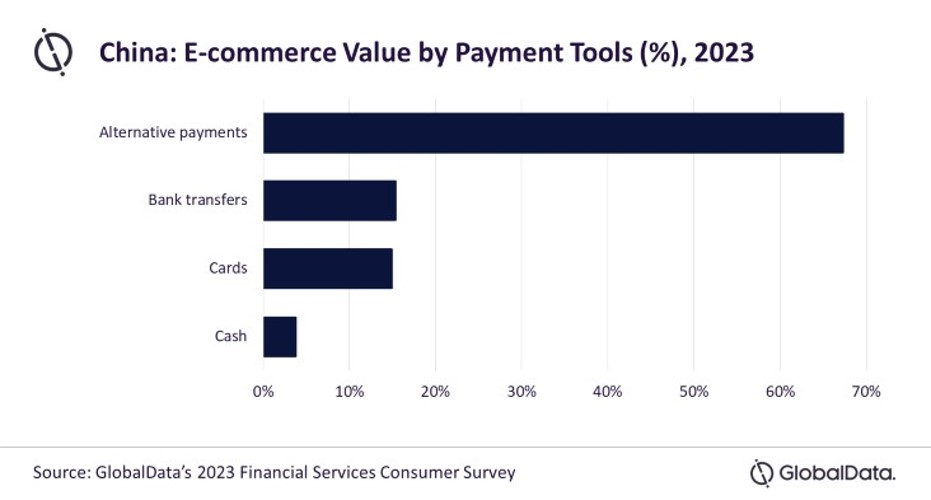

Alternative payment methods like mobile and digital wallets dominate the e-commerce space in China, having displaced cash and cards, and in the process, making them the most preferred payment method with a 67.3% market share in 2023, according to a recent report.

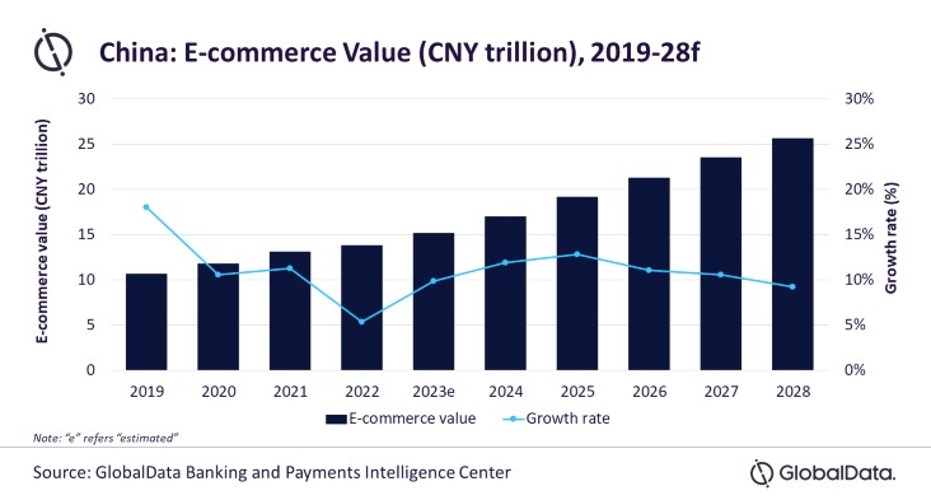

The China e-commerce market is expected to register a 11.9% growth in 2024 to reach 17 trillion yuan (US$2.4 trillion), notes research firm GlobalData in its E-Commerce Analytics report, as consumers increasingly shift from offline to online purchases. And the market, the report adds, is set to increase at a compound annual growth rate of 10.9% between 2024 and 2028 to reach 25.7 trillion yuan (US$3.6 trillion) in 2028.

To boost e-commerce sales, the Chinese government has also taken various initiatives. In August 2023, nine government departments, including the Chinese Ministry of Commerce, introduced a three-year plan to develop and promote e-commerce even in rural areas. The plan includes several aspects, such as improving internet and payment infrastructure, and developing required logistic facilities.

Alipay and WeChat Pay, with more than one billion worldwide users each, are the most popular alternative payment methods, having gained prominence due to their simplicity, speed and convenience, according to the GlobalData’s 2023 Financial Services Consumer Survey, which was conducted in Q2 2023. International brands like Samsung Pay and Apple Pay are also available in the market.

Alternative payments are followed by bank transfers and payment cards. Cards account for a 14.9% share of e-commerce transaction value in 2023. Credit cards are more preferred than debit cards due to the value-added benefits they offer, including interest free instalment payment options, reward programmes, cashback and discounts.

The trend towards alternative payments, the report adds, is also prevalent in many Asian markets.

“The Chinese e-commerce market – the largest in the world – has experienced sustained growth over the past few years,” says Poornima Chinta, GlobalData’s senior banking and payments analyst, “driven by rising internet and smartphone penetration, availability of secure online payment systems and an increasing number of online shoppers.

“The market is expected to continue its upward growth trajectory, and alternative payment solutions are likely to continue their dominance driven by their growing userbase and increasing online merchant acceptance.”