© 2021 Asset Publishing and Research Limited. All Rights Reserved.

Across the world, companies are racing to meet their sustainability targets. The environmental, social and governance (ESG) agenda has certainly risen to the top of discussion as the link between doing good and improved financial performance grows stronger. Research, in fact, has shown that companies that best manage their ESG impact are more profitable in the medium to long term.

While numerous studies on this topic confirm positive quantifiable influence on companies’ operating costs, profitability and share price; to many companies in Asia, it involves a paradigm shift in corporate culture and the collaborative effort of the whole ecosystem – policymakers, regulators and financial institutions.

Corporate treasuries can actively contribute to the sustainability agenda and finance will play a major role as companies work to improve their ESG standing. Already, green and sustainable finance are making waves across Asia as governments launch schemes to encourage market participation. Sustainable supply chain financing is on an upward trend, supported by digitization which provides greater visibility and better data. The market for green and sustainability-linked loans is also growing on the back of increasing investor demand.

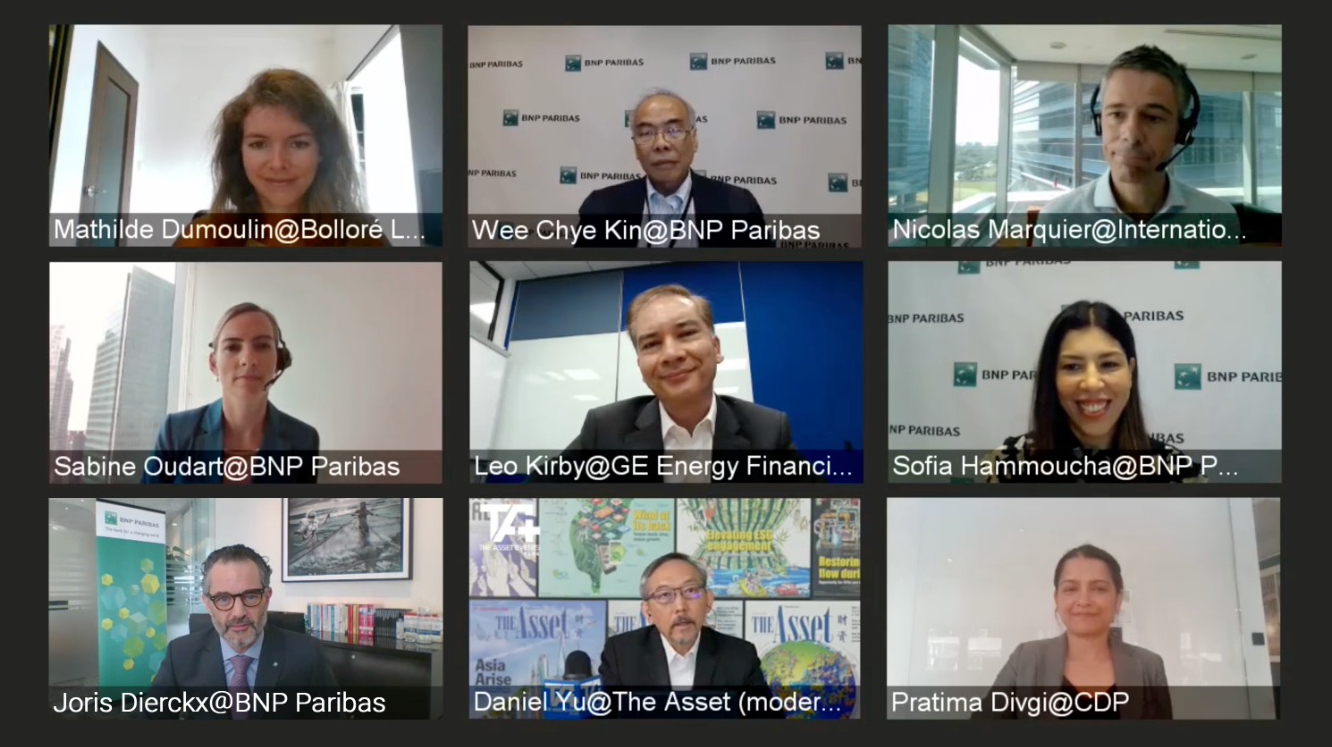

The Asset Events+, in association with BNP Paribas, is pleased to be hosting this exclusive webinar to discuss how companies can harness the power of finance to build a sustainable future.