.jpg) |

|

One of the key deliverables for corporate treasurers is funding working capital cycles and achieving related balance sheet efficiency. A large part of this mission is about managing and monetizing inventory and receivables in order to release trapped cash in the cycle and possibly improve balance sheet efficiency. There are a number of options to consider, depending on the nature and market for one's inventory.

Inventory/warehouse finance

One way to monetize inventory is for the company to borrow from a bank against the security/pledge of the underlying good/commodity as collateral. Depending on the underlying good/commodity, the value of the inventory used as collateral (via legally perfected hedge) may vary (e.g. tradable commodities). The quantum of inventory may also vary with time as the company uses raw materials in production, sells the finished goods or adds to the existing inventory during procurement.

|

|

Depending on historical inventory movements, banks may allow the company to borrow up to a fixed percentage of the current value of the underlying inventory. Mark2market/valuation would be done on a regular basis to determine changing collateral values with either a top-up, hedging mechanism or both put in place to mitigate price risk.

Off -balance sheet/ commodity true sale solutions

Another method involves the use of either the bank's own balance sheet or a commodity arm to purchase the underlying commodity from a client with an in-built option for the client to repurchase it back at a point in the future. This allows the client to receive a true sale benefit (subject to their auditor's views) of the underlying commodity asset, thereby releasing trapped cash. The call option allows the client to buy back the commodity asset in future for further sale to an off-taker. The underlying commodity is typically hedged for price-risk before being sold to the bank or its trading arm.

Monetizing receivables

As with inventory, receivables reflect post-sales trapped cash for the business. There are multiple ways to monetize this trapped cash. A few of these methods are:

* Financing against receivables/ factoring

Account receivables on the balance sheet can be used as collateral for a secured loan. Quantum typically varies from 70%-90% of the receivables' value. While this does allow the company to release the cash trapped in the receivables, it also increases bank debt/leverage on the company's balance sheet.

* Insurance- or import factor-backed true sale of receivables

Another solution offered by banks is the purchase of the receivables off the company's balance sheet via a true sale arrangement. This could be on a portfolio basis or for account receivables due only from select buyers that the bank has risk appetite on. The Sale of receivables to the bank means that buyer payment risk is effectively transferred from the client to the bank, reducing credit risk exposure from buyer default or protracted insolvency. Credit insurance and payment guarantees from import factors may be deployed by the bank to mitigate item level of portfolio risk.

* Securitization

From an accounting perspective, securitization is akin to a true sale of receivables to a bank. However, from a structure perspective, securitization typically involves a special purpose vehicle (SPV) setup solely for the purpose of said securitization opportunity into which the assets (i.e. receivables) are transferred and held. This SPV is typically a ring-fenced, bankruptcy remote entity.

Normally a rated bond/note is issued against the assets in the SPV as security, promising investors a certain yield whilst simultaneously transferring the risk of buyer default from the bank onto the bond/note holders. The SPV could also 'distribute' the underlying assets to private investors or banks without the need for a bond/note issuance (e.g. in the case of a funded risk participation structure).

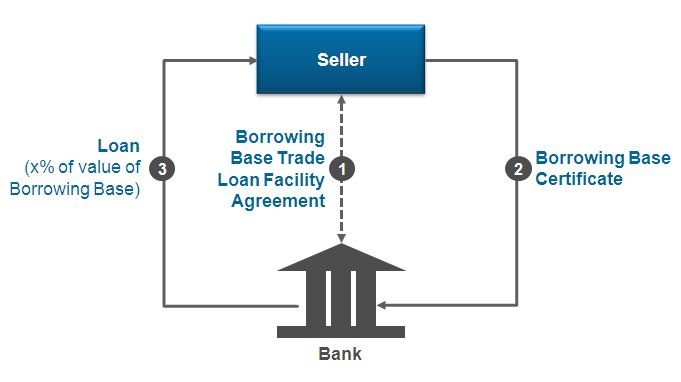

* Borrowing base trade loan

|

|

A borrowing base trade loan is a loan secured against a list of current assets provided by the company. This list is referred to as a borrowing base certificate and is provided by the borrower or a 3rd part stock monitoring agent. The assets are typically secured by way of a floating charge and perfected under the applicable laws. This mechanism helps the borrower monetize all of his current assets including Inventory, floating inventory, receivables, cash at bank, etc. without diluting the borrower's existing physical control over the inventory and processes. The bank relies on a borrowing base certificate to finance the total asset base at an agreed loan-to-value ratio. the total loan amount granted is capped at the value of the borrowing base. This is equivalent to secured borrowing for the company and the secured nature of the facility may potentially translate into better pricing from the lender.

There are several ways for companies to monetize the liquidity trapped in their current assets. Each method has its own advantages and disadvantages. Therefore it is important to choose a right approach depending on the nature of the company's business and the amount of physical control they require on their stock as well as costs tradeoff. Secured inventory finance is a growing portfolio. And we expect it to continue to grow as global demand for commodities - especially the soft-commodities - is set to increase.

Samuel Mathew is the head of solutions structuring, transaction banking, at Standard Chartered Bank