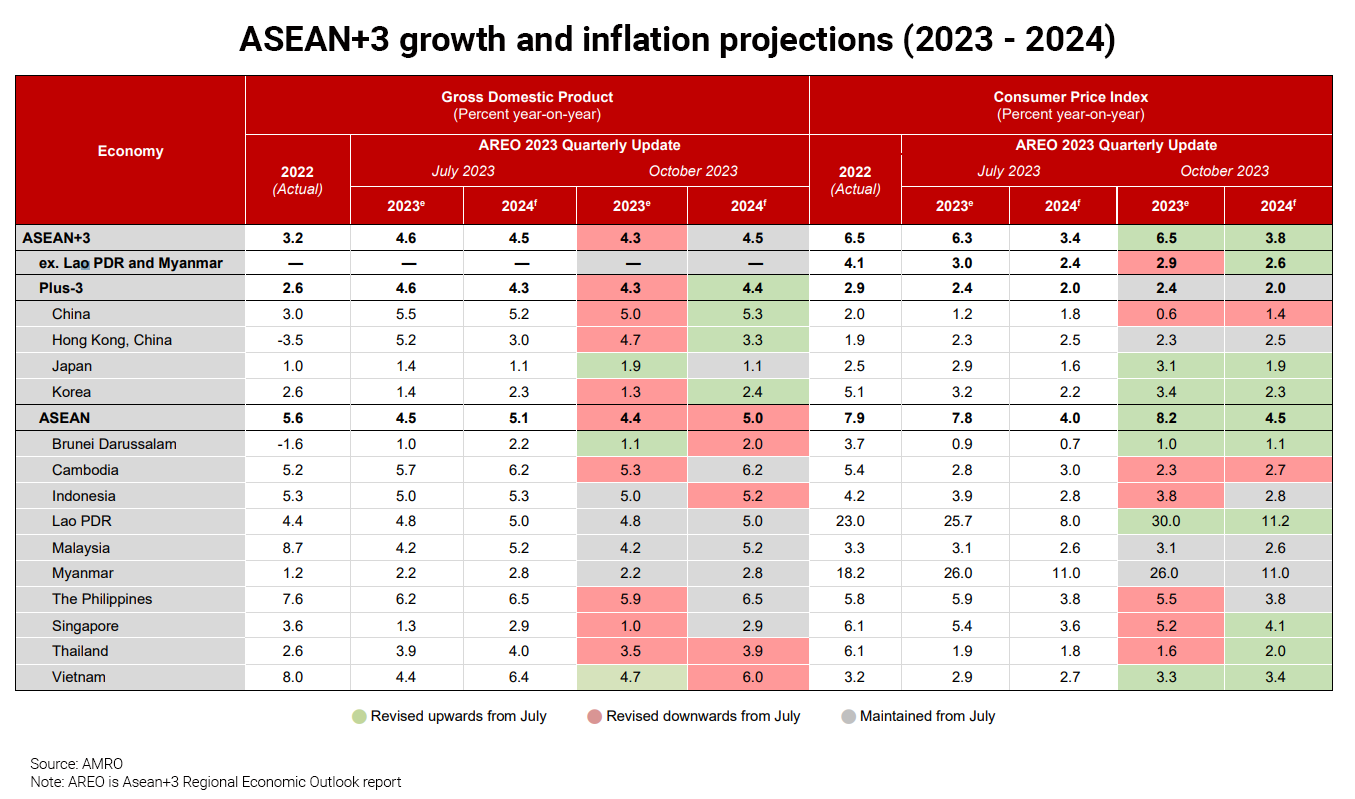

The Asean+3 region is expected to post an economic growth of 4.3% this year, up from 3.2% in 2022 but slightly lower than a previous estimate of 4.6%, according to the latest report from the Asean+3 Macroeconomic Research Office (Amro).

Asean+3 refers to the ten members of the Association of Southeast Asian Nations plus China, Japan, and South Korea.

Weaker-than-expected growth in China in the second quarter of 2023 has contributed to the downgrade in the GDP growth forecast for the region. However, the outlook is bright. Amro projects a 4.5% expansion for the region next year, with domestic demand remaining the key driver.

"Despite the gloomy headlines surrounding China’s economic performance, we must view things in perspective," says Amro chief economist Hoe Ee Khor. “Beyond the real estate sector, manufacturing investment is holding up and consumer spending is starting to get back on track – these should have positive spillover effects across the rest of Asean+3."

Inflation in Asean+3, excluding Lao People’s Democratic Republic and Myanmar, is projected to moderate to 2.6% in 2024, compared with this year's estimate of 2.9%. However, the recent resurgence in global food and energy prices raises concerns about another commodity price spike, which could lead to higher inflation. Factors such as El Niño and the strength of the US dollar relative to regional currencies could further impact inflation in the region.

Concerns such as higher interest rates, inflation, economic uncertainties, and fiscal constraints have slowed investment activity in the region, compounded by limited fiscal headroom and increasing debt levels. Private investment remains muted in Thailand, and regulatory constraints have impeded accelerated public investment disbursements in Vietnam, according to the Amro report.

Meanwhile, the export sector is facing muted demand from major trading partners and the downcycle of the global electronics industry. The major exporting economies in Asean+3 have been hit by contractions in manufactured export growth.

Accelerated rate hikes have created a credit crunch and dragged down demand. Consequently, countries like Cambodia and Vietnam, which are highly dependent on garment and footwear exports, have seen declines in shipments. Additionally, lower demand for commodities has reduced exports from Indonesia and Malaysia, while Singapore's trade slump has continued for ten consecutive months.

Non-tech exports, particularly automotives, grew 50% in the first half of 2023, reflecting the ongoing pick-up in demand for durable goods in the United States. Amro believes the region's short-term export outlook will be supported by this trend. Moreover, as the global semiconductor cycle gradually moves upward, chips exports should serve as an additional growth driver in the coming year.

The region has seen a surge in tourism flows to around 70% of pre-Covid level, which is expected to supplement the manufacturing exports. However, the weaker pace in global growth will limit the speed of the region's expansion this year.

Going forward, a rebound is expected next year, supported by China's policy incentives to boost domestic demand and the anticipated recovery of the global technology cycle.

Amro has adjusted its economic outlook for China in 2024, with GDP growth projected to hit 5.3% from 5.0% this year. The Philippines, Vietnam, and Cambodia are expected to exhibit the strongest GDP growth, surpassing 6%, driven by benefits from the supply chain.

However, the Asian Development Bank presents a less optimistic projection in its September growth outlook report. It predicts that China's GDP growth will moderate to 4.5% next year due to a slow domestic recovery and external risks.