For anyone who has been closely following the technology industry, it is hard to ignore all the talk about doom and gloom. Coming off from 2021, which was a record-breaking year in terms of valuations and funding activity, 2022 has seen a significant decline with global funding in the first quarter having fallen by 19% to US$144 billion from last quarter, according to CB Insights. Global venture capital (VC) funds have sounded multiple alarms to their portfolio companies to brace for the upcoming slowdown and focus on building a cash runway and sustainable growth as days of cheap capital (read equity) have come to an end.

It is during times like these that venture debt comes to the rescue and is set to play a bigger role. While venture debt is still in its infancy in Southeast Asia compared to markets such as the United States and Europe, it is quickly emerging as a viable and complementary financing option for high-growth start-ups in the region, which has predominantly depended on equity raising as a source of capital.

Both the Covid-19 crisis and the ongoing slowdown have underlined the importance of buffer capital for companies.

Appeal of venture debt

Venture debt is a form of financing suited for high-growth start-ups that have high working capital requirements but lack tangible assets or sufficient cash flows to access traditional bank lending. It is fundamentally a founder-friendly and comparatively cheaper financing option, as it helps them avoid overdiluting shareholder equity at the early stages of a company’s growth. Venture debt can also help extend the cash runway for the company between equity rounds without compromising on the growth metrics caused due to uncertainty of capital and thereby helps companies navigate unforeseen market volatility or bridge short-term capital traps.

Venture debt is not a direct substitute for venture equity, though it complements it by offering an avenue to access new funds to expand existing capacity and augment their capital base. Ultimately, with a combination of venture equity and debt, young enterprises can strengthen their balance sheets and develop an optimal funding structure that makes them better positioned for long-term growth across economic cycles.

For investors, venture debt is an attractive asset class that offers regular returns and is a good way to get exposure to the start-up ecosystem without the long wait to get their capital back.

Increasing momentum in Southeast Asia and India

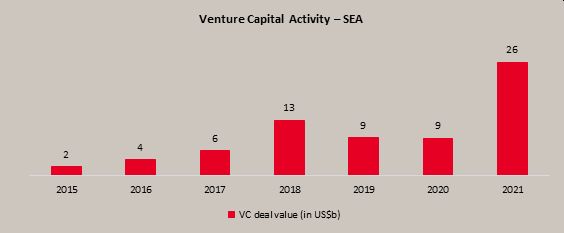

As compared to the US market where venture debt has been present since the 1970s, venture debt entered Southeast Asia only in 2015, with the Singapore government’s launch of a S$500 million (US$358.5 million) pilot venture debt programme. Back then the slow entry of venture debt could be attributed to the lack of significant venture capital activity in the region with venture capital investment in Southeast Asia at a mere US$2 billion. Now with Asia’s start-up scene gaining pace, and venture capital investment in Southeast Asia rising to US$26 billion in 2021, venture debt activity across the region has been rising significantly, particularly in key markets such as Singapore, Indonesia, Vietnam and India.

Singapore has subsequently gone on to announce enhancements to their scheme, and increased the cap on the loan quantum for high-growth enterprises from S$5 million to S$8 million in their 2021 Budget statement. Large private banks in Singapore, such as DBS and UOB, have also tapped into this new asset class by establishing themselves as active venture debt lenders.

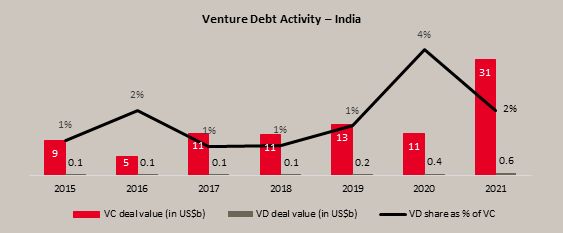

India is minting unicorns at record pace. Within the first 3 months of FY2022, it has seen 14 new Unicorns with over 70 “Soonicorns” – a loosely defined term for start-ups valued between US$250 million and US$1 billion. Following the increase in venture capital funding, venture debt activity in India has also risen twofold to around US$400 million.

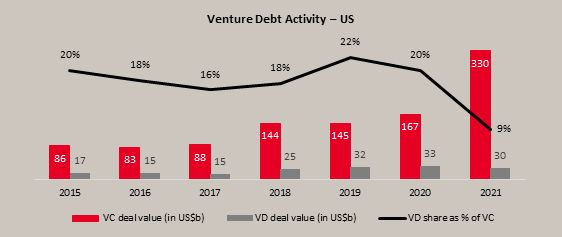

However, it would be fair to say that the venture debt market is still at a nascent stage in Southeast Asia and India, and has a long way to catchup with its peers in US and Europe. For example, more than US$30 billion has been loaned to VC-funded start-ups in the US in the last 3 years and venture debt accounts for 15% to 20% of the overall VC funding.

Source: CBInsights Venture Report 2021, Pitchbook Venture Monitor Q42021

Data on venture debt deal activity in Southeast Asia is relatively scarce, but it is highly unlikely that venture debt investments in Southeast Asia would have even touched US$1 billion in 2021, a year when start-ups in this region raised a record US$26 billion of venture capital, a whopping 200% jump from US$9 billion raised in year 2020.

Source: Cento Ventures, DealStreetAsia report

Even India, which is the third largest start-up ecosystem after the US and China, is lagging when it comes to penetration of venture debt.

Source: Pitchbook Venture Monitor Q42021, Inc42.com, Business Line

For start-ups focused on growth and expansion, venture debt stands to play an important role and catalyst for these budding companies. As start-ups do not have the capital structure to raise traditional debt, they usually rely on equity for their capital needs. Access to venture debt products and facilities can help them with regional expansion plans, however the current lack of depth of venture debt across the region can potentially constrain their geographical growth ambitions.

We believe that there is ample headroom for venture debt to continue its upward momentum in Southeast Asia, with more fundraising and merger and acquisition activity among the region’s start-ups on the horizon.

Sanket Sinha is the head of asset management and Ankit Agrawal is the director venture debt at Lighthouse Canton.