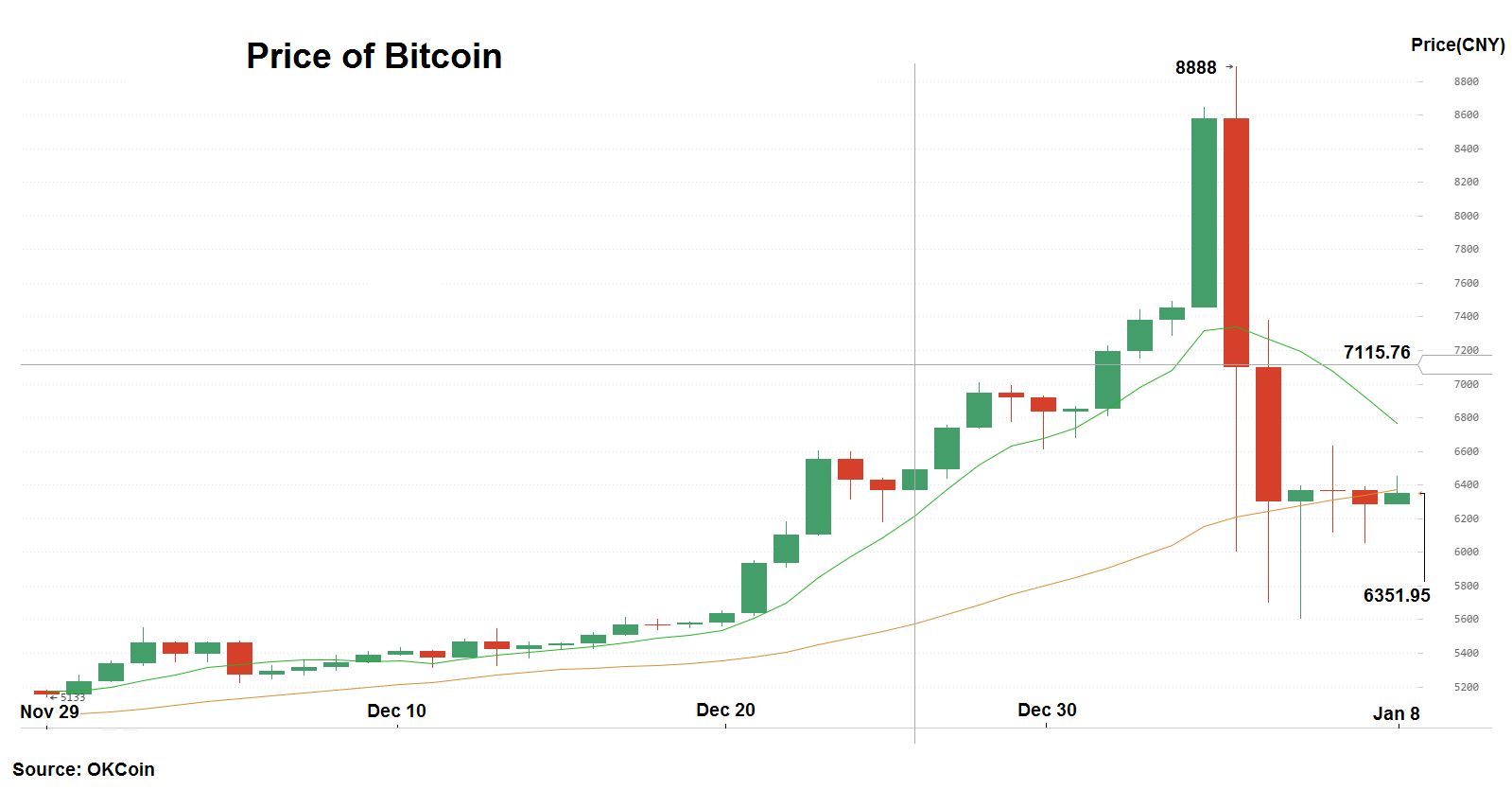

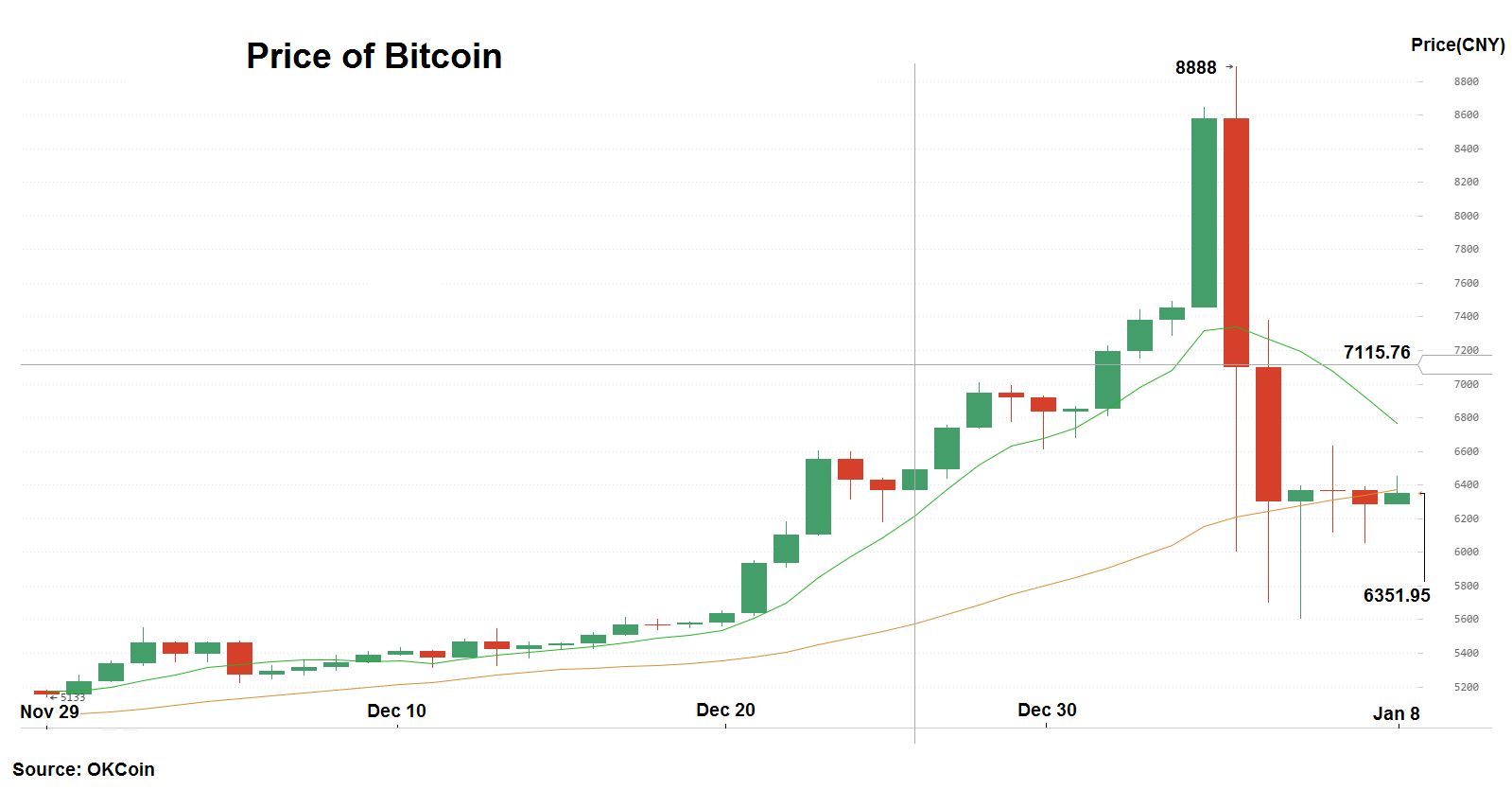

As an emerging investment product in China, bitcoin has recently seen significant price fluctuations. Ninety percent of the global trading volume of bitcoin comes from China. On January 5 2017, bitcoin reached a historical high of 8888 yuan to one bitcoin. Analysts believe that the price hike was a result of the recent depreciation of renminbi and the tightening of capital control, as traders hedge against the yuan, and dodge currency controls restricting capital outflow. However, the bitcoin then soon plummeted to around 6000, a 32% drop from the peak.

The Chinese government has recently introduced strict measures to restrict the outflow of renminbi. To evade this, Chinese bitcoin investors have been buying bitcoins with renminbi, and then selling them in US dollars. This “grey approach” allows the transfer of funds out of China, ducking the Government’s regulations.

Chinese authorities have been quick to react. On January 6 2017, the People’s Bank of China (PBoC) met with representatives of the main bitcoin platforms in Shanghai, officially stating that bitcoin is not an authorized trading currency in China. This caused a 10% drop in bitcoin.

There is no official regulation on the bitcoin trading platforms or exchanges. Once the “grey approach” becomes popular, it is expected that the PBoC will be closely monitoring bitcoin transactions with a view to catching AML (Anti-Money Laundering) activities.

The bitcoin market in China is not yet mature. None of the most popular three bitcoin platforms, huobi.com, OK-Coin.cn, and btcchina.com, employ a third-party custodian for the safeguarding of financial assets. The risk remaining in the structure makes it possible that those using bitcoin could lose all of their money, as happened in the P2P (peer-to-peer) lending market in China.

Cybersecurity has always been a serious concern in the bitcoin market. In August 2016, Bitfinex, one of the most sizeable bitcoin exchanges globally, with a daily trading volume of about US$60 million, was hacked in early August 2016 and lost 120,000 bitcoins (US$72 million).

Ironically, despite the liberal nature of the bitcoin market, the PBoC is speeding up its exploration in cryptocurrency in a bid to build its own sophisticated financial system. In mid-November 2016, the PBoC set up a research and development (R&D) department for cryptocurrency, looking to recruit blockchain and digital currency experts.