent 9.8% of the total domestic bond fund size. Currently 85% of domestic bond index funds are policy bank bond index funds.

In 2014, the first overseas-listed RMB bond ETF was issued by VanEck and listed on the New York Stock Exchange, using the ChinaBond China High Quality Bond Index issued by China Central Depository & Clearing (CCDC). By June 2020, there were 27 overseas-listed RMB bond ETFs with a total value of 53.6 billion yuan, 99% of which comprised Chinese government bonds and policy bank bond ETFs.

Advantages and ways of index investing in RMB bonds.

The main advantages of index investment in RMB bonds are efficiency and liquidity. Compared with direct purchases of bonds, RMB bond index investment has the following advantages:

First, index funds can provide more liquidity. Even when underlying securities trading is inactive, the redemption mechanism of bond index funds and the ETF secondary market trading offer investors needed liquidity.

Second, index investment is a low-cost investment style. Compared to direct participation in the China interbank bond market to build up one’s portfolio, investing in bond index funds is an easier option.

Third, the high transparency and degree of diversification of indexed investment help to spread credit risk.

Ways for foreign investors to index their investments in RMB bonds. There are currently three ways for foreign investors to index their investments in China's bond market:

First, after the inclusion of China bonds into three major international indices4, investors who track the indices passively increase the allocation of RMB bonds.

Second, international investors can invest in overseas-listed RMB bond ETF products, for which secondary market liquidity is relatively strong. In this way investors do not have to open an account in the China bond market.

Third, in March 2013, the China Securities Regulatory Commission, the People's Bank of China and the Foreign Exchange Bureau jointly issued “Pilot Measures for Securities Investment in China by Qualified Foreign Institutional Investors of RMB” (SFC Order No. 90). It relaxes restrictions on the scope of RQFII investment and now allows direct foreign investment in onshore index funds. Domestic fund managers know more about China's bond market and it is relatively easy for them to transfer positions and offer better portfolio performance.

Typical RMB Bond Indices

The international appeal of RMB bonds, especially government bonds and policy bank bonds, is rapidly increasing. RMB bond index products have potential for further development. In the RMB bond index product area, the index with the highest market share is ChinaBond Indices, which is managed by ChinaBond Pricing Center, a wholly owned subsidiary of CCDC. ChinaBond Pricing Center was also the first provider to publish RMB bond indices, forming a reliable RMB bond index family which conforms to the benchmark principles of IOSCO financial markets.

ChinaBond Indices consists of 12 major index groups and publishes more than 880 indices daily, covering more than 52,000 bonds and 100 trillion yuan in bond assets. In addition to general market indices, ChinaBond Indices also contains green bond indices, smart beta strategy indices, custom indices and other kinds of indices.

Compared to international index providers such as Bloomberg Barclays and FTSE Russell, ChinaBond Indices have unique advantages.

First is its deep root in China’s bond market. ChinaBond Pricing Center issued the first bond yield curve in China, the first bond valuation and the first RMB bond index in China, and has become the most influential financial benchmarks of China’s bond market.

Second is its accuracy in reflecting the characteristics of Chinese bonds. ChinaBond Indices is the only index provider who can access ChinaBond Valuation, which is the most preeminent RMB bond evaluated pricing provider in China. The majority of banks and asset management firms adopted ChinaBond Valuation in their portfolios mark-to-market. By using ChinaBond Indices, investors can reduce unintended tracking errors.

Third is its market neutrality. CCDC is one of the most important financial infrastructures in China’s financial market. It undertakes central custody and securities settlement functions. As its benchmark product, ChinaBond Indices has strong market data accessibility and offers market neutrality.

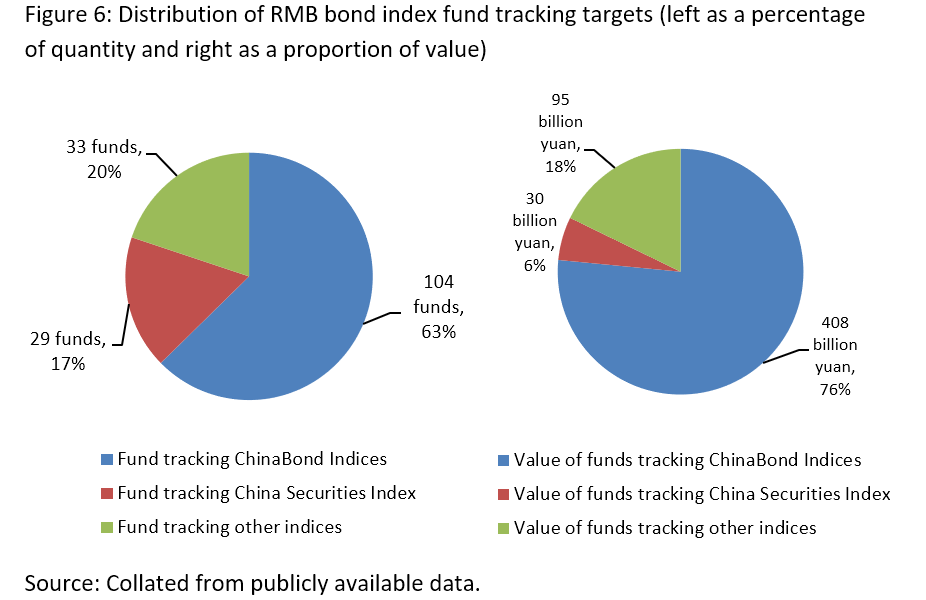

As the leading RMB bond index brand, ChinaBond Indices is the preferred tracking target and performance benchmark for domestic and foreign institutions investing in RMB bonds. The unique advantages of ChinaBond Indices give it top market share in the RMB bond indices, surpassing prominent index providers such as Bloomberg, Barclays and FTSE Russell. At the end of June 2020, among all RMB bond index funds, those tracking ChinaBond indices accounted for 76%, and 85% RMB bond funds used ChinaBond indices as performance benchmarks.

.png)

For performance benchmarking, the most popular RMB bond index is ChinaBond Composite Index. Containing almost all of China's onshore publicly-issued RMB bonds, ChinaBond Composite Index is a broad-based index that fully reflects the performance of China’s onshore RMB bond market.

In terms of passive investment, the current RMB bond index fund sector is dominated by policy bank bond index funds. Among them, ChinaBond 1-3 Year CDB5 Bond Index is the most heavily tracked index, with nearly 100 billion yuan assets tracking the index.

.png)

For investors investing in RMB interest rate bonds, China government bond and policy bank bond indices provide extensive and flexible options. ChinaBond Indices has a total of 48 interest rate bond aggregate indices currently and it can also provide customized index services tailored to the strategic and comparative needs of investors.

For example, in 2019, the Shin Kong China Treasury Policy Bank Green Bond ETF, which tracks the ChinaBond 10-year Treasury and Policy Bank Bond Green Enhanced Index, was listed on the Taiwan Stock Exchange, the first ETF product in Taiwan that includes Chinese RMB green bonds.

As RMB bonds become an increasingly important and indispensable allocation asset for international investors, the advantages of RMB bond index investment will be further highlighted and RMB bond index products will prove to be convenient investment tools, especially for strategic and tactical asset allocation, for global investors.

(1) According to BIS data, the US, China, Japan, UK and German bond markets were worth US$42.4 trn, US$15.0 trn, US$12.9 trn, US$0.6 trn and US$0.4 trn respectively in Q1 2020.

(2) Reference indices: ChinaBond New Composite Index (China); Bloomberg Barclays (all other countries).

(3) Statistics show the correlation coefficients of daily 10-year Treasury yields in various countries from the beginning of 2014 to the end of June 2020.

(4) Bloomberg Barclays Global Aggregate Total Return Index, JPMorgan Government Bond Index Emerging Markets, and FTSE Russell World Government Bond Index

(5) China Development Bank