ETFs/ETPs gathered a record level of US$62.13 billion in net inflows in January, marking three years of net inflows, according to a recent report by ETFGI.

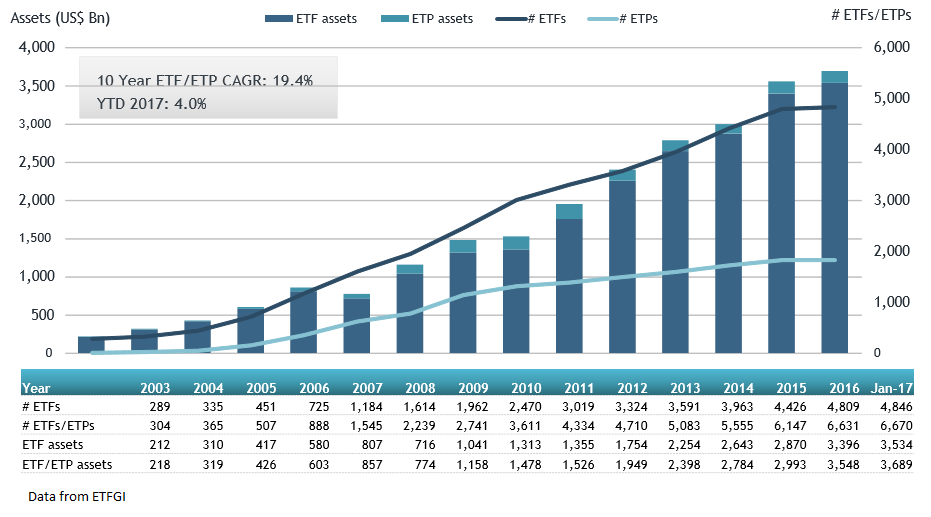

Assets invested in ETFs/ETPs listed globally reached a new record high of US$3.689 trillion at the end of January 2017, surpassing the prior record of US$3.546 trillion set at the end of December 2016. In Asia Pacific ex Japan, assets under management for ETFs/ETPs amounted to US$132.87 billion. This compares to Europe at US$598.76 billion, and the US at US$2.641 trillion.

At the end of January 2017, the Global ETF/ETP industry had 6,670 ETFs/ETPs, with 12,588 listings, from 293 providers listed on 65 exchanges in 53 countries.

“Investors favour equities over commodities and fixed income during January as equity markets had a good start to 2017. Developed markets outside the US and emerging markets showed strong performance in January up 3.2% and 5.1% respectively while the S&P 500 index was up 1.9% and the DJIA index was up 0.6% in January,” according to Deborah Fuhr, managing partner and co-founder of ETFGI.