China's venture capital and private equity market continues to witness a cooling trend this year, but Shenzhen stands out as a beacon of opportunity for investors.

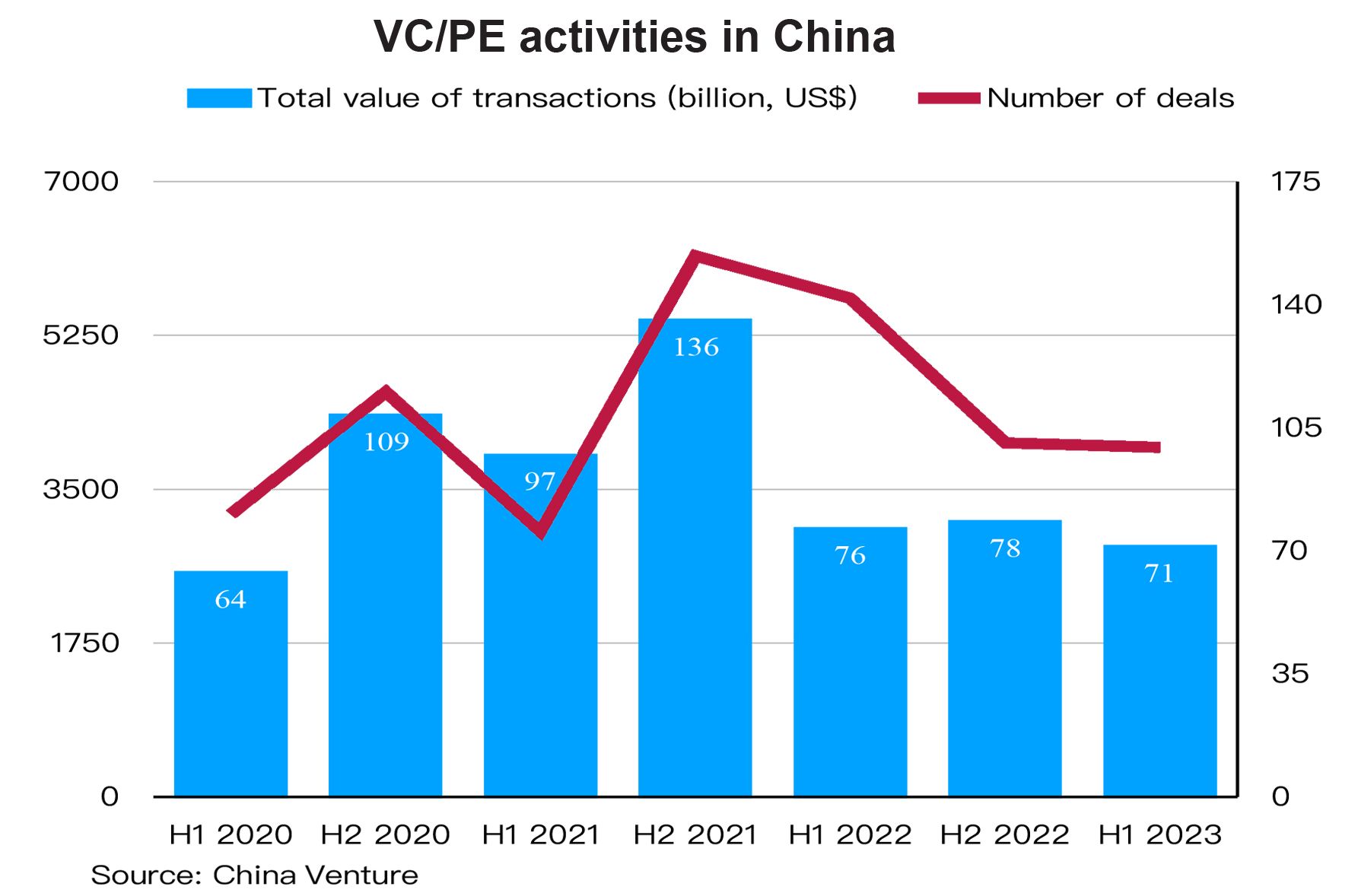

Domestic VC/PE activity fell 29.8% year-on-year to 3,978 deals in the first half of 2023. Compared to H1 2022, that’s a 1.2% drop. In terms of value, the market remained relatively stable, both on a year-on-year and quarter-on-quarter basis, at US$71.3 billion, think tank China Venture says in an industry report released in July.

After a surge in activity in H2 2021, the market saw a dramatic decline and has remained almost flat for three consecutive quarters.

Despite the challenging market conditions, Shenzhen has become a hotspot for VC/PE investments, ranking among the top three Chinese cities in terms of funds launched in H1 2023.

Historically, whenever US dollar funds faced challenges, investors tended to seek investment opportunities in Shenzhen. The city has been a stronghold for renminbi-denominated funds, with players like Shenzhen Capital Group, Qianhai Fund of Funds, Cowin Capital, and Oriental Fortune Capital leading the market.

In H1 2023, the most sought-after industries in the domestic VC/PE market were information technology, manufacturing, and healthcare, according to the report. Sub-sectors such as hardware technology, biopharmaceuticals, and high-end manufacturing are gaining traction, while sectors like batteries and battery materials have seen a surge in activity, boosting investors' interest in the energy and mining sectors.

Against this backdrop, Shenzhen recently unveiled a new batch of VC/PE funds, aiming to raise 8.5 billion yuan (US$1.19 billion) for sectors such as new materials, innovative equipment, cytology and genetics, brain science, and artificial intelligence.

For the new materials sector alone, it is targeting 3 billion yuan, which will be invested mainly in electronic and advanced metal materials. About 2 billion yuan will be focused on the high-end equipment sector, particularly industrial machine tool technology, laser and additive manufacturing, and precision instruments. Another 1 billion yuan will be raised for AI and brain science, including innovative instruments, equipment, and consumables, as well as brain sensors and brain-computer interfaces. Of the target fund, about 1.5 billion yuan will be invested in cellular and genetic sector, primarily in cell and gene therapy, novel virus, novel vaccine research, gene technology, and biotechnology.

The VC/PE market has been challenging but highly competitive over the past year. While the number of newly established funds decreased, the total fund-raising size jumped by 56% to US$356.2 billion.

During the same period, the IPO market slightly improved as well. A total of 222 Chinese companies were listed in mainland China, Hong Kong, and the United States, of which 143 were supported by VC/PE funds, resulting in a penetration rate of 64.41%, according to the report.

As the market slowly revives, Shenzhen appears to have timed the launch of the new funds well. Being a key engine of China’s technological advancement, the city is in a strong position to further develop its unique innovation ecosystem, attracting more start-ups and investors.