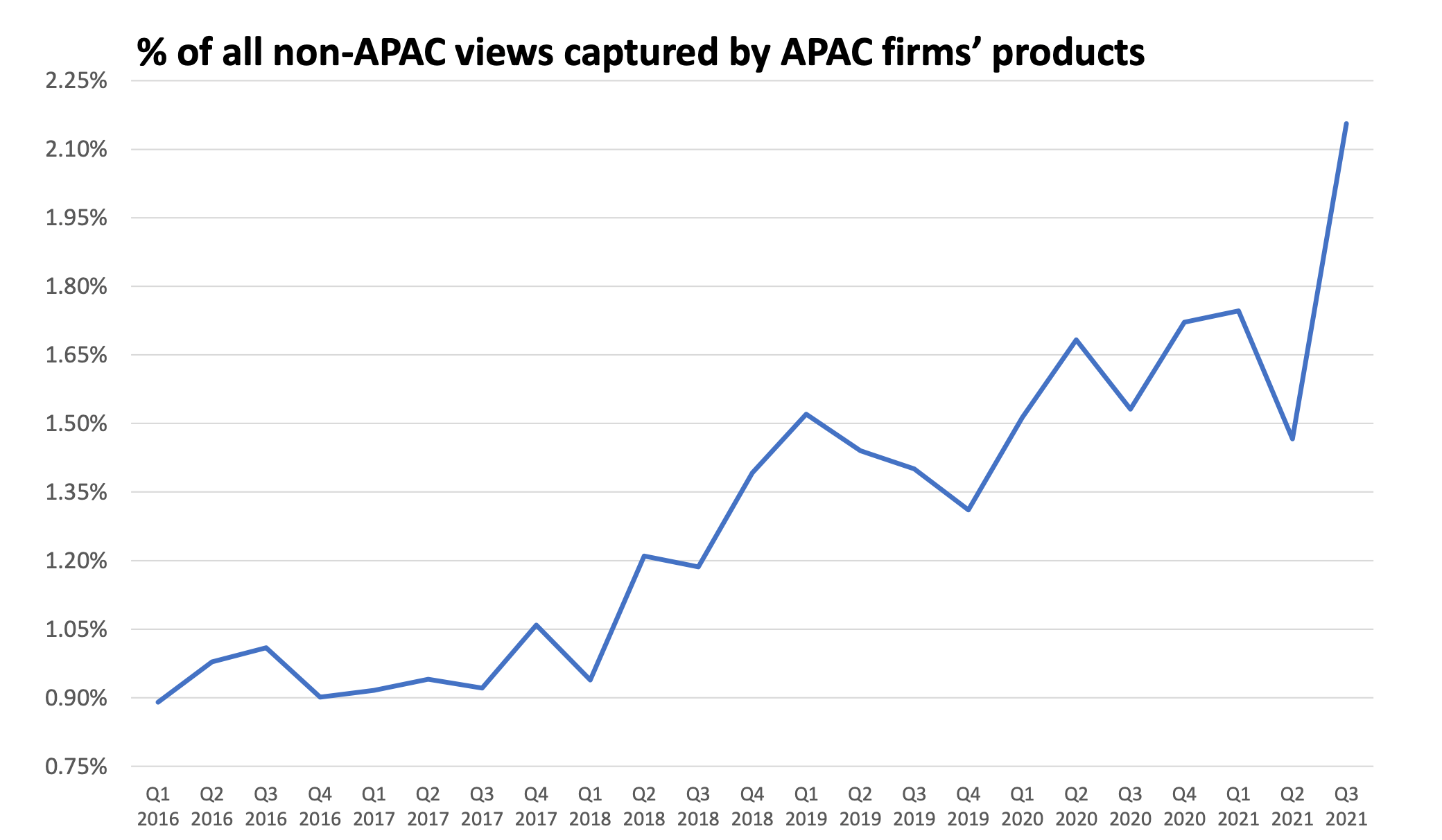

Asset managers based in Asia-Pacific have seen their investment strategies gaining interest outside the region, with non-APAC views captured by their products hitting a record high in the third quarter of 2021, data from Nasdaq’s eVestment platform show.

Investment strategies managed by APAC firms have been gaining traction over the years. “According to our data, products managed by firms domiciled in Asia-Pacific are attracting a larger proportion of the views from investors and consultants outside the region, hitting a record high in the third quarter of 2021. Managers with database marketing enjoy global exposure and are better supported in their effort of raising assets outside APAC,” says John Molesphini, global head of insights at eVestment.

Source: eVestment

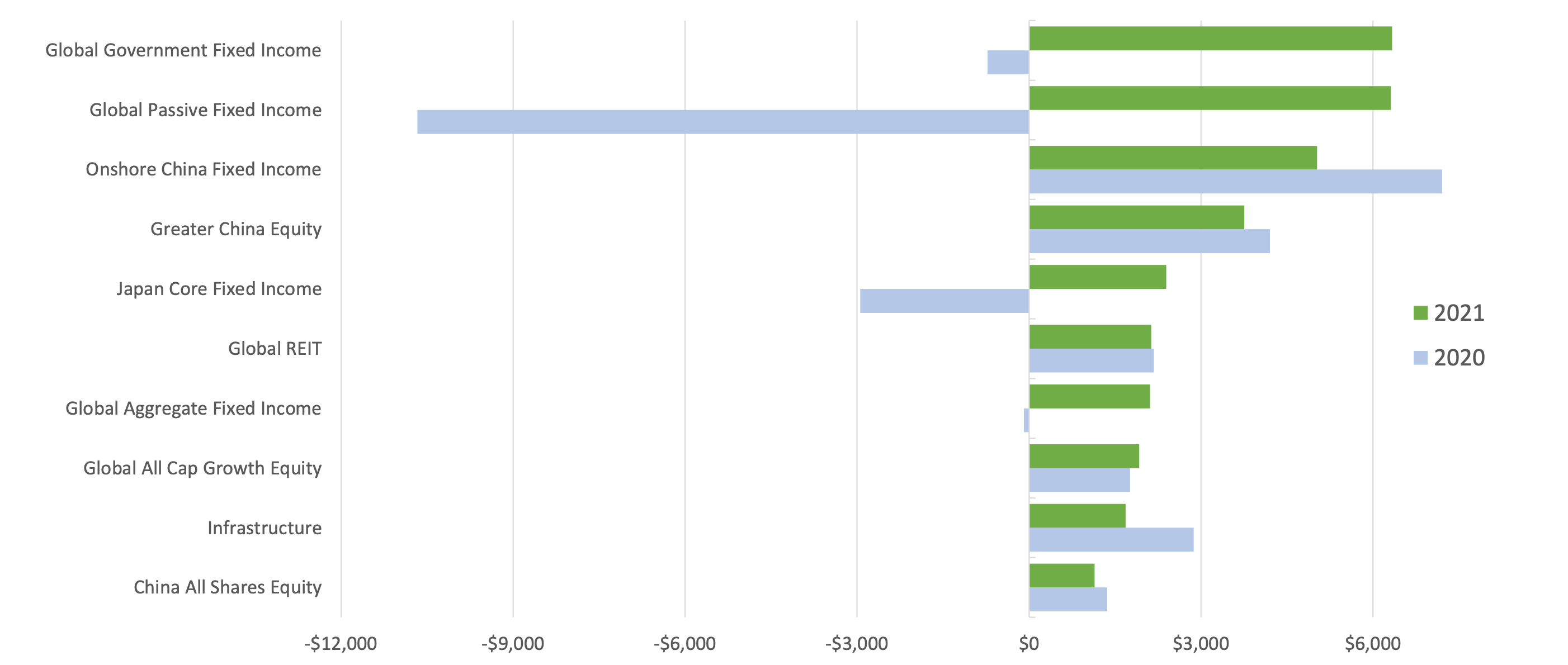

“2020 was a year of great performance and flow volatility, as everyone has gotten used to the new life and approach followed by the pandemic,” Molesphini notes, adding that some of the products by APAC managers have already attracted more inflows in the first two quarters of this year than in the whole of 2020.

Strategies like global government fixed income and global passive fixed income have recorded the most net inflows as of June this year, both hitting more than US$6 billion, followed by China-focused strategies like onshore China fixed income and Greater China equity.

Net flows of APAC-domiciled investment strategies in US$ millions

Source: eVestment Asset Flows

Source: eVestment Asset Flows

“We see some big reversals in some of the fixed-income universes (compared to 2020). In 2020 they were looking to exit in asset classes such as global passive fixed income, but in 2021, they are looking to allocate again, indicating that people are moving the money in and out quickly,” says Molesphini. Some of the China-focused themes have gained continued momentum.

In terms of net outflows, most of the APAC-domiciled products affected are equity-related. “This not a big surprise. There were some allocations away from equity as a result of the volatility that took place in 2020,” he notes, adding that concerns over equity have persisted this year.

Global passive equity and US intermediate duration credit fixed income, which recorded net inflows in 2020, have shown reversals this year, indicating a change in APAC investors’ appetite.