Despite the uncertainty and disruption caused by the ongoing Covid-19 pandemic, wealth has continued to steadily grow in Asia. Supported by a low interest rate environment and government stimulus measures, many in Asia’s growing middle class have started rethinking their investment strategies to capture financial opportunities in the region.

Speaking to a global audience in 18 markets across the Asia-Pacific, Europe and North America, several financial professionals got together virtually to discuss the current direction of Asian capital market flows.

Kicking off the event with an in-depth presentation, Michael Spencer, managing director, chief economist & head of research, Asia-Pacific, at Deutsche Bank, explains the long-lasting impact Covid-19 has had on Asian economies, sharing that many have yet to get back on track with their pre-Covid economic development trends.

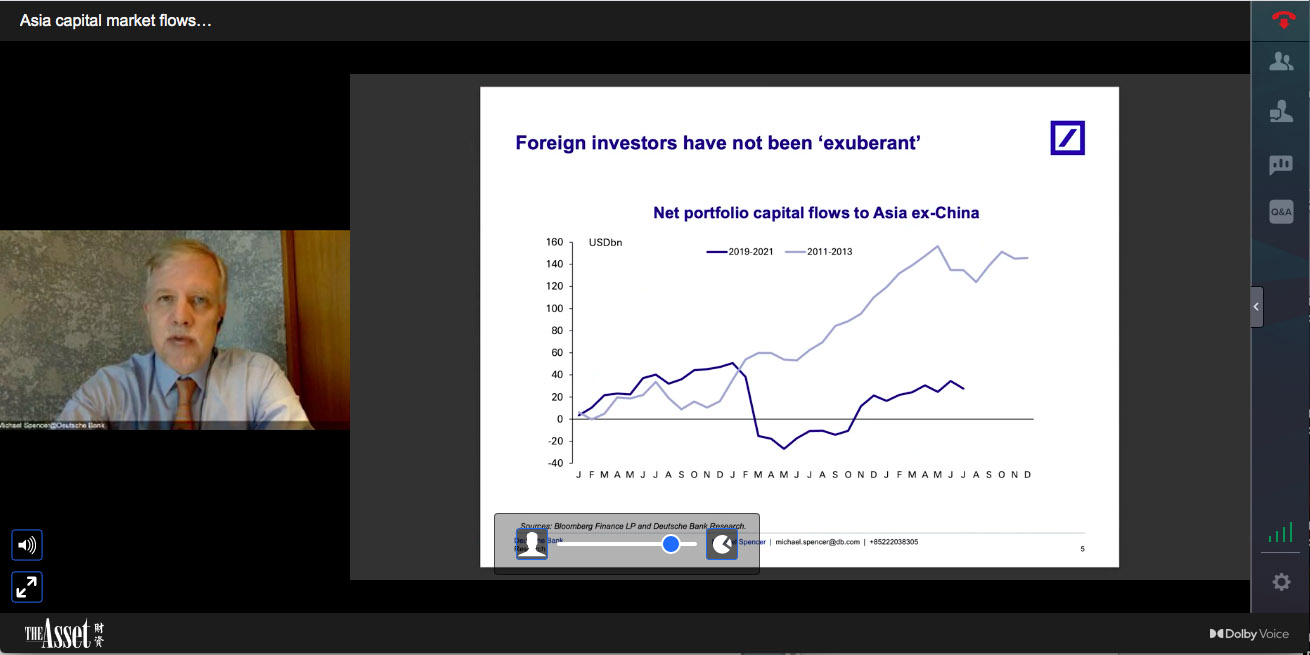

Moreover, despite recent comments from US Federal Reserve Chair Jerome Powell on tapering beginning in 2021, Spencer believes that there won’t be a repeat of the taper tantrum experienced in 2013.

“Asia from a positioning perspective is better placed to weather the Fed tapering. Fundamentally the combination of strong external demand and weak domestic consumption has meant that external positions are much stronger than they were in 2013,” shares Spencer. “In 2013 many economies in Asia had larger current account deficits. Now we are looking at a region with predominately current account surpluses.”

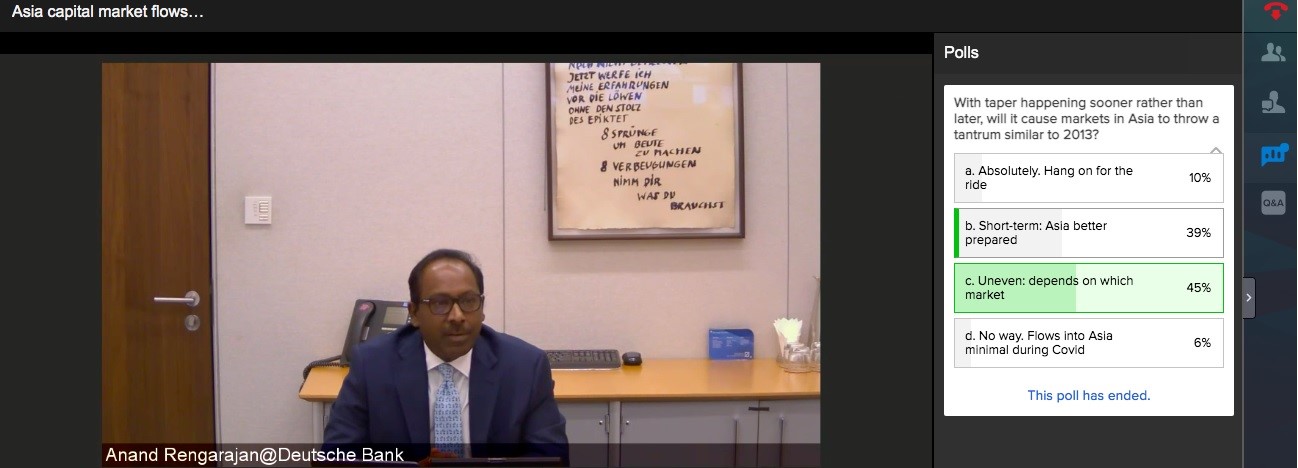

According to an audience poll taken during the virtual event, most respondents (43%) believed that tapering from the US would be uneven and would depend on the market. Another 39% believed that tapering would have a short-term impact given that Asia was better prepared compared to 2013.

Investment flows

Investment flows

In terms of investment flows, China continues to be an appealing market for foreign investors looking for yield. “Despite the external noise in the market, we’ve continued to see flows into China continue fairly unabated. There are many reasons behind this, but one key reason is that many investors are not seeing much yield around in the world. If you want a bond that yields more than 2.5% then slightly more than half of those globally are to be found in China,” explains Ben Powell, chief investment strategist, Asia-Pacific, at the BlackRock Investment Institute during the panel session segment of the event.

Other panellists looked to weigh investment opportunities in both the US and China markets. “Our lives are largely driven by the US and China, they are the two predominant influencers on markets. We are actually underweight China, we are overweight equities but China for us currently is our least preferred region. China’s outperformance peaked towards the end of 2020. It was actually driven more by the macroeconomic environment seeing how fast the rest of the world caught up,” explains Subash Pillai, head of client investment solutions APAC at Franklin Templeton.

Other speakers also see investors looking to implement a flight-to-quality strategy or Asian investors looking for opportunities within the Asia-Pacific region itself. “Emerging market to developed market flows are quite prominent because there is a natural expectation that they will recover faster from Covid-19. Flow of assets from Asia to developed economies is massive compared to the previous years. We are also seeing more intra-Asia flows such as Thailand outbound into China,” says Anand Rengarajan, global head of sales & head of Asia-Pacific securities services at Deutsche Bank. “There is a lot more disposable income that otherwise in normal times would’ve been spent on things such as travel now being deployed to financial assets, there are more new financial investors coming into the market.”

Yet not all capital flows are being picked up by China in the Asia-Pacific; some investors instead have looked at opportunities in Southeast Asia. “Singapore is benefiting for its ability to handle Covid-19. From the start of the pandemic from July to August of this year, the foreign reserves of Singapore increased, reflecting capital inflows coming into Singapore,” comments Alvin Lee, head of group wealth management & community financial services at Maybank Private Wealth.

Yet not all capital flows are being picked up by China in the Asia-Pacific; some investors instead have looked at opportunities in Southeast Asia. “Singapore is benefiting for its ability to handle Covid-19. From the start of the pandemic from July to August of this year, the foreign reserves of Singapore increased, reflecting capital inflows coming into Singapore,” comments Alvin Lee, head of group wealth management & community financial services at Maybank Private Wealth.

Nevertheless, opportunities in Asean will only emerge if policymakers there are able to carefully manage the economic recovery efforts from Covid-19. “From the Asean perspective, one of the key things we will be taking from China’s example is the idea of common prosperity. One of the critical things that is coming out from the pandemic is that you are seeing that big gap in terms of the wealth from the haves and the have nots. A lot of the governments in the Asean nations are going to be focusing on common prosperity as well to ensure that you are not going to get any geopolitical risk coming up,” explains Rejina Rahim, managing director and country head, Malaysia, at Nomura Asset Management.

In addition to looking at different markets in the Asia-Pacific, panellists at the event agree that given the impact of Covid-19, there has been an increase in the number of investors looking at sustainable or ESG-related thematic investment strategies. “Sustainable investing has become centre stage for us as a bank, it’s an integral part of the investment process, and from the client perspective also it has found favour, especially if you look at the thematic aspects,” notes Rishabh Saksena, head, investment specialists, APAC, at Julius Baer.