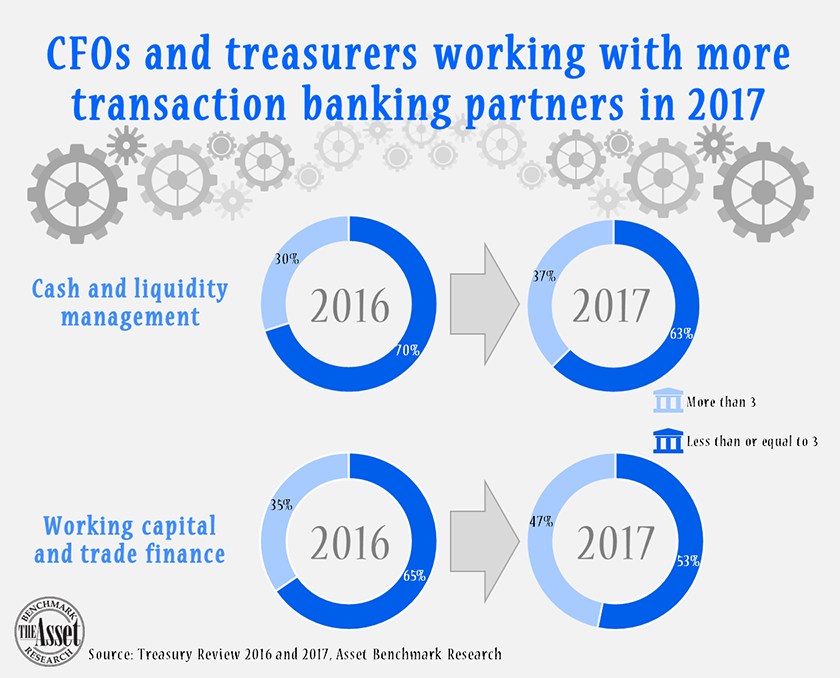

Treasurers and CFOs in Asia are working with a greater number of transaction banking partners, according to data from Asset Benchmark Research’s (ABR) Treasury Review.

Thirty-percent of surveyed CFOs/treasurers were working with more than three transaction banking partners for cash and liquidity management (CLM) in 2016, which grew to 37% in 2017. Just over a third (35%) were working with more than three transaction banking partners for working capital and trade finance (WCTF) in 2016, which grew to nearly half (47%) in 2017.

ABR conducted their Treasury Review from February through to April of this year. As part of the review, respondents were asked to score banks they work with for treasury, cash management and trade finance. These results contribute to ABR’s Client Satisfaction Index (CSI) of transaction banks in Asia.

On the one hand, fewer banking partnerships means fewer platforms and relationships to manage, on the other, more banking partners means a reduction in counterparty risk. According to one CFO from an Asia-based insurance company, “You have to look at all of your banking relationships. In order to run a financial institution, you need many banking relationships because you need to hedge your counterparty risk.”

Another indicator is when we asked treasurers and CFOs in 2017 whether they had increased or decreased their service providers for CLM and WCTF since 2016. A third (33%) said they increased the number of service providers they worked with for CLM, and 35% said they increased the number of service providers they worked with for WCTF. This compares to only 5% who had decreased the amount of service providers they worked with for CLM, and only 7% who said they decreased service providers for WCTF.

Additional reporting by Jacky Fung and David Wingrove