For Professional Investors use only. Not for further distribution.

In recent years, Asia has emerged as a key player in the global energy landscape, both as a major consumer and as a rapidly growing market for renewable energy.

Asia is home to some of the world's most populous and rapidly developing countries, yet the region faces significant challenges in meeting its energy demands, while minimizing greenhouse gas emissions.

We believe private market activity focuses where companies and investors can generate compelling risk-adjusted returns, or in places which are offering incentives to invest. The availability of skills and raw materials, as well as environmental conditions conducive to renewable energy sources, are also important factors.

In our view, when considering each of these factors, the opportunity in Asia stands out. The scale of investment needed in renewables is large and spread across many countries, many of which have a long-term track record of infrastructure delivery with private sector participation. This is supportive of investment activity, as risks are reduced, compared to other countries without this long-term experience or track record of investment, or compared to those without established regulatory or legal frameworks. Furthermore, many countries within Asia currently use coal as an outsized contributor to electricity generation. As mentioned earlier, we believe coal will likely be hit first amongst the fossil fuels, providing further impetus to the energy transition in Asia.

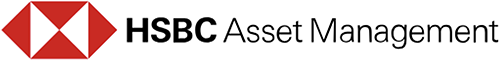

Fig 1: Share of annual electricity generation by region or country

Source: BloombergNEF, as of November 2022

Demand for electricity from the APAC region has risen over the past decade and the continent now accounts for half of global generation. Mainland China alone accounts for 30% of the global power generation (up from 23% in 2012).1 Meanwhile, relative generation capacity in North America and Europe continues to decline. North America and Europe accounted for 19% each of the world's electricity production in 2021, down from 21% each in 2016. Clearly, the trajectory in Asia is very different to that in Europe and the US. As a result, in our view any energy transition investment needs to have a focus on this region.2

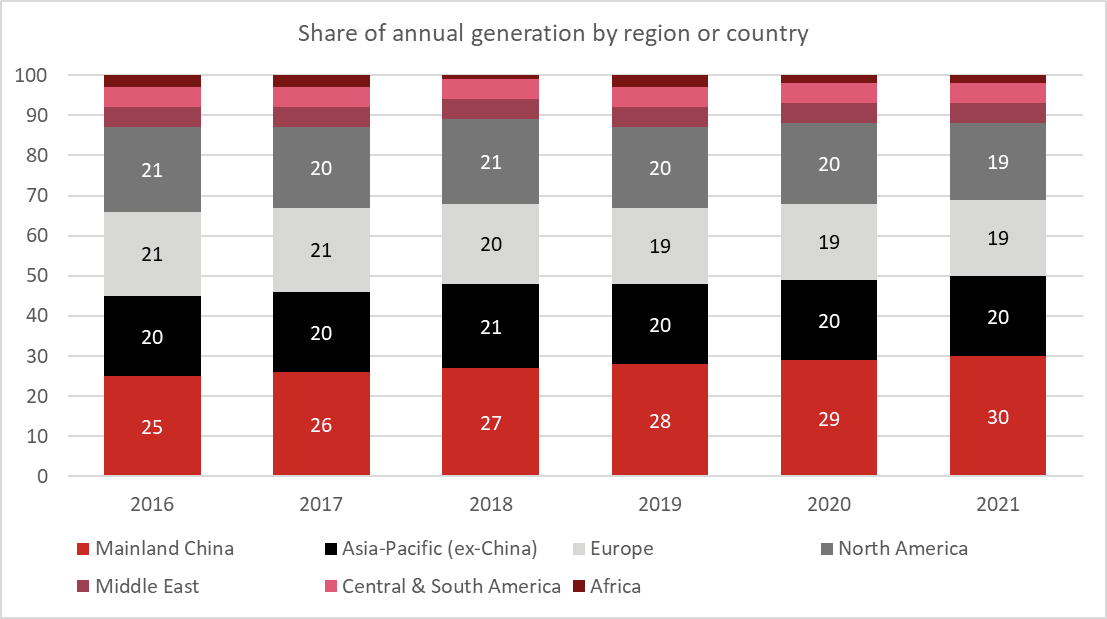

China has experienced the strongest growth in electricity generation over the period between 2012 and 2021. Over this time, electricity generation grew from 4.8TWh to 8.2TWh - equal to compound growth of 5.9% per year. In comparison, Europe saw growth of just 0.2% and North America saw growth of 0.7%. Europe and North American generation is also behind that of Asia Pacific (ex-China), which has delivered 5.5TWh of capacity.2

Fig 2: Global annual electricity generation by region

Source: BloombergNEF, as of November 2022

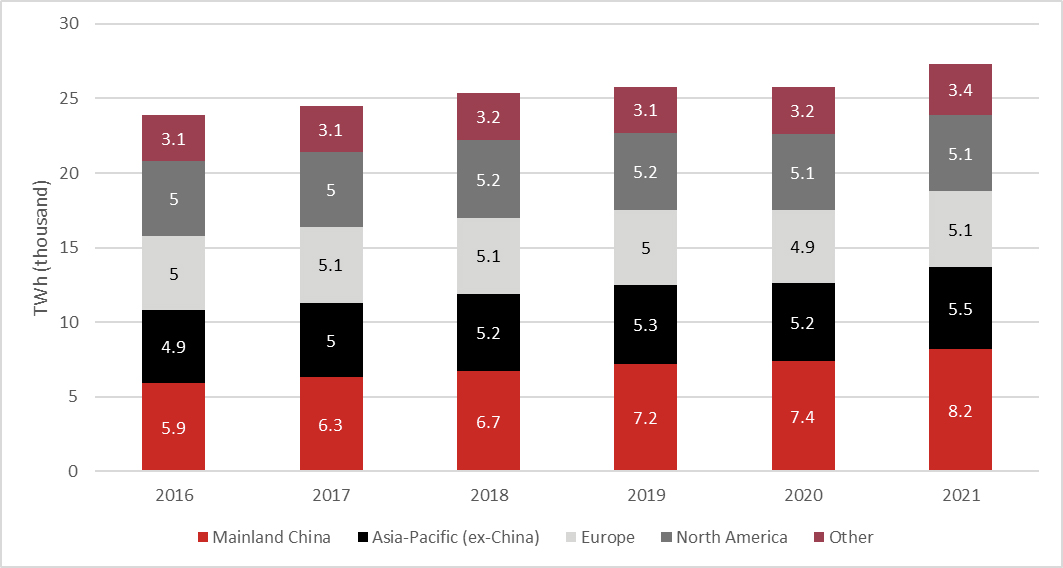

The Asia energy transition is increasingly important given the proportion of generating capacity derived from coal-fired power plants. Global coal-fired power generation capacity has also increased by 1.1TWh in 2021, to reach 9.6TWh in 20212 - meaning coal remains the dominant source of global energy generation. Mainland China and India lead in the building of new coal-fired power generating capacity. The two countries accounted for 83% of new coal additions in 2021. Mainland China alone added 62% of global coal generating capacity between 2012 and 2021. Transitioning this generation capacity to renewable energy sources is important to achieving net zero targets, not only for Asia but also globally.

Fig 3: Global annual electricity generation by technology

Source: BloombergNEF. As of November 2022

Finally, the majority of the global renewables supply chain is located in Asia.3 This means Asia, in addition to replacing its existing generation capacity with renewable sources and installing new renewable generation capacity to meet growth, in our view also needs to invest in the industrial capacity to deliver the required equipment for this region and the rest-of the-world. This should provide significant ancillary investment opportunities in the region.

Investing in energy transition infrastructure in Asia offers a compelling opportunity to combat climate change effectively. By focusing on renewable energy sources such as solar, wind, and hydroelectric power, countries in Asia can reduce their reliance on fossil fuels, decrease carbon emissions, and contribute to global climate goals.

Learn more about the investment opportunities in the energy transition

HSBC Asset Management is a major global asset management firm managing assets totaling USD707 billion as at 31 December 2023, with well-established businesses in Europe, Asia-Pacific, Americas and the Middle East. We are the asset management division of, and wholly-owned by HSBC Holdings plc (HSBC Group), one of the largest financial services organisations in the world. Our investment capabilities span across different asset classes - equities, fixed income, multi-asset, liquidity and alternatives. HSBC Asset Management is well placed to provide a globally-consistent, disciplined investment process across our capabilities, drawing on the local knowledge and extensive expertise of our team of over 600 investment professionals across over 20 locations around the world.

For more details, please visit http://www.assetmanagement.hsbc.com.hk

Source: HSBC Asset Management as at 31 December 2023

1. Greenfield infrastructure struggles to attract private investment (gihub.org), June 2023

2. All data from BloombergNEF, as of November 2022

3. Can US and EU unseat China as the dominant supplier of green energy tech globally? SCMP as of August 2023

Any views expressed were held at the time of preparation and are subject to change without notice. While any forecast, projection or target where provided is indicative only and not guaranteed in any way, HSBC Asset Management accepts no liability for any failure to meet such forecast, projection, or target.

For professional investors and intermediaries only. This article should not be relied upon by retail clients/investors.

Investors in alternatives products should bear in mind that these products can be highly speculative and may not be suitable for all clients. Investors should ensure they understand the features of the products and fund strategies and the risks involved before deciding whether or not to invest in such products. Such investments are generally intended for investors who are willing to bear the risks associated with such investments, which can include: loss of all or a substantial portion of the investment, lack of liquidity in that there may be no secondary market for the fund and none may be expected to develop; volatility of returns; prohibitions and/or material restrictions on transferring interests in the fund; absence of information regarding valuations and pricing; delays in tax reporting; key man and adviser risk; limited or no transparency to underlying investments; limited or no regulatory oversight and less regulation and higher fees than mutual funds.

Please note that alternatives related investments are generally illiquid, long term investments that do not display the liquid or transparency characteristics often found in other investments (e.g. listed securities). It can take time for money to be invested and for investments to produce returns after initial losses. As such alternatives related investments should be considered as a very high risk investment and are only suitable as part of a diversified portfolio. Before making such investments, prospective investors should carefully consider the risks set forth in the relevant investment documents.

The contents of this document have not been reviewed by the Securities and Futures Commission of Hong Kong (“SFC”) or any regulatory authority in Hong Kong. You are advised to exercise caution in relation to any relevant offer. If you are in any doubt about the contents of the relevant investment documents you should consult your accountant, legal or professional adviser or financial adviser. The relevant product is not authorized under Section 104 of the Securities and Futures Ordinance of Hong Kong (“Ordinance”) by the SFC Accordingly, the distribution of any relevant Private Placement Memorandum, and the placement of interests or units in Hong Kong, is restricted. Any relevant Private Placement Memorandum may only be distributed, circulated or issued to persons who are professional investors under the Ordinance and any rules made under the Ordinance or as otherwise permitted by the Ordinance.

HSBC Asset Management is the brand name for the asset management business of HSBC Group. The above communication is distributed in Hong Kong by HSBC Global Asset Management (Hong Kong) Limited.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted, on any form or by any means electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of HSBC Global Asset Management (Hong Kong) Limited.