ESG investors in China need to be more engaged with the companies they invest in because companies tend to use a lack of investor interest as an excuse for not actively pursuing their sustainability targets, according to a new study.

“When we look at the numbers for the companies that are already publishing ESG reports, 43% actually cite meeting investor expectations as the key driver,” says Tina Chang, associate director for sustainable investing at Fidelity Investments, citing the study, “How companies in China are approaching ESG”. The study was presented to the media on May 24.

“The key takeaway here is that investors really need to be more engaged, because when investors are engaged, companies are more likely to take action on ESG. On the other hand, when investors don’t engage, it will become a reason that companies cite for why they will not take action,” Chang explains.

The Fidelity Investments study, which covered 262 listed companies across all industries in China, indicates that ESG is increasingly becoming a strategic priority among Chinese listed companies. About 53% of the companies surveyed say they have publicly announced their ESG strategy, 29% say they have not done so but it is already a part of their strategic focus, while 18% say they intend to announce their ESG strategy in the future. None of the companies surveyed say they have no plans to include ESG as part of their strategic focus.

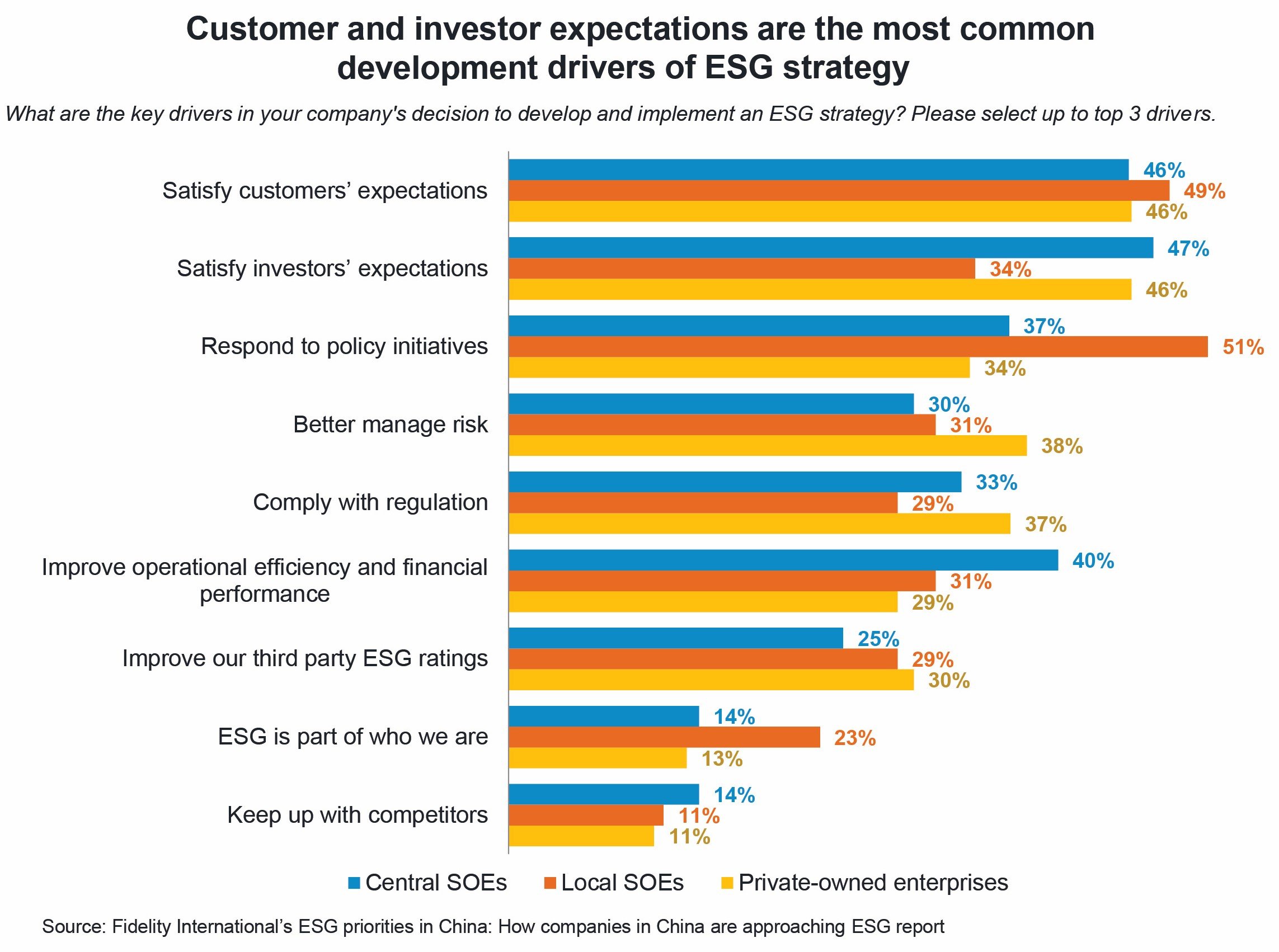

Customer and investor expectations are the most common drivers of ESG strategy development, with almost half of the respondents (49%) saying they have developed an ESG strategy to meet customer expectations while 44% aim to meet investor expectations.

Reporting quality

On disclosure, 64% of the companies surveyed are already disclosing ESG reports annually while 29% are planning to do so in the near future. However, the quality of the reporting varies quite widely from company to company.

“Investor and customer feedback is the main driver that is pushing Chinese companies to adopt ESG integration strategy, and while there is still a lot of room for improvement, the formulation of ESG strategy by Chinese listed companies are becoming more sophisticated,” says Flora Wang, head of stewardship, Asia, and portfolio manager at Fidelity Investments. “They are maturing, they’re utilizing tools like materiality assessment and asking their key stakeholders for feedback.”

For example, there has been significant progress in establishing special board functions, with nearly all firms establishing remuneration and nomination committees. Many listed firms are exceeding regulatory requirements on board committees and larger firms are more likely to outperform regulation on committee independence, but not overall board independence, according to data from the survey.

Says Chang: “All but one surveyed firm had established remuneration and nomination committees. Larger listed companies are leading in committee independence – will smaller firms catch up?”

Survey results also indicate that data collection remains the key obstacle to progress on ESG disclosure with more than half of Chinese listed companies not publishing ESG reports because of data collection challenges.

However, the survey also indicates that China’s appetite to bring ESG into the corporate agenda is on the rise and here to stay with two-thirds of companies planning to review focal areas for ESG in the coming 12 months.

“Over half of companies plan further investment in building tech and data capabilities to improve efficiency in ESG data collection and a third top priority is reviewing quantitative ESG targets,” says Chang.

In terms of ESG goals, the survey indicates that climate change action was one of the focal areas that received the most responses for future ESG goals, as well as increasing female gender representation on boards and independence committees and boards.

“We see progress with the establishment of committees at the board level that exceeds regulatory requirements. We also see that the regulators in China are emphasizing the role of independent directors,” Chang adds.