North America is the biggest market for private credit – bilateral agreements or small “club deals” outside the realm of public securities or commercial banks. But the International Monetary Fund (IMF) finds that other regions, including Europe and Asia, are experiencing similar growth dynamics.

In an extract from the IMF's forthcoming Global Financial Stability report released in Washington this week, the global private credit market is valued at US$2.1 trillion in combined assets and undeployed capital commitments as of last year.

Assets of private credit managers in the United States alone reached US$1.6 trillion in June, growing at an average annual rate of 20% over the past five years.

Private credit now accounts for 7% of credit to non-financial corporations in North America – comparable with broadly syndicated loans and high-yield corporate bonds.

In Europe, the IMF says, private credit grew 17% a year over the same period but has a smaller footprint of 1.6% of corporate credit.

Growth in Asia matches US expansion

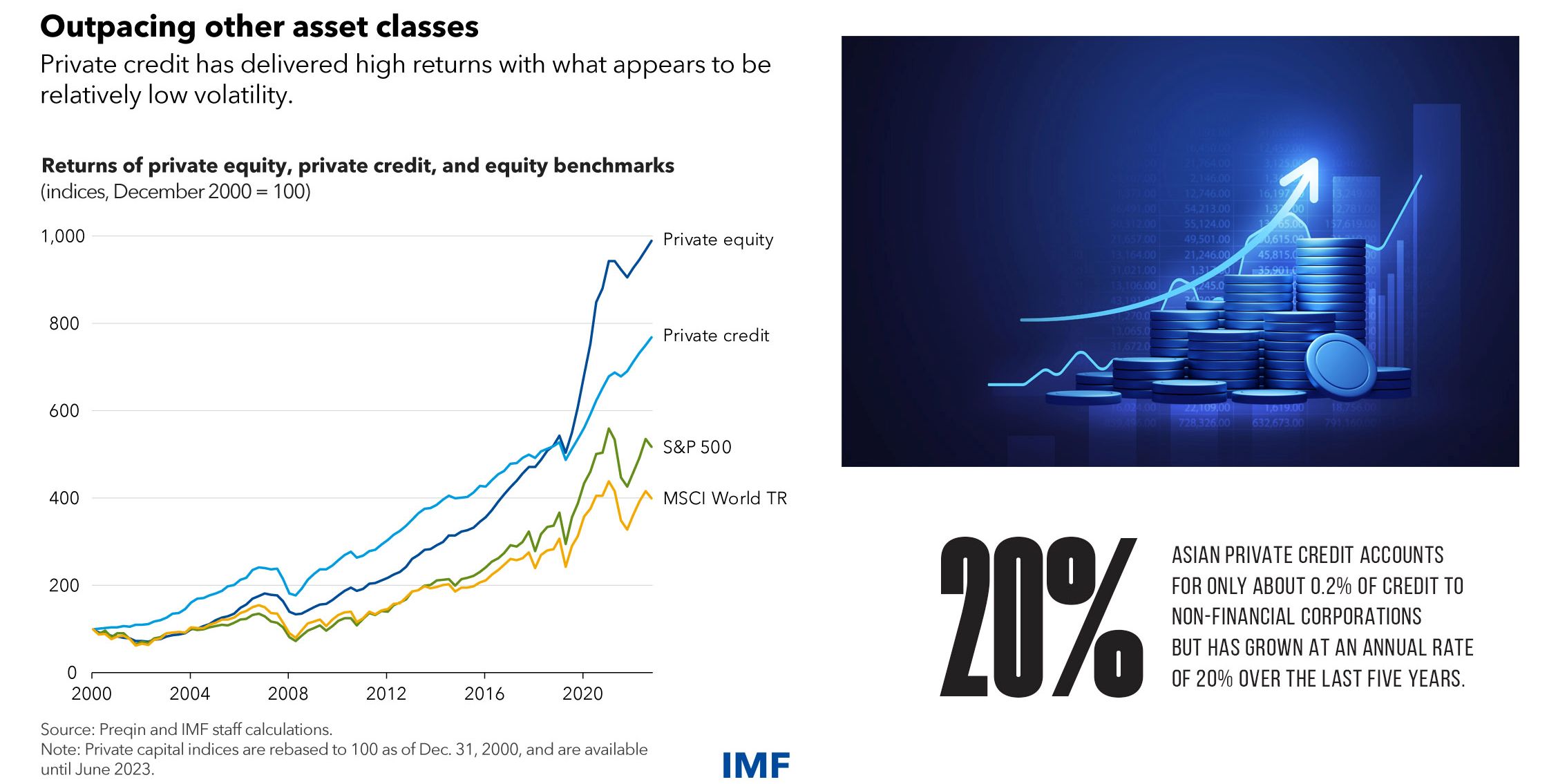

Asian private credit accounts for only about 0.2% of credit to non-financial corporations but has grown at an annual rate of 20% over the last five years.

“Private credit in Asia finances mostly smaller deals, targeting high-yield and distressed segments that have limited financing options in emerging market economies,” the IMF says.

According to Natalia Novikova, the IMF’s resident representative in Singapore, growing numbers of mature companies in Asia are seeking funding for acquisitions and diversification of their creditor base.

Long-term investors such as pension funds and wealth managers are meanwhile drawn to high yields.

“In recent years, several international alternative asset managers have launched Asia-focused funds,” Novikova says. “A recent industry survey showed that many institutional investors in the region intend to increase allocations to private credit.”

Valued at US$93 billion – about 5% of the global total – Novikova says Asia’s private credit market “remains relatively small” with most investors being local and focusing on smaller deals.

At the same time, global allocation to private credit in Asia remains limited at 0% to 5% of assets under management.

Moreover, it is “relatively less appealing because of tighter spreads and high foreign exchange hedging costs”, Novikova says.

Jurisdictions with highly liquid banking systems or those with modest growth tend to have small or nonexistent private credit markets.

"China, India, and Indonesia are emerging as key examples, whereas Australia and New Zealand have more mature markets with active participation from superannuation funds.”

‘Filling the gaps banks leave’

Novikova – a former Russian central banker who worked at Citi before joining the IMF a decade ago – says many private credit funds in Asia have investment teams based in Hong Kong and Singapore.

“Private credit in Korea has also grown steadily,” she adds.

“Unlike in the United States, where the private credit market acquired the ability to finance relatively large transactions, Asia’s market primarily fills the gaps banks leave.

“In this context, private credit funds focus on acquisition financing, asset-light businesses, and distressed debt, providing financing to the high-yield segment, which remains underdeveloped in many emerging markets and developing economies in the region.”

Novika concludes that “private credit is experiencing robust growth in Asia” but that the regional market remains fragmented.

“The regional portfolios are complicated by differences in currencies, regulatory environments, and investor protection regimes,” she says.

“Most funds are closed-end structures of six to eight years for performing credit and up to ten years for distressed assets. Covenants tend to be tighter in emerging market Asia, given weaknesses in investor protection.”

The extract from the report, to be published in full to coincide with the Spring meetings of the IMF and World Bank in Washington next week, notes that private credit has been around for three decades.

"It developed as a lending solution for middle-market companies deemed too risky or large for commercial banks and too small for public markets,” the IMF says.

‘Market warrants closer scrutiny’

Growth since the global financial crisis has been particularly rapid, fuelled by the prolonged period of low interest rates that saw a huge expansion of attention to alternative investment strategies.

“At the same time, post-crisis regulatory reforms raised capital requirements for banks and made regulation more risk-sensitive, incentivizing banks to hold safer assets.

“Some end investors (notably insurance companies) were also incentivized to move into private credit because the capital charges are lower and less risk-sensitive than the charges applicable to commercial banks.”

In such an environment, "there is a concern that tighter bank regulation will continue to encourage the migration of credit from banks to private credit lenders", the IMF says.

In a blog accompanying the release of the extract on April 8, the IMF says the private credit market warrants closer scrutiny.

“Rapid growth of this opaque and highly interconnected segment of the financial system could heighten financial vulnerabilities given its limited oversight,” it says.