In the 2017 year to date, the SGX S-REIT 20 Total Return Index has generated a 20.4% gain, with the broader group of 31 Real Estate Investment Trusts (REITs) and six stapled trusts averaging 18.6% total returns.

All these trusts have generated gains over the period which range from 5% for Fortune REIT to 34% for Sabana Shariah Compliant Industrial REIT, according to a Singapore Stock Exchange (SGX) note.

Singapore REITs have a current gearing ratio limit of 45%. The 31 REITs and six stapled trusts average a 34.6% gearing ratio, which range from 25.6% for SPH REIT to 43.4% for Cache Logistics Trust. In addition to the type of property assets and geographical locations, varied gearing ratios may also serve as a differentiator for REIT Sector investors.

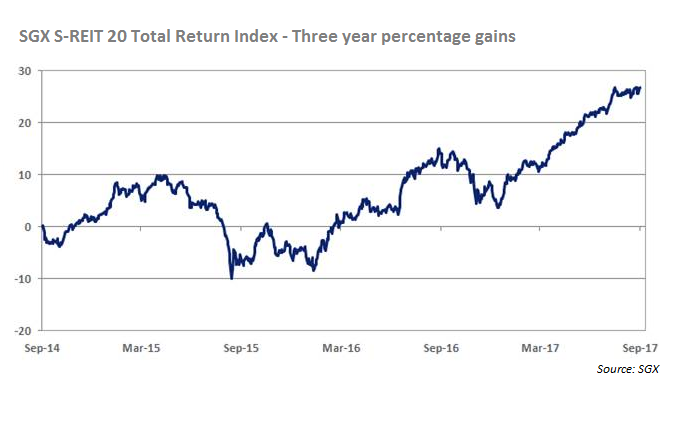

The month-to-month gains of the SGX S-REIT 20 Total Return Index were relatively consistent from the last week of December 2016 through to the first week of September 2017.

The SGX S-REIT 20 Total Return Index has also experienced some downturns particularly in the second half of 2015. This coincided with the building in of expectations of an interest rate hike in the United States at the end of 2015 which eventuated.

At that time markets had also built in expectations of multiple interest rates hikes in 2016, which did not eventuate, rather there was just the one hike at the end of 2016. This coincided with the SGX S-REIT 20 Total Return Index recovering from those preceding losses in the course of 2016. In the 2017 year-to-date, the REIT Sector has benefited from the same broad growth theme that contributed to strength in the Real Estate Management & Development stocks, in addition to the Banks.

SGX also lists two REIT ETFs – the Phillip SGX APAC Dividend Leaders REIT ETF and NikkoAM-StraitsTrading Asia ex Japan REIT ETF which were listed on SGX in October 2016 and March 2017 respectively.