© 2021 Asset Publishing and Research Limited. All Rights Reserved.

Before Covid-19, the Philippines was one of the world’s fastest-growing economies, posting an average annual expansion rate of 6%. But with the unprecedented challenges brought on by the pandemic, including the imposition of long and strict lockdowns that crippled economic activity, the country witnessed its worst recession yet, with the GDP contracting by 8.3% in the fourth quarter of 2020 and by 9.5% for the full year.

As millions lost their jobs, private consumption collapsed. Disruptions in domestic and global supply chains, as well as international travel restrictions, aggravated the situation. Exports dropped 10.1% while imports plunged 23.3%.

The year 2021 brought fresh hopes of recovery. In anticipation of the vaccine rollouts, the Philippines forecast a strong rebound, with the GDP expected to expand by 6.5% to 7.5% this year. But in its latest report, the Asian Development Bank slashed its 2021 growth forecast for the country to 4.5% as the Southeast Asian nation continued to grapple with the health crisis. The recent surge in infections, particularly of the more contagious Covid-19 variants, had resulted in the reimposition of strict quarantine measures in Metro Manila and neighbouring provinces.

Amid the economic dislocations, and despite falling fiscal revenues, the government has been expanding its relief efforts. The Bangko Sentral ng Pilipinas, the country’s central bank, has vowed to maintain its accommodative policy stance while infusing US$41.6 billion of liquidity into the financial system – equivalent to 10% of the country’s GDP. The government has also accelerated the implementation of recovery programmes such as Bayanihan 2, Corporate Recovery and Tax Incentives for Enterprises (CREATE) and Financial Institutions Strategic Transfer (FIST). In the meantime, remittances from Filipinos working abroad continue to support consumer spending and remain an important stabilizer of the economy.

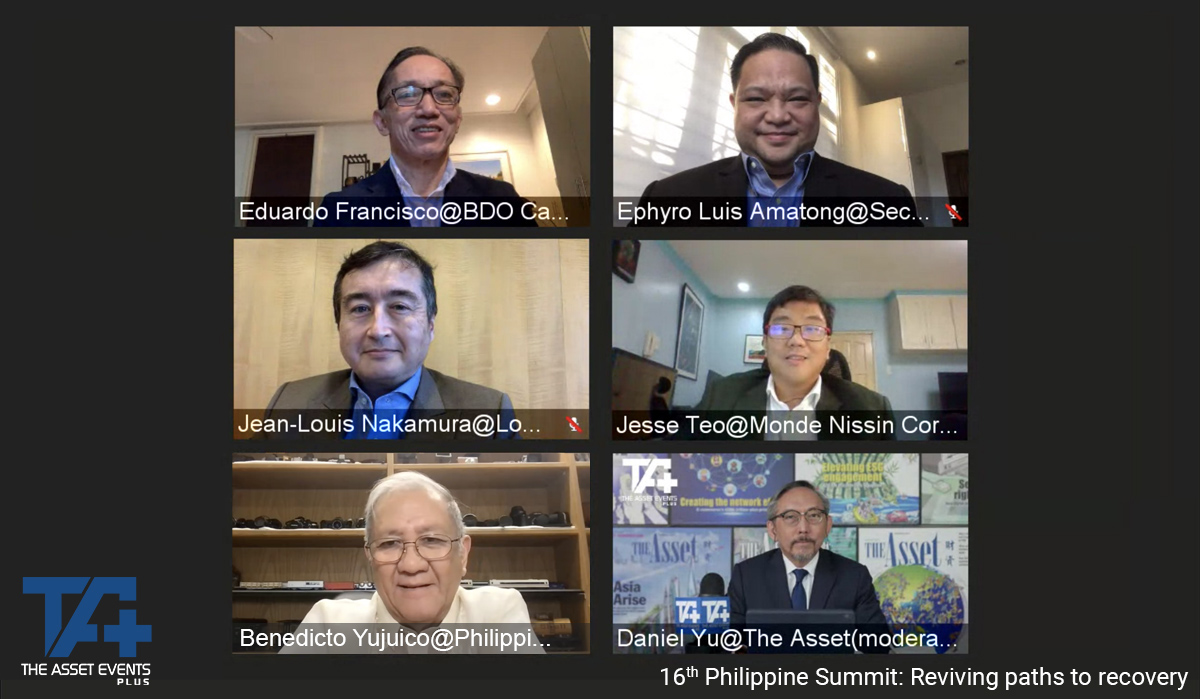

The Asset Events+ is pleased to be hosting the 16th Philippine Summit. The virtual event brings together experts who will discuss and exchange views on the challenges, trends, and opportunities in the Philippines.

Keynote address by Benjamin Diokno, governor of the Bangko Sentral ng Pilipinas (BSP)

Keynote address by Benjamin Diokno, governor of the Bangko Sentral ng Pilipinas (BSP)

Panel discussion

Panel discussion

Keynote address by Carlos Dominguez III, secretary of finance, Republic of the Philippines

Keynote address by Carlos Dominguez III, secretary of finance, Republic of the Philippines

Panel discussion

Panel discussion