Taiwan’s latest regulatory measures over exchange-traded funds (ETF) will help contain market and counterparty risks arising from the sharp increase in ETF volumes, says Fitch Ratings.

Despite its recent rapid expansion, however, the ETF market size remains moderate, the rating agency believes.

Taiwan’s Financial Supervisory Commission (FSC) recently implemented six regulatory measures aimed at enhancing product structure, improving data transparency, and increasing liquidity for ETFs. The new measures follow FSC’s press release in November last year, which highlighted potential product and market risks associated with ETFs, and the introduction of “special financial inspections” for ETFs in January.

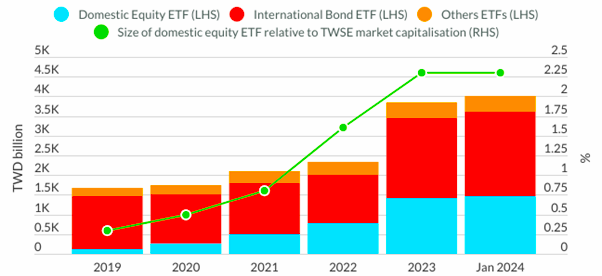

The popularity of ETFs among investors in Taiwan has led to an increase in the size of the market's ETF funds, reaching NT$4 trillion (US$125 billion) in January 2024 from NT$2.3 trillion at end-2022. International bond ETFs and domestic equity ETFs – which account for 53% and 36% of the total ETF market, respectively – have experienced the strongest growth.

This is attributable to the still-low interest rate environment in Taiwan and positive capital market sentiment. Total ETFs accounted for 8.3% of Taiwan’s market turnover in January 2024, highlighting their growing influence. The total balance for domestic equity ETFs reached NT$1.5 trillion in January 2024, a 71.7% increase from a year earlier.

However, equity ETFs still represent a relatively small portion of market value, with the total balance of domestic equity ETFs amounting to 2.3% of the total equity market capitalization in Taiwan as of January 2024. This proportion is significantly lower than that in the US, Europe and other developed Asia-Pacific markets.

Market size still moderate despite rapid expansion

ETF size by product type

Source: Fitch Ratings, SITCA, FSC

Source: Fitch Ratings, SITCA, FSC

According to Fitch, the current risk exposure within the securities sector is relatively contained, particularly considering the modest size of ETFs in absolute terms. Domestic equity ETFs are predominantly straightforward equity products and are often issued by investment trust firms, which are typically affiliated with securities firms within large financial holding company structures.

Bond ETFs are larger, but the risk to securities companies is limited, as these bond ETFs are issued and managed by investment trust companies and mostly sold to institutional investors or wealth management clients, with most underlying assets linked to international bonds with higher credit quality, the rating agency says.

Securities firms are typically involved in the ETF market mainly through product sales and they also serve as market makers and authorized participants. The risks associated with these business activities include potential operational risks in sizeable ETF transactions and asset impairment risks, particularly when securities firms are required to provide liquidity during market downturns.

Continued growth in Taiwanese domestic equity ETFs, especially those focusing on high-dividend or technology securities, could lead to increased market volatility and excess valuation for a concentrated portfolio of equities, according to the rating agency. It also says a sell-off in ETFs in a market downturn could exacerbate selling pressure, heightening operational, counterparty, and asset impairment risks for securities firms.

However, Fitch expects the larger securities firms in its rated portfolio to have adequate capital headroom and execute risk policies effectively to navigate the potential challenges.