Liquidity risk and financial risk are ranked as the most important for Asian CFOs and treasurers, according to a recent survey by Asset Benchmark Research.

The survey of nearly 800 respondents asked treasurers and CFOs to rank nine different financial risks in order of importance. They ranked the following from 1-9: commodity risk, counterparty risk, compliance risk, equity risk, financing risk, foreign exchange risk, interest rate risk, liquidity risk, and other risks not listed.

Each risk was then given a total score out of 100, which was weighted by the ranked positions given by each respondent. The scores were then ordered in order of importance.

Liquidity risk was considered the most important by treasurers and CFOs, followed by financing and foreign exchange risk. However, responses varied between North Asian (Japan, China, South Korea, and Taiwan) and South/Southeast Asian corporates, with those in the south having more concern for foreign exchange risk, whilst respondents in the north were more concerned about liquidity.

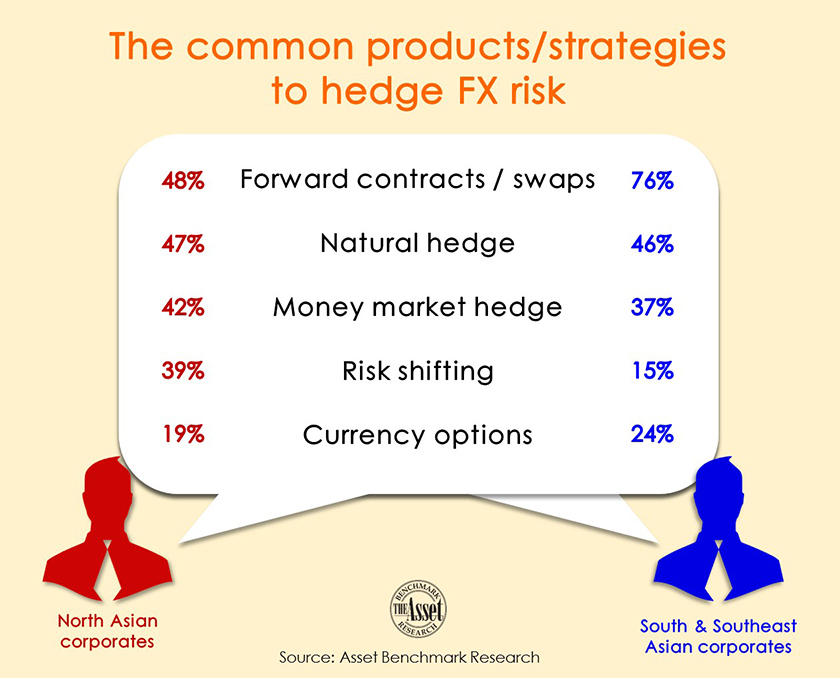

The survey also asked respondents which products/strategies they employ to hedge FX risks. Strategies such as currency risk sharing and currency collars were barely used, but forward contracts/swaps, natural hedges, and money market hedges were favoured by most respondents.

Additional reporting by Jacky Fung.