The excessive concentration of global equity markets in technology stocks, particularly the “Magnificent Seven”, is reaching extreme levels, resulting in the indices being heavily concentrated in actively managed funds, thus making them vulnerable to changing market conditions.

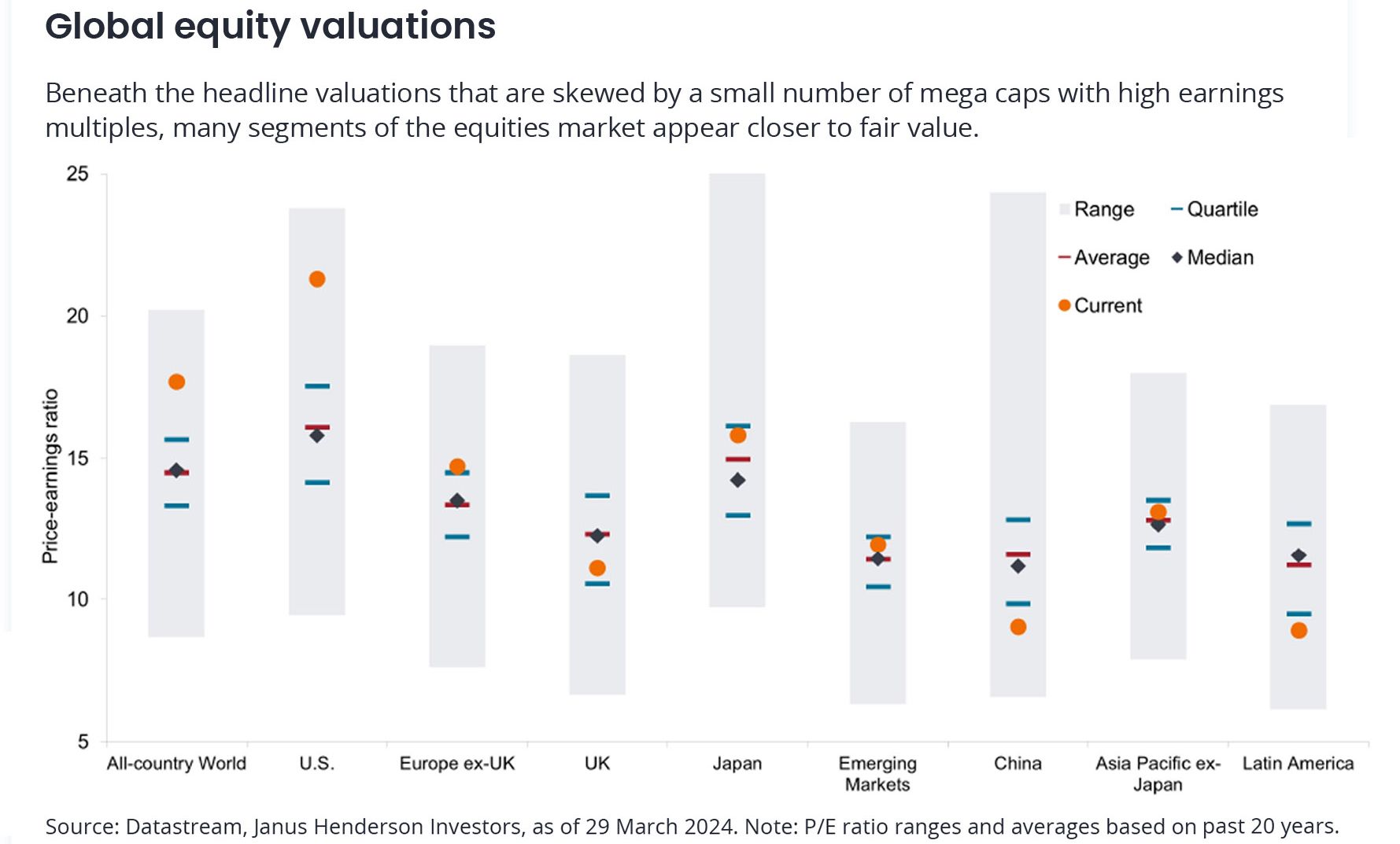

The Magnificent Seven (Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms, and Tesla), which now account for 34% of the S&P500’s market capitalization, have also skewed valuations by virtue of their high earnings multiples.

The good news is that beneath the headline valuations, many segments of the equities market now appear closer to fair value than before.

This means that investors may do well by diversifying their portfolios beyond tech stocks to other sectors, particularly smaller companies that stand to benefit from the forthcoming interest rate cuts.

Oliver Blackbourn and Adam Hetts, portfolio manager and global head, respectively, of the multi-asset team at Janus Henderson, say: “The dominance of a few richly priced mega-cap stocks obscures more attractive valuations across a range of equity market segments. Looking exclusively through a valuation-based lens at market cap weighted indices, a neutral tilt is all that global equities can presently muster. Peeling back the layers, however, we see pockets of opportunity but also areas where even more caution is merited.”

Although growth stocks are currently enjoying a tailwind, driven mainly by the impressive performance of the Magnificent Seven, aggregate corporate earnings in the US equity markets may have already reached their cycle peak.

In comparison, smaller companies, which tend to have higher levels of leverage versus their large-cap peers, have been suffering from the high interest rate environment. The impact of high interest rates on the small caps was exacerbated by their higher exposure to floating rate loans and shorter maturities.

“With the interest rate cuts, they stand to benefit from a decrease in borrowing costs amid a resilient US economy that could lead to improved earnings. Small-cap valuations also look less demanding that that of large caps,” say Blackbourn and Hetts.

Attractive valuations

In terms of asset allocation, “diversification considerations clearly favour value stocks in a portfolio context, especially over the long term, and valuations currently appear to be attractive,” says Bjorn Jesch, global chief investment officer of DWS.

Value companies generally have low price-to-book ratios, high dividend yield, and low price-to-earnings ratios; the opposite is true for growth companies. In practice, however, the distinctions are sometimes blurred, Jesch says.

Value stocks are mainly found in the financial, healthcare, industrial and energy sectors. Growth stocks are mainly found in the technology, consumer discretionary, and communication services sectors.

“We continue to see a good case for both value and growth strategies and certainly see the need to balance them in an investment portfolio. Diversification is key,” Jesch says.