Asset managers and ownersin Asia are witnessing a transformation in the industry driven by data insights and digital innovation. They have been deploying technologies to enhance their capabilities, efficiency and competitiveness. As a result, the increasing demands are shaping the way they select asset servicing providers.

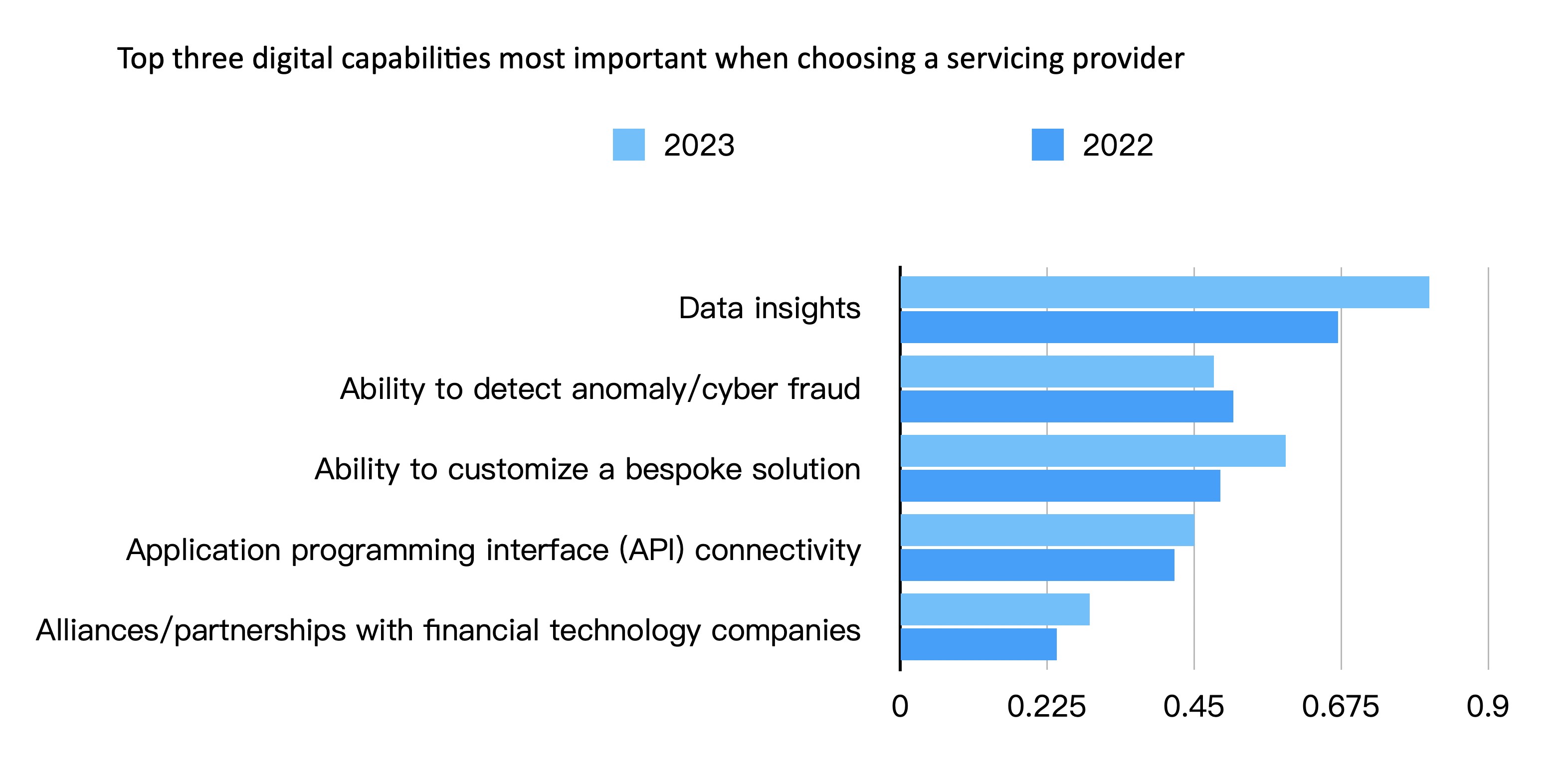

Data insights continue to be the top reason for asset managers and owners when choosing asset servicing providers. The Asset Servicing Insights 2023, an annual survey conducted by Asset Benchmark Research, finds a significant 81% of respondents indicating that data insights are the primary factor driving their choice of asset servicing providers. This marks an impressive increase of 14% from the previous year. In an era where information is power, asset managers and owners are placing a premium on data-driven decision-making.

Another notable trend is the increasing demand for customization. In the same survey, 59% of the respondents chose the ability to customize a bespoke solution as one of the top three digital capabilities most important when choosing asset servicing providers, up 9% from last year. Asset managers and owners are recognizing the need for tailor-made solutions to address their unique requirements and challenges.

Other important characteristics asset managers and owners are looking for include the ability to detect anomaly and cyber fraud (48%), application programming interface (API) connectivity (45%) and alliances and partnerships with financial technology companies (29%).

Asset managers and owners have been actively deploying technologies to enhance their capabilities and efficiency. Cloud technology is the most widely adopted, with 51% of respondents incorporating it into their processes. Big data analytics (46%), API (45%), robotic process automation (37%), and artificial intelligence and machine learning (35%) are also being widely applied.

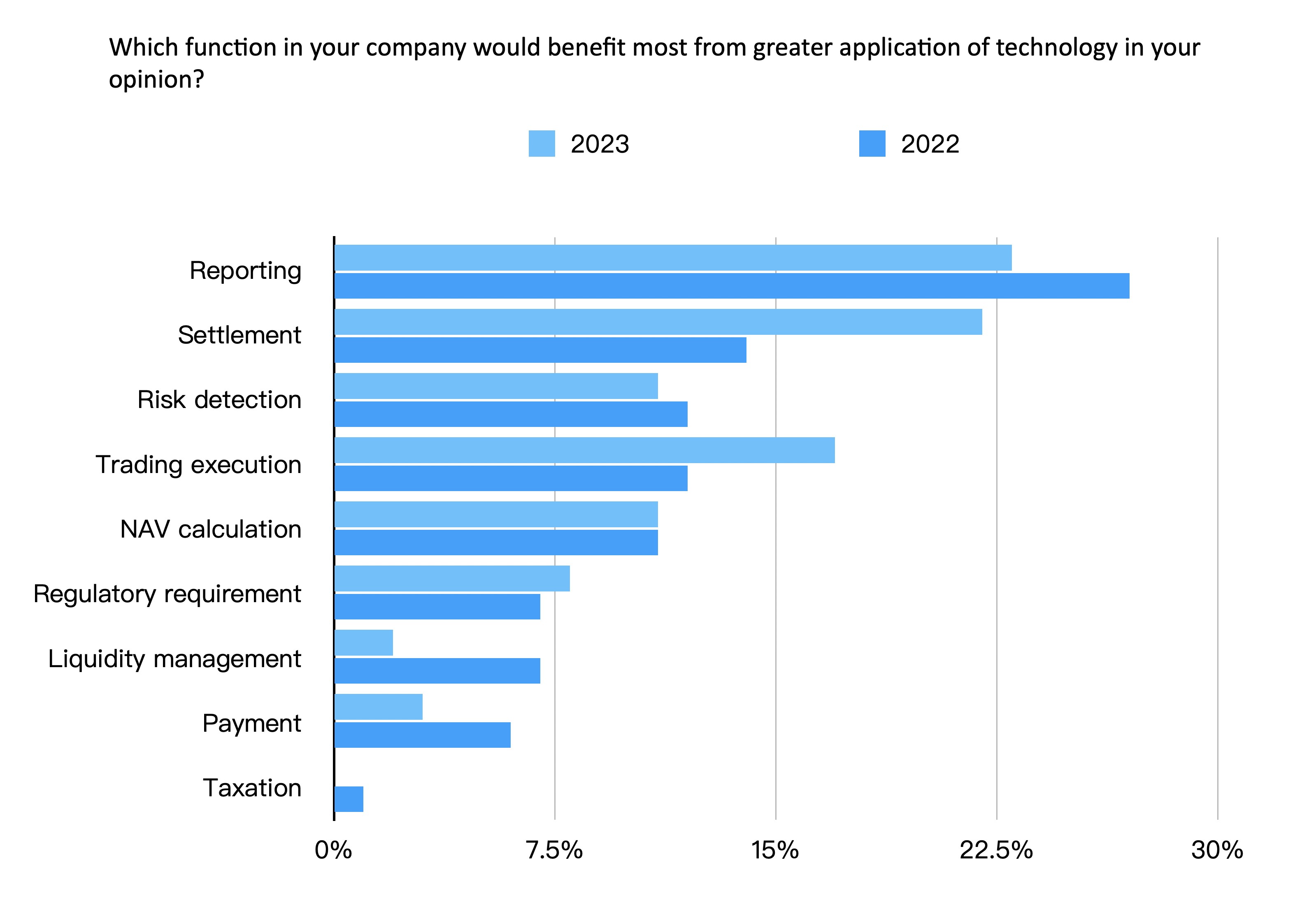

These technologies have led to significant improvements in various areas. Asset managers and owners have found enhancements, according to the survey, especially in areas such as settlement (22%), up 8% from last year. Technology also improves trading execution, with 17% of respondents mentioning it, up 5% from last year. Other outstanding improvements are found in reporting (23%), risk detection (11%) and net asset value (NAV) calculation (11%).

Digital asset investments on the rise

In recent years, the survey has been seeing stable interest in digital assets. This year, Asset Servicing Insights has found that 3% of asset managers and owners have invested in digital assets.

Notably, this year’s survey reveals a significant increase in cryptocurrency investments, with 100% of respondents considering this asset class, marking a 25% increase from the previous year. Investments in non-fungible and security tokens also saw a 25% increase.

Many asset managers and owners are choosing to invest in digital assets through private equity (75%), marking a new channel mentioned by this year’s respondents. Digital exchanges are also gaining popularity, attracting 75% of the respondents, an 8% increase from the previous year. Additionally, approximately 50% of respondents are investing through digital funds, indicating a 17% increase from the previous year.

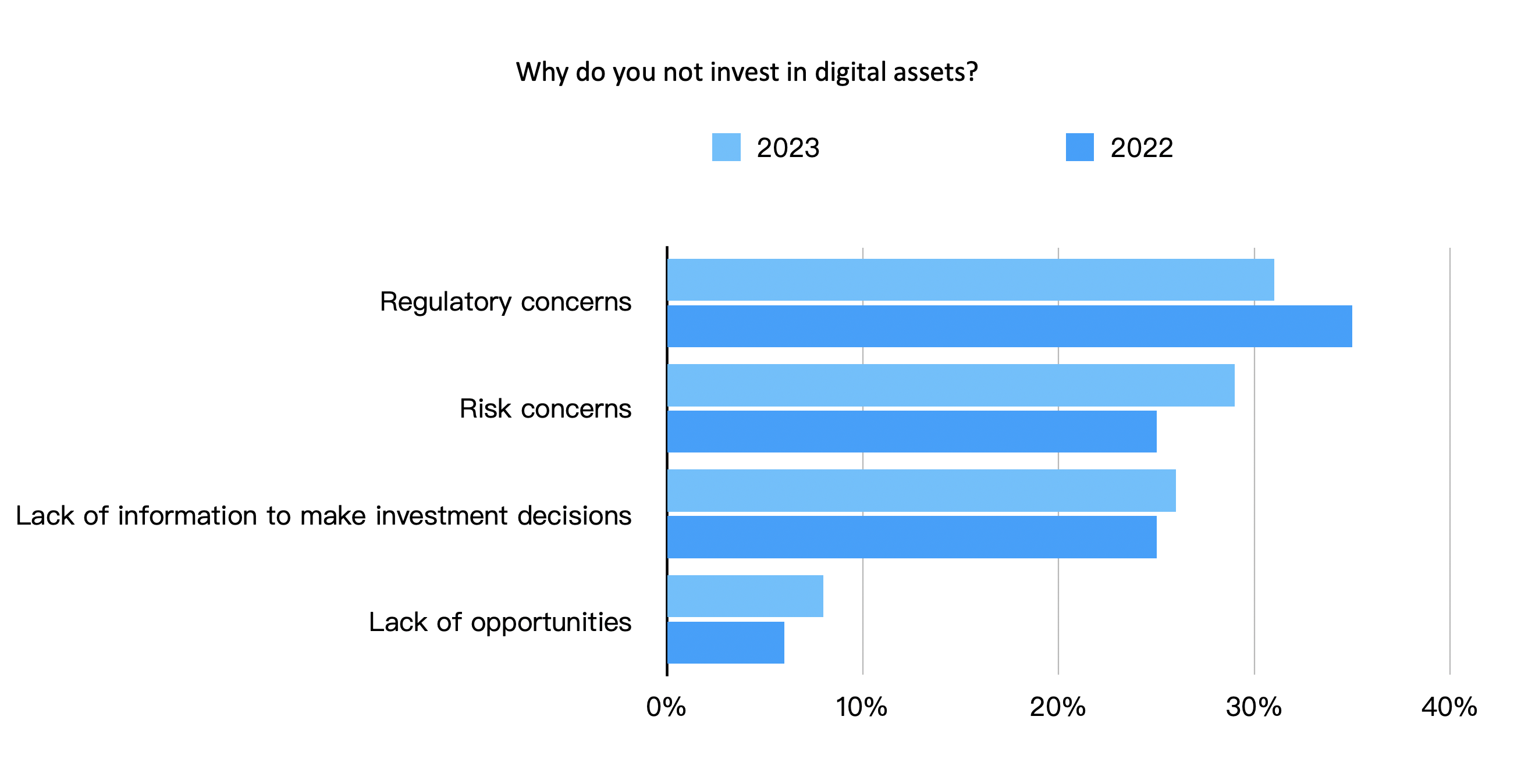

Despite the growing interest in digital assets, asset managers and owners remain cautious. Key concerns such as regulatory hurdles (31%), risk concerns (29%) and a lack of information to make informed investment decisions (26%) are restraining some asset managers from fully embracing this new investment class.

However, 59% of respondents, the survey reveals, remain unsure about their future plans related to digital asset investments, while 34% have decided not to invest in digital assets at all. Although most of the asset managers and owners have not started their digital asset investment plans, 63% of them plan to use digital asset service providers in the future, signalling that they are keeping a close eye on this evolving landscape and may enter the market once they feel more confident and informed.