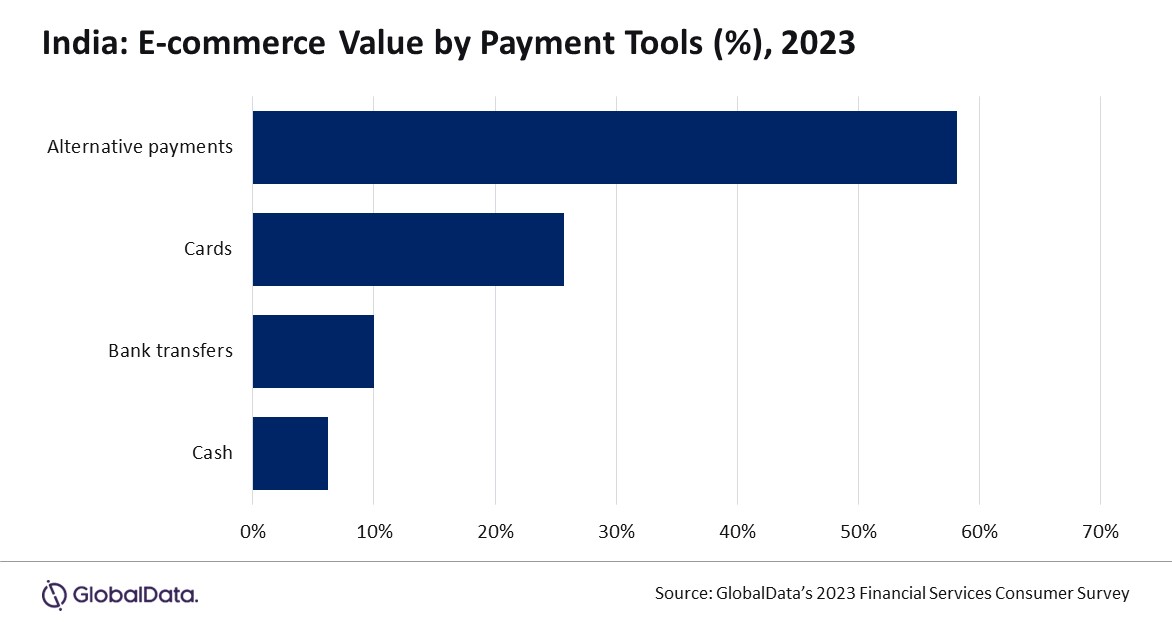

India’s e-commerce sector is witnessing a seismic shift – alternative payment methods now command a staggering 58% share of the market in 2023 – as mobile and digital wallets have eclipsed traditional payment modes, reflecting a paradigmatic change in consumer preferences and transactional behaviour.

This dominance, notes a report from research firm GlobalData, underscores the country’s digital revolution, which is propelled by increasing internet connectivity and a burgeoning e-commerce ecosystem.

India’s e-commerce market, the report shares, is growing at a healthy pace, supported by rising internet and smartphone penetration, and growing consumer preference for online shopping – the latter coupled with increasing consumer confidence in online transactions.

There were 881.3 million internet subscribers in India as of March 2023, according to India’s Telecom Regulatory Authority, up from 865.9 million in December 2022.

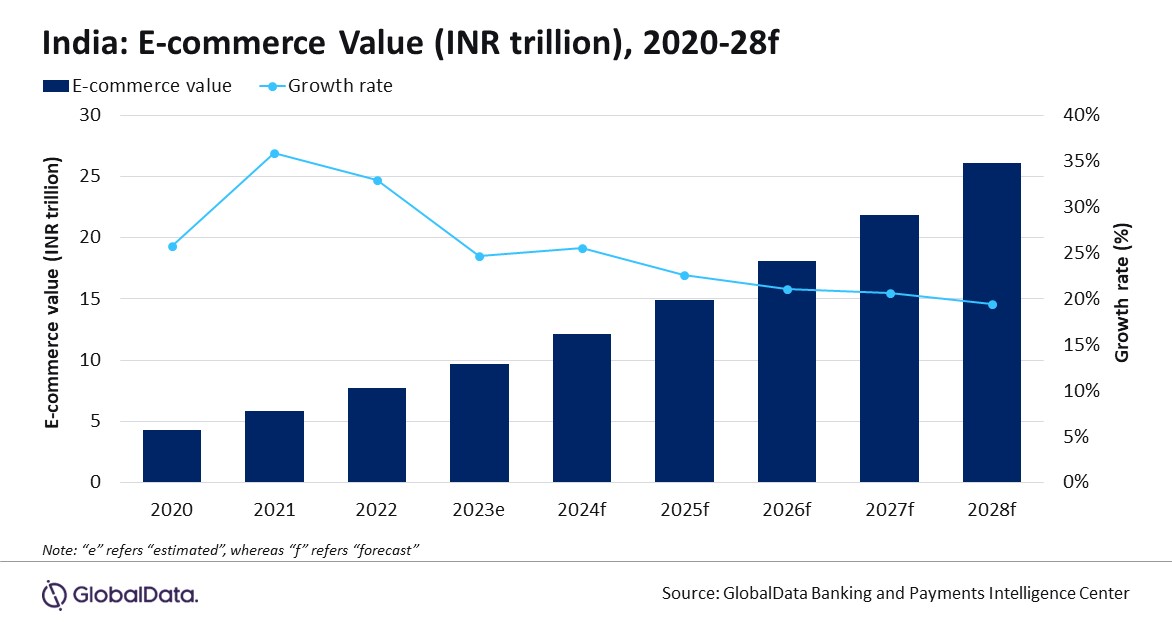

India’s e-commerce market value is set to increase, the report shares, at a compound annual growth rate of 20.9%, from 12.2 trillion Indian rupees (US$147.5 billion) in 2024 to 26.1 trillion rupees in 2028.

This strong momentum is encouraging merchants, especially small and medium-sized enterprises (SMEs), to enter the e-commerce space. Many domestic and international e-commerce retailers, such as Flipkart, Amazon and Myntra, the report adds, offer benefits, including discounts and cashback through their respective shopping events Flipkart Big Billion Days, Amazon Great Indian Sale, and Myntra Big Fashion Festival Sale.

Alternative payment solutions, according to the GlobalData’s 2023 Financial Services Consumer Survey, have consistently gained popularity among the Indian consumers in the last five years with some of the popular brands being Amazon Pay and Google Pay.

Payment cards are the second most popular e-commerce payment method in India with a share of 25.7% with credit and charge being the preferred card types, accounting for a 15.4% share in 2023.

Cash, which is widely used for in-store retail payments in India, has seen a significant drop in the market share for online purchases, accounting for only 6.2% share.

The future of e-commerce payments in India, the report concludes, appears promising, driven by government’s initiatives, such as Make in India and Start-up India, and the rising number of online shoppers.

The online shopper base in India, according to Flipkart, is anticipated to increase to 400 million to 450 million by 2027. In 2019, the company launched an initiative called the Flipkart Samarth Programme to help SMEs sell their products online. As of December 2023, the programme has spread to 28 states across the country.

Alternative payments have gained huge “traction in India since the demonetization in 2016,” says Ravi Sharma, the research firm’s lead banking and payments analyst. “The Covid-19 pandemic has accelerated this trend as both consumers and merchants preferred digital payments to avoid exposing themselves to disease vectors such as cash.

“The uptrend in e-commerce sales in India is likely to continue over the next few years supported by the improving payment infrastructure and growing popularity of alternative payment solutions.”