Fund managers and asset service providers in Asia are in a better position to automate their processes than their Western counterparts, a new report finds.

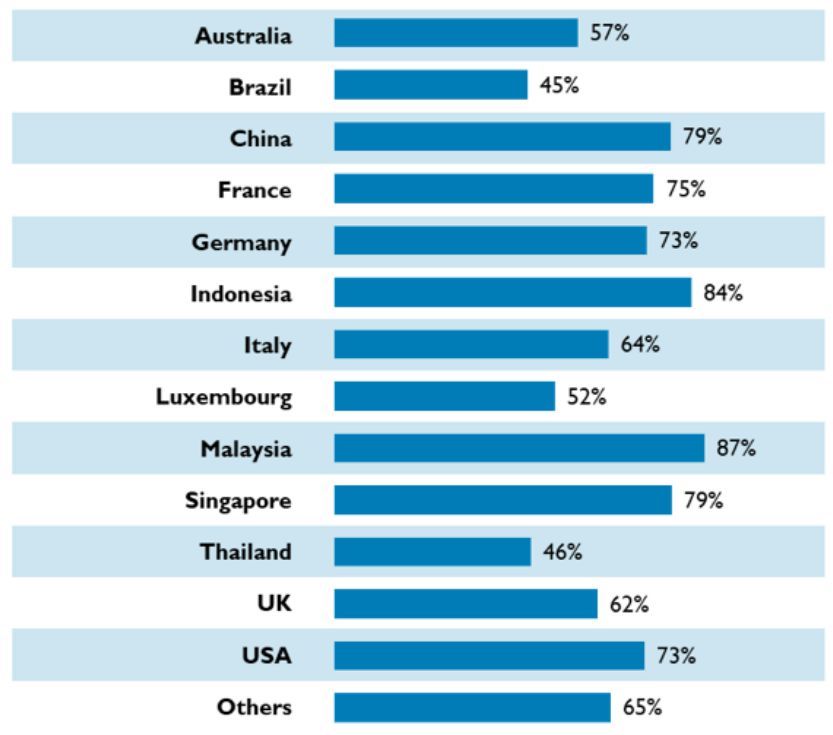

Organizations based in Singapore, Indonesia, and Thailand, for example, perceive themselves “mostly” or “fully” automated, while those based in Australia, the United States, the United Kingdom, and Germany are the least likely to consider themselves “mostly” or “fully” automated, and the most likely to be “manual”, global funds network Calastone says in the report Global Fund Automation Caught Between Future And Past.

The report is based on a survey of nearly 600 respondents globally across the fund management industry.

Legacy systems in older markets such as the US and the UK make automation a much harder and costlier task, and the established nature of the big players tends to hinder disruption and competition, as reflected in the fact that around three-quarters of organizations in the US, France and Germany still rely on fax.

In addition, the sheer size of these markets, the US in particular, make it hard for new innovations to become commonplace. “In emerging markets, the reverse is true. With fewer established funds monopolizing the market, there’s more room for the competition to innovate and leapfrog with nimble, modern systems,” the report says.

Worldwide, 68% of organizations are still using fax machines for in-source operations and remain unautomated in many areas, based on Calastone’s survey. This suggests that firms need to look beyond themselves to external partners to help drive their digital transformation, according to the report.

“For managers and servicers operating in those fax-heavy markets, shifting towards a more modern means of communication presents a quick automation win and provides a clear opportunity to carve out a competitive advantage,” it says.

“Those that move to digital alternatives provided by tech such as open APIs (application programming interfaces) and cloud transfers can process more trades – only a certain number can go via a fax’s phone line at any given time – and significantly reduce the time spent and errors made by manually inputting orders.”

Survey question: Does your organization use fax?

Source: Calastone report, Global fund automation caught between future and past

Firms in Asia-Pacific looking at automating manual tasks are putting more energy into transformative technologies such as distributed ledger technology (DLT). Particularly in Singapore, there is a lot of DLT-related activity and a rapidly growing tokenization market, further boosted by advances in artificial intelligence (AI) and machine learning (ML).

Geographical expansion is recognized as a main driver by organizations listed in Singapore (52%), followed by those in Thailand (38%), where more automation will be needed to facilitate cross-border flows and provide the kind of processing efficiency that global players expect, the report says.

Top three main drivers of automation in Asia are client service (67%), revenue expansion (59%), and fund distribution (55%).

To automate operations, Asian markets such as Thailand, Singapore and Malaysia are prioritizing “the basics” such as orders and settlements, while established markets such as the UK and Europe, which have already done that legwork, are looking at account opening.

Analyzing the data, Calastone notes that asset service providers are less likely to be manual than investment managers. “This makes sense when considering the administrative nature of the processes they’re responsible for and their main role, that is, to remove complexity and streamline processes for fund managers. By removing manual processes when it comes to processing trades, onboarding investor accounts and reconciling cash flows, servicers can save themselves and the managers they serve huge amounts of time and cost,” the report explains.

As such, order management as well as clearing and settlement are the areas most likely to be automated first. “In contrast, client account opening, a task which often requires a greater degree of insight – and an area in which ML is starting to be used already – is most likely to be manual. Overall, however, progress is being made across businesses,” Calastone says.

Fund management has entered a new era, where a growing number of clients, particularly the emerging generation of tech-first investors, are demanding convenience, immediacy and personalization.

“The same technologies that help fund managers and asset servicers to run a more profitable and global business can also enable them to deliver a better, more personalized and responsive service for end-investors,” the report says.