Wealth management clients in Asia-Pacific are showing a growing interest in environmental, social and governance (ESG) themes, indicating that a major reallocation of investments could be in the cards.

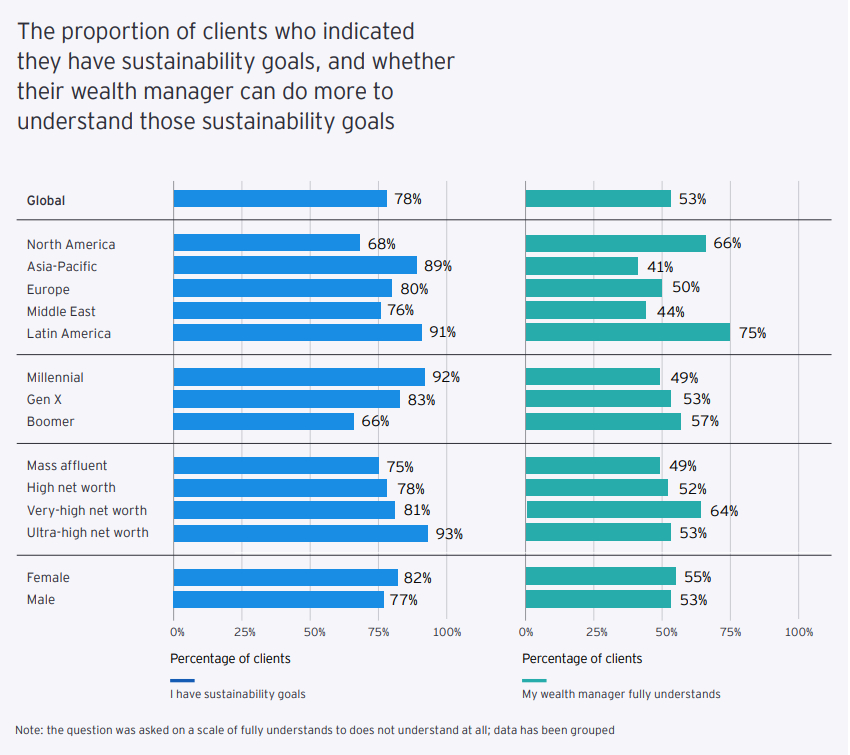

About 89% of respondents in the region say they have personal sustainability goals, compared with the 78% global average, a new study finds. However, 59% feel their wealth manager falls short of understanding their values.

“Clients are now investing for purpose and looking beyond return on investment. For clients, purpose underpins the reasons why they invest – including their desire to do good and to create a meaningful personal legacy,” according to the 2021 EY Global Wealth Research Report.

“Worldwide, 78% of wealth clients now have goals related to sustainability in their lives, while 62% of clients, regardless of age or gender, have goals related to generating a legacy. Each of these two aspects – sustainability and legacy – are important when considering a client’s overall purpose and how it is changing.”

The survey also finds that 88% of respondents in Asia-Pacific believe it is important to consider ESG parameters in their portfolios and impact investing is expected to grow through 2024, reaching an average adoption level of 52% from 45% in 2021.

Source: 2021 EY Global Wealth Research Report

Wealth providers’ understanding of their clients’ sustainability goals appears to be falling short of expectations. “True, half of clients believe wealth managers understand their goals, but 41% [of respondents globally] feel their provider could understand those goals better and 5% think firms don’t understand them at all,” says the report.

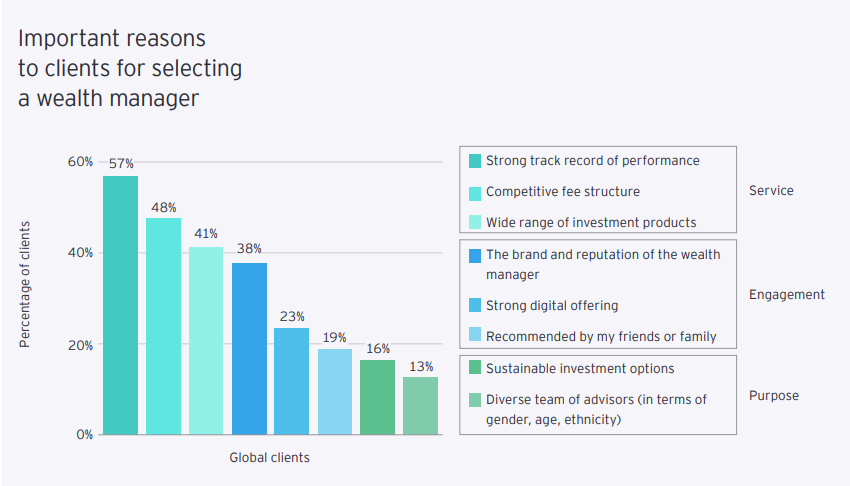

More significantly, 35% of clients who have sustainability goals are looking to switch wealth managers in the next three years, over twice as many as among clients without sustainability goals (15%). It’s also striking that a quarter of millennial clients see sustainable investment propositions as the most important factor when selecting a new wealth manager.

"A major reallocation of investments is clearly in the cards, with 76% of [global] clients believing it is important to integrate ESG parameters into their portfolios," the report says. Some issues, such as climate change, are a major concern in every region. Others are more localized. For example, deforestation is a concern for 61% of Latin American clients but just 19% for those in Asia-Pacific.

Mark Wightman, EY Asia-Pacific wealth & asset management consulting leader, says: “The growing focus and interest on ESG and impact investing present a huge opportunity for wealth managers in the coming years and the winners will invariably focus on understanding their clients’ values and offering a broad choice of ESG investing options, tailored guidance and advice.

“Wealth managers that can offer a combination of bespoke advice and niche investments will become increasingly popular as global demand for more holistic approaches to wealth management rises. There’s a lot to gain also from seeking collaboration with other providers, from health insurers to competitors, in order to deliver an ecosystem for clients.”

According to the research, 43% of respondents in the region want to consolidate all their financial relationships in one place – across private banking, wealth, insurance and investment services – but 72% of those who would like to consolidate have yet to choose a sole provider. Even among investors who prefer multiple financial providers, 33% say they would pay more to access a consolidated view of their investment portfolios, pointing to a greater need to deliver an ecosystem of financial services.

One deciding factor in the choice of a provider will be a firm’s diversity and inclusion (D&I) practices. Wealth management clients surveyed increasingly view D&I as a sustainability goal with 59% seeing D&I efforts as important when evaluating a wealth manager. This rises among millennials (72%), the ultra-wealthy (60%) and in markets such as China (68%) and Singapore (63%).

Source: 2021 EY Global Wealth Research Report

Based on a survey of 2,500 wealth management clients in 21 geographies, the report looks into what investors value in their wealth management relationships and how this changes across service models, engagement choices and value-aligned advice.

It finds that over three-quarters (76%) of wealth management clients in Asia-Pacific are willing to pay more for personalized service, while 70% are willing to share personal data with their primary wealth manager, a higher proportion than those willing to share with doctors, retailers, technology firms and media platforms.

They have also accelerated their use of digital technology amid the Covid-19 pandemic, which is likely to lead to permanent changes in the behaviour of firms and investors. The study finds that 64% of respondents in the region plan to use more digital and virtual tools, while 61% plan to engage more with their adviser virtually. At the same time, 49% expect their relationship with their wealth manager or adviser to become less personal from a human interaction perspective in view of the pandemic.

Elliott Shadforth, EY Asia-Pacific wealth & asset management leader, says: “There’s no doubt the shift into digital is here to stay. Customers are increasingly relying on these tools to analyze their investments and manage their wealth more efficiently, but financial services firms have to find a way to also leverage technology to bring more value and curated options, bringing a whole new experience to each interaction they have with their clients.”

While the vast majority of Asia-Pacific respondents (89%) are aware of trading and product fees, 50% remain concerned about hidden costs when working with their wealth manager, suggesting there is scope to improve transparency and education.

Clients also want to change the way they pay for specific wealth and investment services. For discretionary investment management, there is growing preference for performance-based fees, which creates a stronger perception of alignment between charges and value creation. However, for basic wealth offerings like portfolio reports and life-goals coaching, 16% and 8% of respondents respectively expect to receive them at no cost by 2024.

“The notion of what value really means in wealth management is rapidly changing and technology has a big role to play in elevating experiential factors so that they’ll become key drivers of pricing going forward. We know people are willing to pay more for a better experience and leading firms will be focusing more and more on these value-added products and services to meet their clients’ evolving needs,” Shadforth says.