The Federal Reserve announced on March 23rd that it would purchase corporate bonds for the first time in its 107-year history, and the Federal Reserve Bank of New York began purchases of exchange-traded funds (ETFs) on May 12th via its Secondary Market Corporate Credit Facility (SMCCF).

The Fed is not the first central bank to purchase ETFs as part of a stimulus package. The Bank of Japan has been purchasing equity ETFs listed in Japan since 2012 as part of its quantitative easing programme. The Bank of Japan reported holding US$289 billion or approximately 76% of the US$382 billion investment in the ETF industry in Japan. This will be the first time in the Fed’s 107-year history that it will purchase ETFs.

BlackRock, the world’s largest asset manager and largest ETF issuer, will be running the Fed’s three debt-buying programmes. BlackRock said it would waive investment advisory fees on the iShares ETFs it buys on behalf of the Fed.

The Fed reported that between May 12 and May 19 it purchased US$1.58 billion in investment-grade and high-yield ETFs with a current market value of US$1.307 billion. The purchases have been in 15 fixed-income ETFs of which six are high-yield and 11 are investment grade. The majority – 83% – of the investment has gone into investment-grade ETFs, with the remaining 17% allocated to high-yield ETFs.

The ETF and exchange-traded products (ETP) industry in the United Sates had 2,315 ETFs/ETPs, assets of US$4.046 trillion, from 158 providers at the end of April 2020. iShares is the largest ETF/ETP provider in terms of assets under management (AUM) with US$1.542 trillion, reflecting 38.1% market share; Vanguard is second with US$1.074 billion and 26.5% market share, followed by SPDR ETFs with US$66.06 billion and 16.5% market share. The top three ETF/ETP providers, out of 158, account for 81.1% of global ETF/ETP AUM, while the remaining 155 providers each have less than 6% market share.

In the US, at the end of April, there were 1,292 products that provide exposure to equity indices with US$2.970 trillion or 73.4% of overall assets; 284 products provide exposure to fixed-income indices with US$806 billion or 19.9% of the assets; and 84 products provide exposure to commodity indices with 2.5% of the assets. (Active, leverage, inverse and other products account for the remaining assets.) There are 76 investment-grade corporate bond products with assets of US$158.92 billion, and 36 high-yield corporate bond products with assets of US$47.06 billion.

The ETFs the Fed has purchased are managed by five ETF managers. There are seven iShares ETFs on the list, which represent 48% or nearly half of the US$1.307 billion overall investment. Vanguard has two ETFs on the list that account for 35% of the assets. There are three SPDR ETFs (SSgA) with 15%, while VanEck and Xtrackers (DWS) each have one ETF with 1% of the overall allocation.

The 15 ETFs that the Fed has purchased through May 19 are:

The SMCCF may purchase US-listed ETFs whose investment objective is to provide broad exposure to the market for US corporate bonds. The preponderance of ETF holdings will be of ETFs whose primary investment objective is exposure to US investment-grade corporate bonds, and the remainder will be in ETFs whose primary investment objective is exposure to US high-yield corporate bonds. The SMCCF will consider several additional factors in determining which ETFs will be eligible for purchase. Those considerations include the composition of investment-grade and non-investment-grade debt, the management style, the amount of debt held in depository institutions, the average tenor of underlying debt, the total AUM, the average daily trading volume, and leverage, if any.

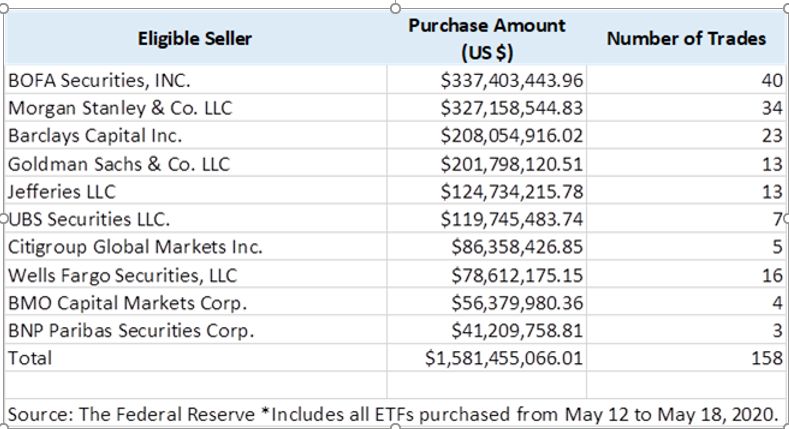

The SMCCF is transacting with primary dealers that meet the eligible seller criteria and that have completed the seller certification materials. As of May 19, the Fed has purchased ETFs from 10 primary dealers:

Additional counterparties will be included as eligible sellers under the SMCCF, subject to adequate due diligence and compliance work.

Deborah Fuhr is the managing partner and founder of ETFGI, an independent research and consulting firm on the global ETF industry and ecosystem.