High-net-worth individuals (HNWIs) are increasing their capital commitments to private equity at a rate that will outpace institutional growth in the asset class, with a compound annual growth rate of 19% by 2025, a new report finds.

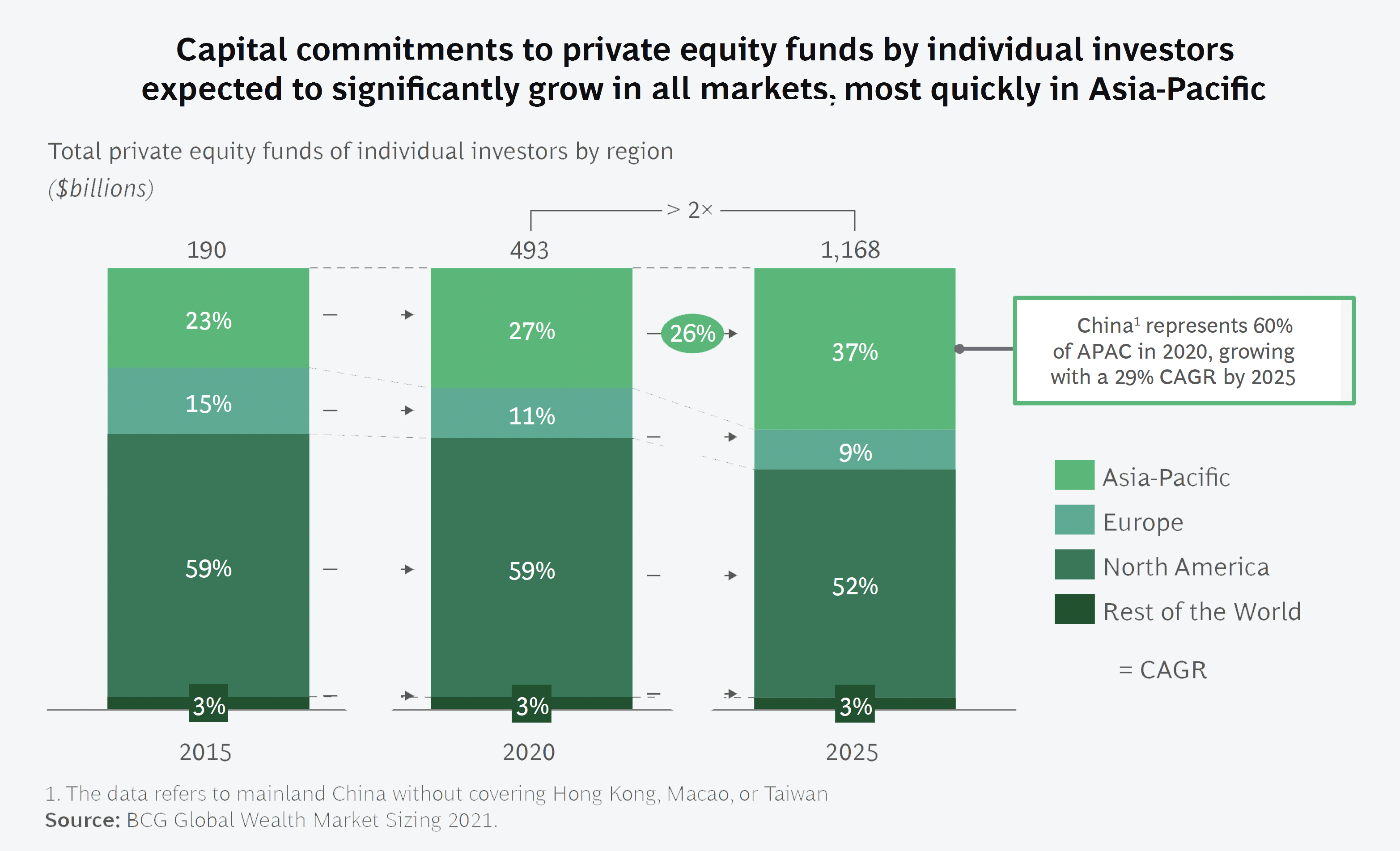

By 2025, HNWIs will account for more than 10% of all capital raised by private equity funds and the total assets under management of individual investors in private equity will be 2.4 times larger than today, rising to US$1.2 trillion, according to the report by Boston Consulting Group and iCapital.

“Our study underlines not only the magnitude of rising HNWI asset allocations towards alternatives, but also the size of the market opportunity for banks and wealth managers who expand access to private market investments for their high-net-worth clients. It is not only an opportunity for wealth managers, but downright a responsibility towards their clients to do so,” says Anna Zakrzewski, managing director and partner at Boston Consulting Group. “By helping clients more adeptly tap into alternatives as part of a holistic approach to portfolio planning, banks and wealth managers can alleviate the margin pressures they are experiencing today.”

“We are seeing a greater proportion of wealth creation taking place outside public markets driven by the fact that companies stay private longer,” says Marco Bizzozero, head of international at iCapital. “As a result, and because of the enhanced return and diversification benefits, wealth managers are making private markets a key strategic priority. Technology and education will play a critical role in supporting wealth managers in responding to the growing demand to incorporate private markets in a diversified portfolio.”

While the trend of rising HNWI allocations is reflected across all markets, the report finds that capital commitments to private equity funds by affluent individual investors are set to grow at a faster pace in Asia-Pacific. Individual investors in the region will represent 37% of total HNWI allocations by 2025, up from 27% in 2020, with capital commitments growing at a CAGR of 26%.

In order to make the most of this opportunity, banks and wealth managers should use state-of-the-art technology solutions, often provided by fintech firms, to efficiently scale their private markets business, according to the report. This will also help them overcome the barriers which have historically held back HNWI investors from gaining exposure to alternative assets. These barriers include a cumbersome, paper-based investment process; a manual client servicing model with several administrative complexities; and a lack of insightful analysis and education for advisers and individual investors.