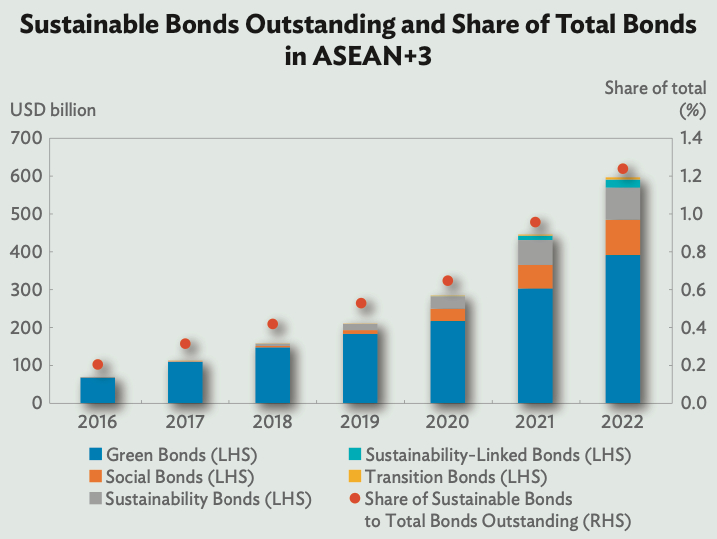

The Asean+3 outstanding sustainable bond market topped US$598 billion in 2022, crossing the halfway mark to US$1 trillion for the first time, data from AsianBondsOnline (ABO) indicate. This represents a year-on-year (YoY) growth of 34%, slower than the 57.1% growth posted in 2021 as activity was impacted by tightening financial conditions. Compared with 2016, it represents a five-fold increase.

Source: AsianBondsOnline

Asean+3 sustainable bonds outstanding at the end of the year represents the second-largest market globally behind Europe, accounting for 18% of the total sustainable bonds outstanding in the world. Still, as a proportion of the region’s bonds outstanding, it is a mere 1.2% of the total.

“Sustainable bond issuance in Asean+3 reached US$251.2 billion in 2022, up 1.7% YoY from US$247.1 billion in 2021. ASEAN+3’s share of global sustainable bond issuance rose to 28.9% in 2022, up from 21.3% in 2021,” ABO notes.

China remains the biggest market representing 46.5% of the total, which is slightly higher than the 43.2% share of the region’s overall bond market. Asean markets, accounting for 7.9% of the regional sustainable bond market at the end of 2022, similarly exceeds Asean’s share of 5.5% in the region’s overall bond market. For both China and Asean, the pace of issuance is faster than the overall market, indicating continued interest by issuers to explore sustainable bond issuances.

Interestingly, South Korea accounted for a significant 62.4% share of social bonds outstanding at the end of the review period, while Japan and Hong Kong had substantial shares of transition bonds at 42.9% and 31.3%, respectively. In the case of China, it dominates the green and sustainability-linked bond market segments, accounting for 64.3% and 61.0%, respectively, of the total outstanding for each bond type at the end of 2022.

ABO shares that the private sector largely dominates the Asean+3 sustainable bond market, accounting for 88.9% of the total outstanding amount at the end of 2022. However, given the headwinds in economic activity in 2022, that share is 21% only for the year. In the Asean markets, with its accelerated pace to deal with the Covid crisis in 2022, the public sector’s share was a significant 57.9% of the regional sustainable bond total issuance, a substantial increase from 14.4% in 2021. In terms of currency, 74.7% of Asean+3 sustainable bond issuances were denominated in the local currency.