Bitcoin (BTC), the bellwether of the cryptocurrency market, will peak at US$29,095 in 2023 before dropping to US$26,844 by the end of the year, a new report forecasts.

But the price of BTC, currently around US$23,000, will jump to US$77,492 in 2025 and US$188,451 in 2030, according to a panel of 56 crypto and fintech specialists gathered by Finder.com, a comparison website for products and services.

.jpg)

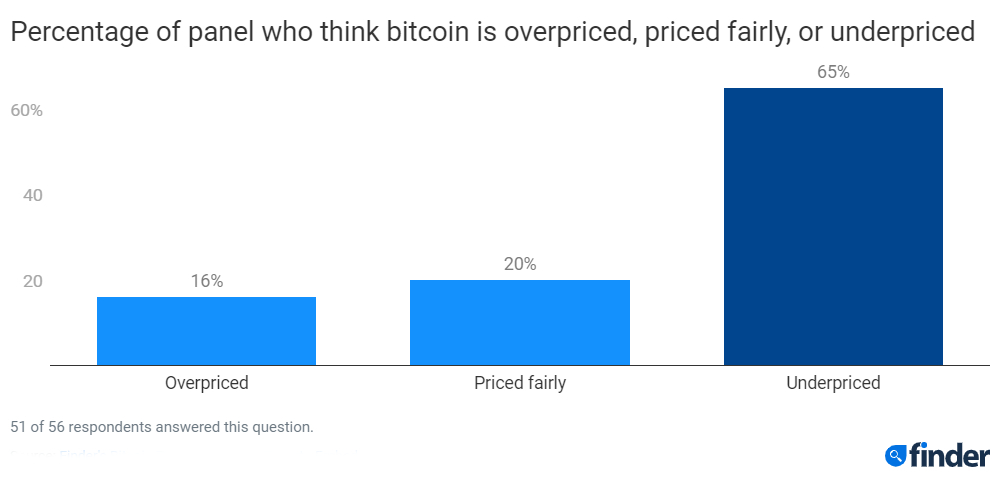

Seasonal Tokens creator and founder Ruadhan O thinks bitcoin’s price is still suppressed by worries about the financial health of centralized businesses in the industry.

“The price is low because possible imminent catastrophes are being priced in,” he says. “By the end of the year, market sentiment will have changed, and after the fear goes away, the market will rediscover the scarcity of bitcoin.”

As it is, 65% of panellists, including FxPro senior market analyst Alexander Kuptsikevich, believe that BTC is underpriced. Only 20% say it’s priced fairly, while the remaining 16% say it’s overpriced.

“The phase of the most active cryptocurrency sell-off is over. 2023 will be a year of careful price recovery. However, a real FOMO (fear of missing out) market is unlikely to come until 2024-2025,” Kuptsikevich says.

Bitcoin needs two things to rebound: the return of bullishness on Wall Street and the Federal Reserve’s exit from its rate-tightening policy, asserts Finance Magnates senior analyst and editor Damian Chmiel.

“The former will not happen without the latter, and we are left to wait patiently for now. In the long term, however, I believe bitcoin will become a popular choice among traders,” Chmiel says.

University of Canberra senior lecturer John Hawkins is more bearish, predicting that BTC will close the year at US$10,000, before dropping to US$5,000 in 2025 and US$500 in 2030.

Hawkins believes that bitcoin has no useful role as an asset after it’s been “spruiked as a payments instrument, safe haven, inflation hedge and diversification asset”.

“In the short term, more of the crypto companies that are shedding staff and restricting withdrawals, and no longer have FTX to bail them out, will fail, putting downward pressure on the bitcoin price,” he adds.

While BTC is currently rallying above US$20,000, the panel expects it to drop to US$13,067 at some point in 2023 – the lowest it’s been since October 2020.

Following the recent market crash and FTX collapse, a fifth (21%) of Finder’s panel believe institutional investors will leave the crypto market for other asset classes this year. However, the majority (75%) think otherwise, while the remaining 4% are unsure.

AskTraders senior cryptocurrency and forex analyst Nick Ranga is one of those who believe that institutional investors will leave crypto this year. Commenting on BTC specifically, he says: “With inflation still uncomfortably high and recession risk looming, overall market sentiment remains risk-off. US interest rates are expected to peak at around 5% in the first half of 2023 so we could see investors return to riskier assets later in the year. In the short term, there could still be more downside.”

Rouge International managing director Desmond Marshall is part of the majority who think institutional investors are here to stay: “Unless there are more sudden surprises like FTX, the market is now undergoing a clean-up of scammy and faulty exchanges and companies. After this clean-up and with the Fed interest continuing to hike, and with the BTC upcoming halving in 2024, there should be stronger support during H2 of 2023.”

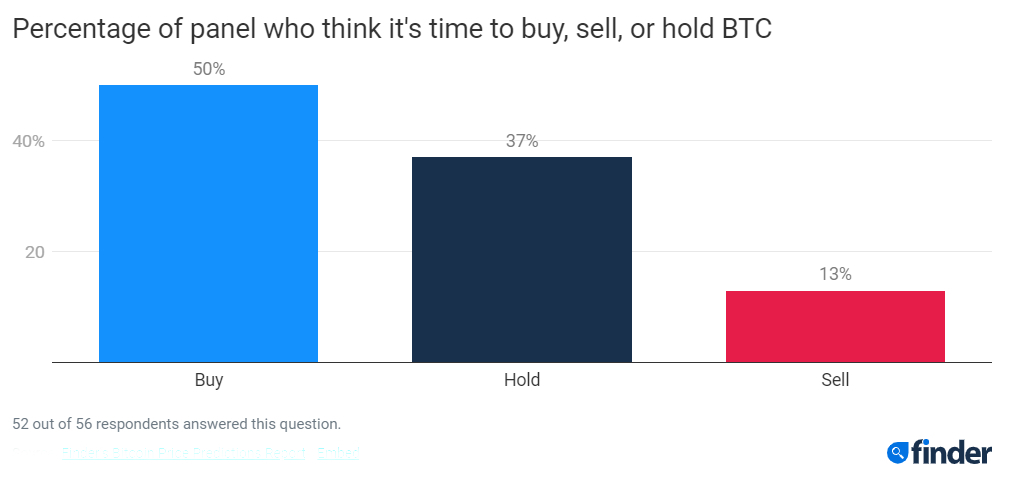

Overall 50% of Finder’s panel say now is the time to buy BTC, 37% hold, and 13% sell.