As the demand for accurate and insightful corporate reporting continues to grow, finance departments around the world are finding it increasingly difficult to keep up in this ever-changing reporting environment. According to a recent survey conducted by EY the top two challenges faced by CFOs and financial controllers when it comes to optimizing reporting systems is integration and automation.

Similar system pain point can be seen here in Asia where close to half of the firms surveyed in the region stated that they were looking to improve their IT reporting infrastructure. Despite the drive towards IT improvement, firms need to grapple with several challenges before embarking on their updating journey.

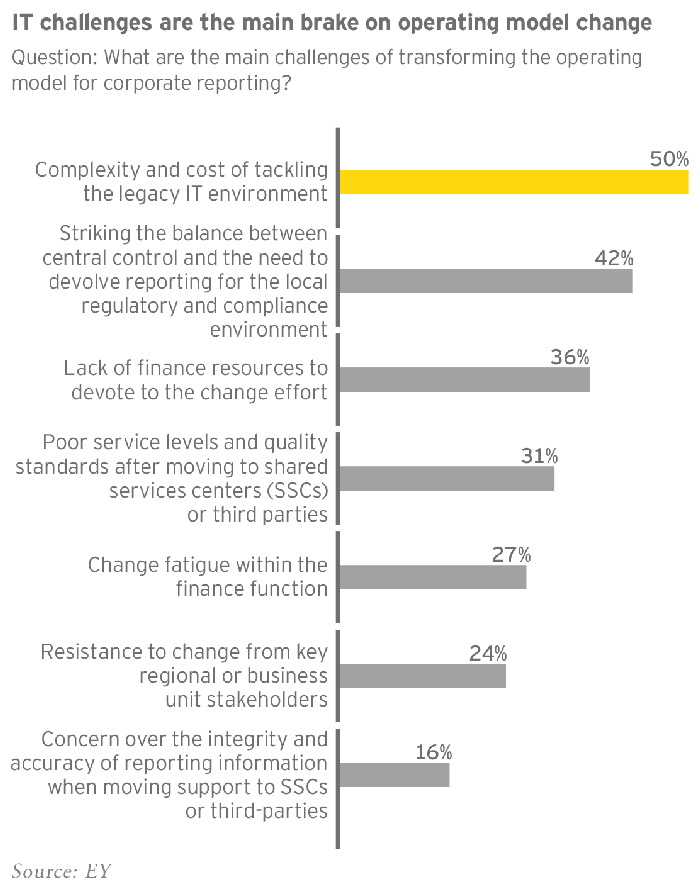

The EY report states that 50% of participants felt that the cost of tackling legacy IT systems was the main factor in holding the firm back for any improvements. Other roadblocks included crafting a system that had a balance between central and localized reporting that complied with local regulatory standards. Moreover, firms mentioned a lack of resources in handling the change management process.

Firms able to enhance their corporate reporting have looked at a wide spectrum of technologies in speeding up their financial processes. One area is big data technology. For years auditors have had to deal with the time consuming task of reviewing financial documents. However, with big data involved auditors can focus on how the technology can be used for conducting audits and therefore automate highly repetitive work.

Other companies have sought cloud computing as a solution for handling large amounts of financial data. As mentioned last week regulators in Asia are slowly getting accustomed to businesses leveraging on cloud technology for better efficiency. In the realm of financial reporting cloud computing is seen as an enabler of flexibility letting businesses respond quickly to changing reporting standards.

Aside from revising internal reporting processes some firms have opted to outsource a portion of their reporting. EY’s data reveals that 67% of firms surveyed were looking to increase their outsourcing to support the overall reporting team. While it is still early days, expect additional changes to take place on financial reporting as data volumes continue to increase over time.