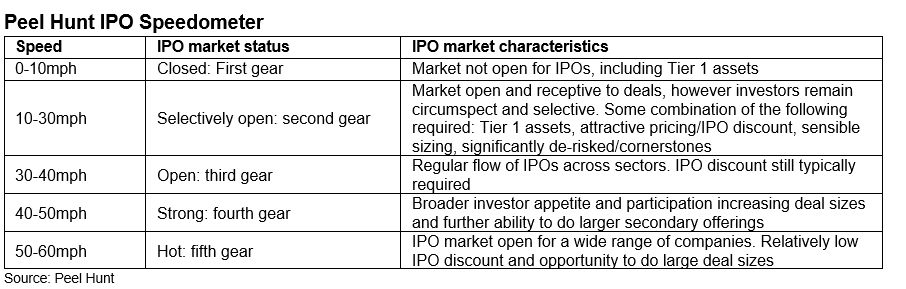

Just to prove investment banks can make it interesting and a little fun while waiting for the UK IPO market to show signs of life, Peel Hunt (PH) just launched an IPO Speedometer, a bi-monthly sentiment indicator that displays market speeds of 0-60mph as a proxy for the health of the market. Behind the speedometer lie over 30 inputs, including fund flow data, initial public offering (IPO) and broader equity capital market (ECM) activity, investor feedback and sentiment scores, equity market performance and macro data.

The speedometer shows the UK market currently driving at 24mph. That’s pretty slow, although it is three times the average driving speed in gridlocked central London, and it comes out as ‘selectively open: second gear’ on PH’s speedometer. But the car was driving at just 15mph in January! Speed has picked up on the back of a better pace in European IPOs and fund flows, which PH hopes will feed through to the UK. (Wishful thinking?)

On the plus side, some of the legs required for a successful ECM in Continental Europe are starting to drop.

Deal size

Europe ex-UK has seen a couple of mega-flotations so far this year. Fashion and beauty products conglomerate Puig just launched its €2.5 billion (US$2.66 billion) IPO (a combination of new shares issued by the company alongside a sell-down by the Puig family) on the Spanish stock exchanges. The group owns brands like Carolina Herrera, Charlotte Tilbury, Jean-Paul Gaultier, Nina Ricci, Paco Rabanne, Adolfo Dominguez and Christian Louboutin.

Swiss dermatology and skincare specialist Galderma completed its 2.3 billion Swiss franc (US$2.5 billion) IPO in March. The company was founded as a joint venture between L’Oréal and Nestlé and fully acquired by Nestlé before its sale to a private equity-led consortium in 2019. There’ve been a few large IPOs too: Douglas (the German beauty products company, €890 million); Athens International Airport (€785 million) and Renk (the German manufacturer of specialist parts for tanks, military vehicles and ships, €500 million).

Galderma, Renk and Douglas were private equity sell-downs. Galderma is an EQT portfolio company acquired in 2019 in partnership with the Abu Dhabi Investment Authority, Canada’s Public Sector Pension Investment Board and others. Douglas was a secondary buy-out from Advent International and the Kreke family as far back as 2015, making CVC’s sell-down way overdue. Triton acquired most (over 90%) of Renk from Volkswagen and squeezed out minorities to gain full control in 2021.

Cornerstone investments

Some deals have been helped out by investments from cornerstone investors, always a good signal for institutional buyers. The Renk IPO was supported by military hardware manufacturer and major customer KNDS (€100 million investment) and asset manager Wellington (€50 million). The sale of the Greek government’s shares in Athens International Airport came with additional investment by Canada’s Public Sector Pension Investment Board, the company’s majority shareholder.

Stock markets

European stock markets are currently all rising. That’s clearly a plus although far from a raging, continuing certainty. The major stock indices of the UK, Germany, France, Italy and Spain are all up year-to-date by between 3% and 10%-plus. Rising markets are a sine qua non of an open equity capital market.

Individual performance

But there’s open and there’s open. Markets are going up but they feel fragile. And if getting deals to market is a monumental achievement, getting them to perform is another issue altogether. As ECM maven and former investment banker Craig Coben pointed out recently comparing the wildly divergent aftermarket performances of Douglas (26% below the IPO price at the lows and gaining only a little weight by the time of writing to -24% on April 12th) and Galderma (+23% at the highs before losing a little steam to +18%).

Performance is always in the lap of the gods to a large extent, but getting price, size, timing and deal strategy right has become a real art for underwriters today with so much macroeconomic, monetary, political and geopolitical noise out there.

UK flow-through?

So, given all of the above, will that European activity breathe life into the UK’s IPO market? That certainly remains to be seen in Brexit Britain. Beyond two micro deals, the IPO market for domestic UK companies has been as dead as the proverbial dodo so far this year. The London Stock Exchange was involved in the US$370 million IPO of (LSE-listed) Kazakh airline Astana Air, but you’d be hard pushed to call it a UK affair. The deal was conducted simultaneously with the Kazakhstan Stock Exchange and the Astana International Exchange and 58% of the stock was allocated to Kazakh retail and institutional investors.

Adding to the constructive breeze wafting to the UK from Continental Europe, though, the UK has seen some large primary and secondary offerings. UK real estate company Segro increased the size of its primary retail and institutional offering from £800 million to £907 million. And it came with support from BlackRock (already a substantial shareholder), which agreed to subscribe for shares worth just over £91.25 (US$113.59 million).

The UK has seen two mega secondary trades this year. UK-headquartered consumer healthcare group Haleon (a 2022 GSK spin-off originally formed from a merger of GSK, Novartis and Pfizer’s consumer health products businesses) was the subject of two closely-linked secondary share sales worth £2.475 billion that allowed Pfizer to sell down its stake and GSK to exit.

Meanwhile, an investor consortium of Blackstone, Canada Pension Plan Investment Board, Singaporean sovereign wealth fund GIC, Thomson Reuters and others further reduced their stake in the London Stock Exchange Group by selling £1.19 billion worth of shares.

So, the UK has shown it can do size. Now, it’s a waiting game. But I sense a nervous wait. Even if the FTSE 100 is up, UK fund flows are still negative. Peel Hunt noted that March was the 34th straight month of outflows so UK IPO candidates will have to appeal to non-UK buyers.

A UK IPO pipeline is reportedly starting to build based on media stories and market intel. But deal pipeline while much vaunted, can turn out to be mythical. Peel reckons there’ll be more UK IPOs in the second half with a broader re-opening in the first half of 2025.

Now, if I got a pound for every time I heard those sort of predictions...