With the market rotation from growth to value stocks losing steam, analysts are turning positive on the clean energy sector in the second half of the year on the back of a catalyst-rich period supporting sentiment. These include progress on the extension of tax credits for renewables in the United States and US President Joe Biden’s infrastructure plan.

Notably last month, the European Union released the “Fit For 55%” legislative package, a proposed set of measures to meet its 2030 target to reduce greenhouse gas emissions by 55%, up from the previous target of 40%. While this proposal still needs to be approved by the EU Parliament and member states, we already see major support for multiple segments within the clean energy sector. Some highlights of the package are as follows:

- Boosting renewable energy targets to 40% of the energy mix by 2030, from the existing 32% goal, potentially boosting annual increase in wind and solar capacity installations by around 2.5 to four times compared to today.

- Tightening car emission from new cars to fall by 55% from 2030 and drop to zero from 2035. This means that 100% of new car sales in the EU should be zero-emission by 2035, and a target of 3.5 million electric-vehicle charging points by 2030. This policy will strongly bolster the outlook for electric vehicles.

- Improving energy efficiency by aiming for a 9% reduction in energy consumption by 2030, which will cover multiple sectors from construction and agriculture to transport, manufacturing and communications. The “Fit for 55%” proposal also includes reforming the EU carbon market to tighten the supply of carbon permits after 2025, which should incentivize various industries to cut their emissions faster – thus increasing the demand for energy-efficient solutions and products.

- Land use and forestry: The EU also wants to increase the amount of carbon dioxide absorbed by “carbon sinks” such as forests and grasslands. The bloc is working on a system of carbon-removal certificates, which would help curb emissions in agriculture by allowing farmers to offset their pollution.

China also launched its national carbon emissions trading market on July 16, which marks a major step in its policy to support the clean energy transition and mitigate climate change. As the world’s largest carbon market, the first trading phase will only cover the power sector, which accounts for around 40% of the country’s total emissions. In the future, more sectors will be included such as steel, aluminium, paper, cement, airline, oil and refineries. This again marks the beginning of the clean energy transition in the world’s second largest economy, which will benefit renewables and incentivize energy efficiency in the long term.

Other reasons for optimism are Germany's plan to revise up its 2030 renewables targets to meet increased CO2 reduction targets set by the EU, the United Nations COP26 summit in November where countries are expected to announce more concrete plans to achieve the Paris Agreement targets, and the United Kingdom’s renewable energy auctions in December where the UK could award as much as 12-15 gigawatts of offshore wind capacity. Furthermore, Bloomberg New Energy Finance forecasts two years of record onshore wind builds in Europe in 2021 and 2022, plus a record year for solar builds in 2021 as well.

Significant acceleration in phasing out carbon emissions, cost of clean energy technologies continues to decline

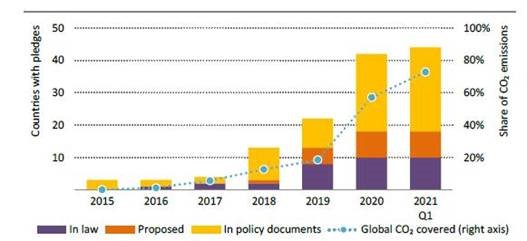

There has been a phenomenal acceleration in global government pledges to phase out carbon emissions and support the energy transition in recent years. In mid-May, the International Energy Agency (IEA) released for the first time a report providing a "Roadmap for the Global Energy Sector to Net Zero by 2050". Of note was the significant acceleration in net-zero emissions pledges announced by governments within the past three years. In 2018 the pledges covered barely 10% of global emissions, but in 2021 these pledges cover around 75% of global GDP and CO2 emissions. Furthermore, almost 20% of these pledges are enshrined in law and legally binding, with more about to be voted into law soon.

Number of national net zero pledges and share of global CO2 emissions covered

Source: International Energy Association, 2021

(In law = a net zero pledge has been approved by parliament and is legally binding. Proposed = a net zero pledge has been proposed to parliament to be voted into law. In policy document = a net zero pledge has been proposed but does not have legally binding status.)

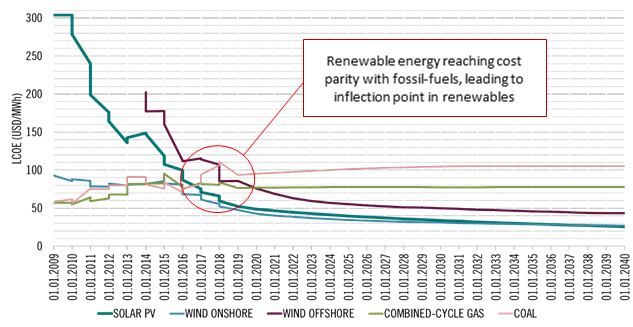

At the same time, the cost of clean energy technologies continues to decline and they are now out-competing fossil fuels based on economics alone. Technology innovation has driven down costs of clean energy technologies over the past decade, bringing about true structural disruption and transformation, with historical data showing that cost parity between renewables and fossil fuels has been reached within the past three years.

Global historical and forecast prices for the levelized cost of energy of different technologies (LCOE)

Source: Bloomberg New Energy Outlook, 2019

(LCOE is a measure of the average net present cost of electricity generation for a power plant over its lifetime. It is used for investment planning and to compare different methods of electricity generation on a consistent basis.)

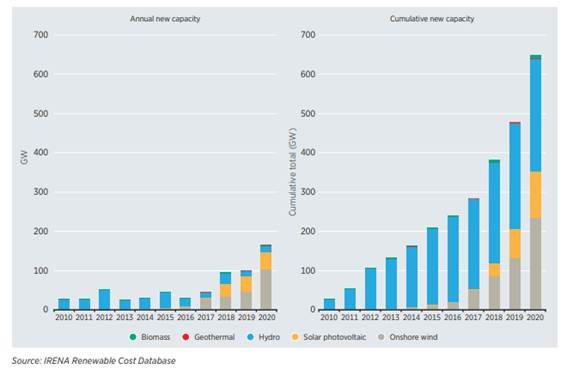

This means that long gone are the days when renewable energy depended on government subsidies or additional regulatory support to thrive. They are outpacing and replacing coal and, in the future, gas power plants simply because it makes economic sense, and this is reflected in recent data. The 2020 International Renewable Energy Agency (IRENA) analysis of power generation costs shows the increasing amount of renewable power generation capacity that has been added at a lower cost than even the cheapest fossil fuel option, with the majority being wind and solar power.

Annual and cumulative total new renewable power generation capacity added at a lower cost than the cheapest fossil fuel option, 2010-2020

(One gigawatt could power approximately 300,000 homes. Chart does not show total renewable capacity added, which was around 127 GW of solar and 111 GW of wind in 2020, but simply the amount that has been added at a lower cost than the cheapest fossil fuel option.)

Recent analysis from Bloomberg suggested that in countries that represent 46% of the world's population, building a brand-new solar park or wind farm is already even cheaper than running existing coal or gas plants, and this trend will continue. It is therefore of no surprise that wind and solar are considered the winning energy-supplying technologies of the future.

As such, the energy transition is uniquely positioned right now as it is underpinned by secular growth with long-term visibility. However, with such a long-term horizon, there will always be moments of profit-taking due to one catalyst or another, yet these moments provide rare opportunities for investors to enter such an attractive long-term theme. Ultimately, the energy transition is gaining momentum and given continuously improving fundamentals such as cost declines and increasingly ambitious government policy, the long-term characteristics of this theme will always lead investors back, despite short-term resets.

Jennifer Boscardin-Ching is client portfolio manager, thematic equities, Pictet Asset Management.