Underpinned by abundant supplies, coal-fired power generation continues to dominate China’s power sector. But the strategic importance of renewable energy has been increasing, reflecting the country’s growing efforts to combat air pollution and climate change.

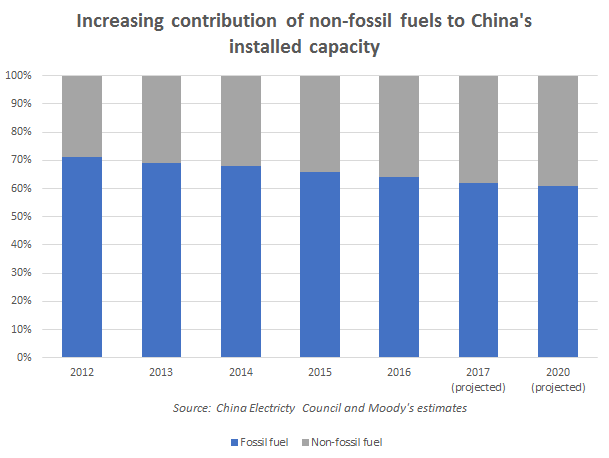

China’s total installed capacity reached 1,646 gigawatts (GW) at the end of 2016, of which coal-fired plants account for 57%. The contribution of coal-fired plants to national power generation was even higher at 65%. Hydro was the second largest power source, accounting for 20% of the national installed capacity. Renewable energy in total accounted for about 34% of the national installed capacity.

According to Moody’s Investors Service, China’s national targets for capacity expansion and favourable policies will continue to encourage the development of renewable energy. They are consistent with the country’s commitment to reducing carbon emissions as reflected in the Paris Agreement signed in 2016.

The country’s 13th Five-Year Plan (2016-2020) targets to raise the installed capacity of key renewable energy sources to at least 660GW in 2020 from 531GW in 2016. At the same time, the government has launched various regulatory directives and policies in recent years, which will help underpin the sector’s growth over the next five years.

Wind and solar power are expected to demonstrate higher growth potential than hydro power in the near term in view of the relatively low base of installed capacity and supportive government policies.

In announcing the renewable energy portfolio standards in March 2016, the National Energy Administration set a target for non-hydro renewables to account for 9% of the total electricity consumption by 2020. Individual consumption targets are also set for each of the 31 provinces at levels ranging from 5% to 13%.

But there are challenges facing the renewable energy sector in meeting their targets. Moody’s identifies grid curtailment and over-reliance on government subsidies as key industry challenges that could somewhat hinder the pace of development in the near term. Grid curtailment refers to the reduction in power generation compared to the optimal utilization of wind and solar power capacity.

The curtailment rate in wind power reached a record high in 2016, with the provinces of Gansu and Xinjiang in northwest China, both with abundant wind resources, reporting curtailment rates of around 43% and 38%, respectively.

According to the performance of solar-rich regions in the northwest China, the regional curtailment rate was high at 20%, with Gansu and Xinjiang reporting curtailment rates of around 30% and 32% last year. There is limited information on the national curtailment of solar power in 2016.

Direct support from the government in the form of subsidies is crucial to foster renewable energy in the early stage of development. In China, Moody’s notes government subsidies are a key component in the feed-in tariff, ranging from 17% to 35% of wind power tariff and 51% to 60% of solar power tariff respectively, on average, in 2016.

Subsidies are paid by the national renewable energy fund, whose main source of income is the renewable energy surcharge paid by end-users, excluding agricultural and residential users.

Meanwhile, the solar and wind tariffs are on a downward trend in the near term, but the financial impact on renewable companies is manageable. This will also enhance price competitiveness against conventional power sources and pave the way for grid parity in the future. It echoes China’s power sector reforms to liberalize the generational market in the long term.