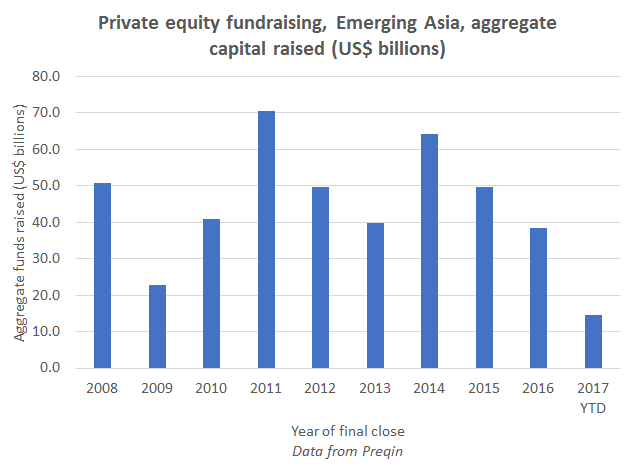

The total capital raised through private equity (PE) vehicles in Emerging Asia has slowed, from US$64 billion in 2014, to US$49.6 billion in 2015, and US$38.6 billion in 2016. Capital raised so far in 2017 (up until the end of May) is just US$14.6 billion, according to recent data from Preqin.

As Emerging Asia (Asia ex-Japan, Singapore and Hong Kong) accounts for the bulk of emerging market PE fundraising, Emerging Asia’s slowdown is in-line with an overall decline in capital raising through emerging market PE vehicles, from US$78.9 billion in 2014, to US$59.9 billion in 2015, US$45.1 billion in 2016, and US$16.2 as of May 2017.

“The private equity industry in emerging markets faces a set of challenges that can at times be quite different from those facing the more developed markets of Europe and North America. Slowing growth and rising debt in China, political and economic upheaval in Brazil, Venezuela and Argentina, and instability in Eastern Europe and the Middle East all put pressure on private equity operators in those regions,” says Christopher Elvin, head of private equity products at Preqin.

Asian markets still account for the bulk of emerging markets private equity funds. Funds focused on Emerging Asia have raised US$441 billion since the start of 2008, compared to US$45 billion for Latin America-focused funds and US$28.6 billion in Central and Eastern Europe, the second two highest totals. Emerging Asia activity is focused in Greater China, which is home to 883 private equity fund managers and 224 investors in the asset class.

Private equity funds also represent a declining proportion of global activity in recent years. Proportionally, EM-focused fundraising peaked in 2011 at 51% of funds closed and 40% of aggregate capital. This has fallen year-on-year to 2016, when they accounted for 20% of fund closures and 12% of total capital raised.

This is despite how emerging markets-focused private equity funds have seen their assets grow at an average annual rate of 21% over the past decade, from US$93 billion in December 2006 to US$564 billion in September 2016.

“However, if anything, this underlines the success of the asset class to have doubled in size over the past six years. Robust performance and recent net capital flows to investors have proved that emerging markets-focused vehicles can offer real returns on investment. While fewer investors view emerging markets as presenting the best opportunities compared to Europe or North America, if EM-focused funds can maintain their strong performance we may see that gap narrow in coming quarters,” adds Elvin.