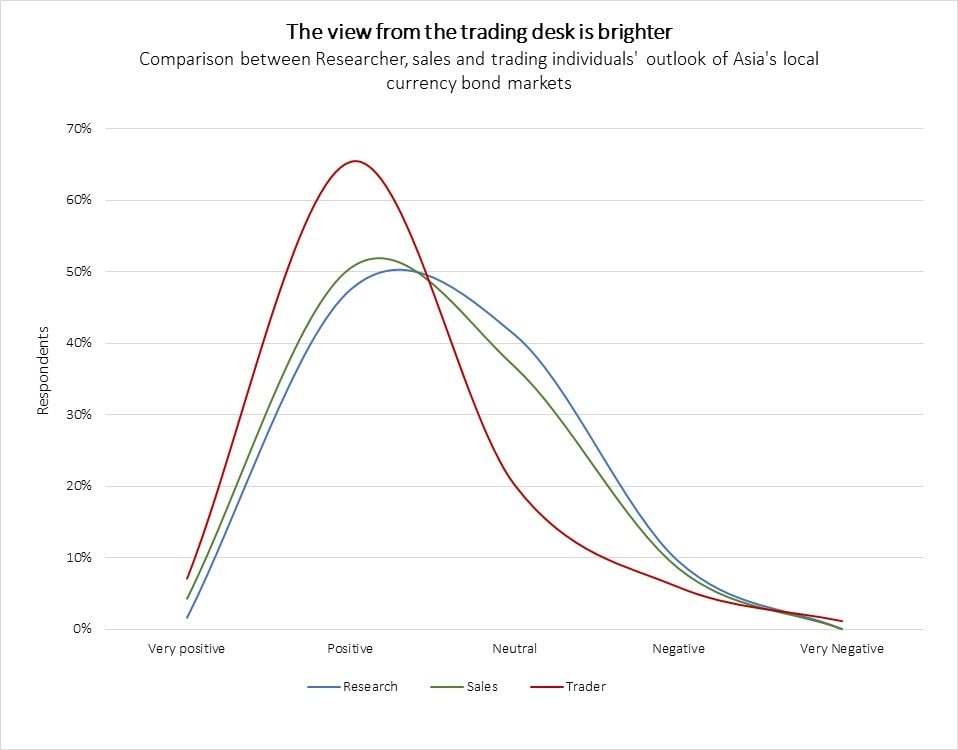

The mood in the Asian local currency bond markets for the year ahead is distinctly upbeat. Nine out of ten leading sellside individuals have either a positive (58%) or neutral (34%) outlook, according to a survey* conducted by Asset Benchmark Research (ABR). Interestingly, traders are slightly more positive than sales people or researchers.

But despite the optimism, external risks cloud the horizon. When asked what would impact Asia’s local currency bond markets in the coming 12 months, a hike in Federal Reserve rates emerged as the top concern for over one-third (37%) of respondents. One year ago, the threat of US trade protectionism was the dominant reason for anxiety and this could still re-emerge as the top fear factor once again.

.jpg)

On May 5, after the Trump administration had accused China of reneging on trade commitments and subsequently announced a new round of tariffs, many respondents signalled alarm. While up to May 3, only 14% of sellside professionals ranked the trade war as their top concern, after May 14 the percentage increased dramatically to 25%.

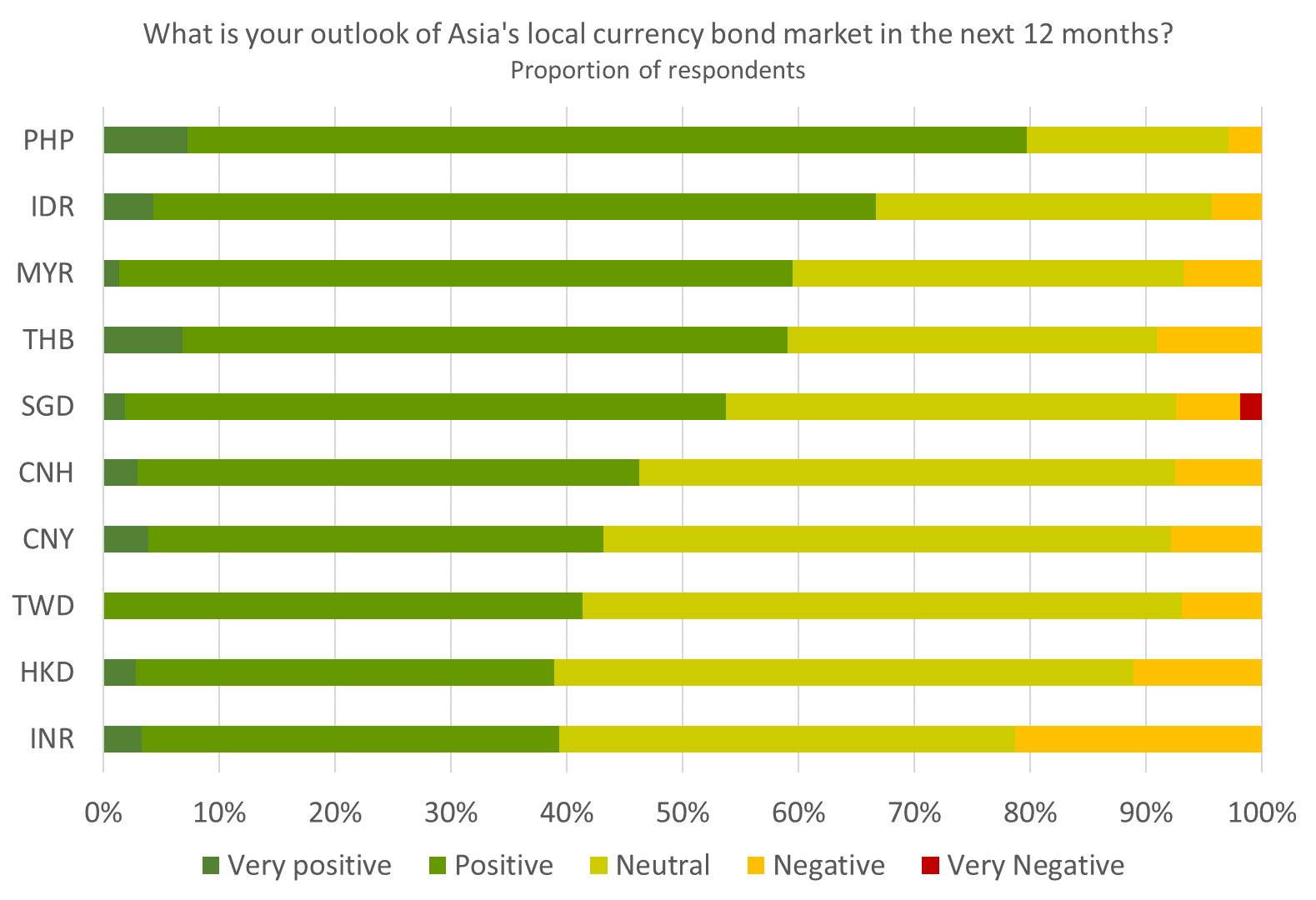

Sellside individuals covering the Philippine and Indonesian markets express the most positive view on the outlook in the coming twelve months, while individuals in India are the least optimistic. As each market has its own indigenous factors, ABR will produce a series of articles in the coming weeks to provide an in-depth view of each of the markets.

*The survey of 346 sellside individuals took place between April 26 and May 14. The sellside individuals were nominated by investors taking part in the Asian Currency Bond Benchmark Review 2019, which covers 11 markets including China (onshore and offshore), Hong Kong, India, Indonesia, Korea, Malaysia, the Philippines, Singapore, Taiwan and Thailand. The review has been conducted annually since 2000 and provides a wealth of data on the product needs of investors and the market penetration of the banks that are active in local currency bonds. It also provides detailed analysis on investors’ buying behaviour when selecting their counterparties.

To find out more about Asset Benchmark Research and our work, please click here.

To view the rankings of the best research, sales and trading individuals in Asian local currency bonds by country, please click here.