Global green bond issuance achieved a new record in Q2 2017 buoyed by Chinese issuance, which still accounts for the majority of global green bond issuance, Moody’s has said in a recent report.

In Q2 2017, global green bond issuance totalled US$32.3 billion across 116 transactions with an average transaction size of US$278 million. This compares to Q1, which had a lower overall issuance and fewer transactions: a total issuance of US$29.5 billion across 82 transactions with an average transaction size of US$360 million.

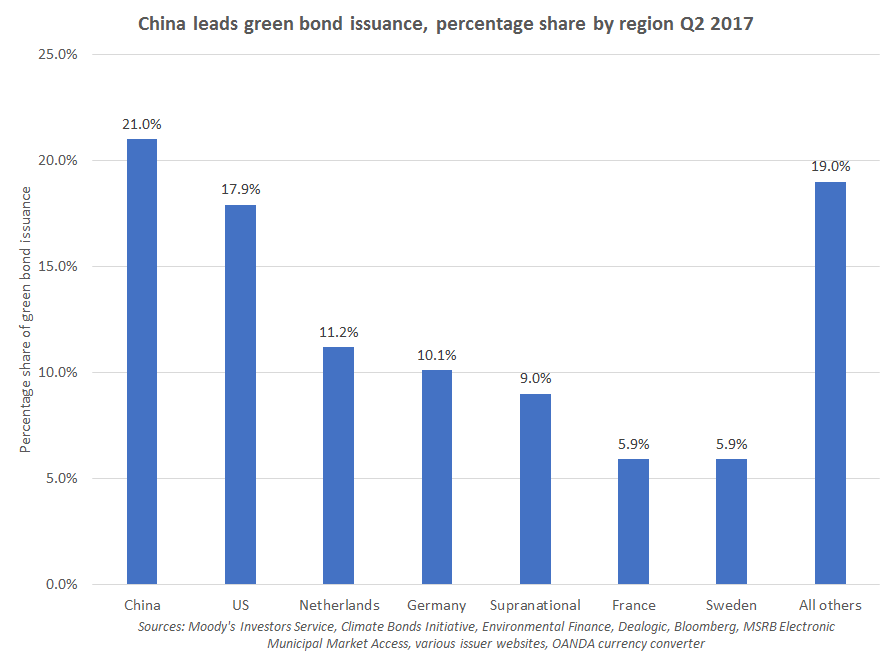

Chinese issuers brought US$6.8 billion of green bonds to market in the Q2, accounting for 21% of issuance globally. The US came in second with 18% (US$5.8 billion), the Netherlands with 11% (US$3.6 billion), Germany with 10% (US$3.2 billion) and supranational issuers with 9% (US$2.9 billion) of new deals. Despite the increased Q2 share from China, Chinese issuance remains reasonably muted compared with 2016, when China-based issuers accounted for 35% of issuance for the full year.

In March, the China Securities Regulatory Commission (CSRC) issued new guidelines for green bonds. The guidelines aim to accelerate the approval of green bond issuance and encourage financial institutions to invest in green bonds. Eligible green projects include energy conservation, pollution control, resource conservation and recycling, clean transportation, clean energy, ecological protection and adaptation to climate change. Moody’s says that the growth in regional green bond standardization will encourage growth in green bond issuance.

Second quarter global green bond volumes were supported by a record number of individual issuers: 82 individual issuers as opposed 60 in the first quarter, where total green bond issuance was supported by record issuance from the Government of France. The growth rate of the green bond market has slowed over the past year, with a growth rate of 24% compared to 170% over the previous year.

“We still don't see any material pricing advantages between green bonds and non-green bonds,” says Moody's analyst Matthew Kuchtyak. “The increased volume is easily being absorbed, same as with non-green bonds. But the depth of the green bond investor pool has yet to be tested, and we think it's very deep and growing deeper by the month. When the fixed income markets see some volatility, we think the benefits of the green bonds will become more transparent.”