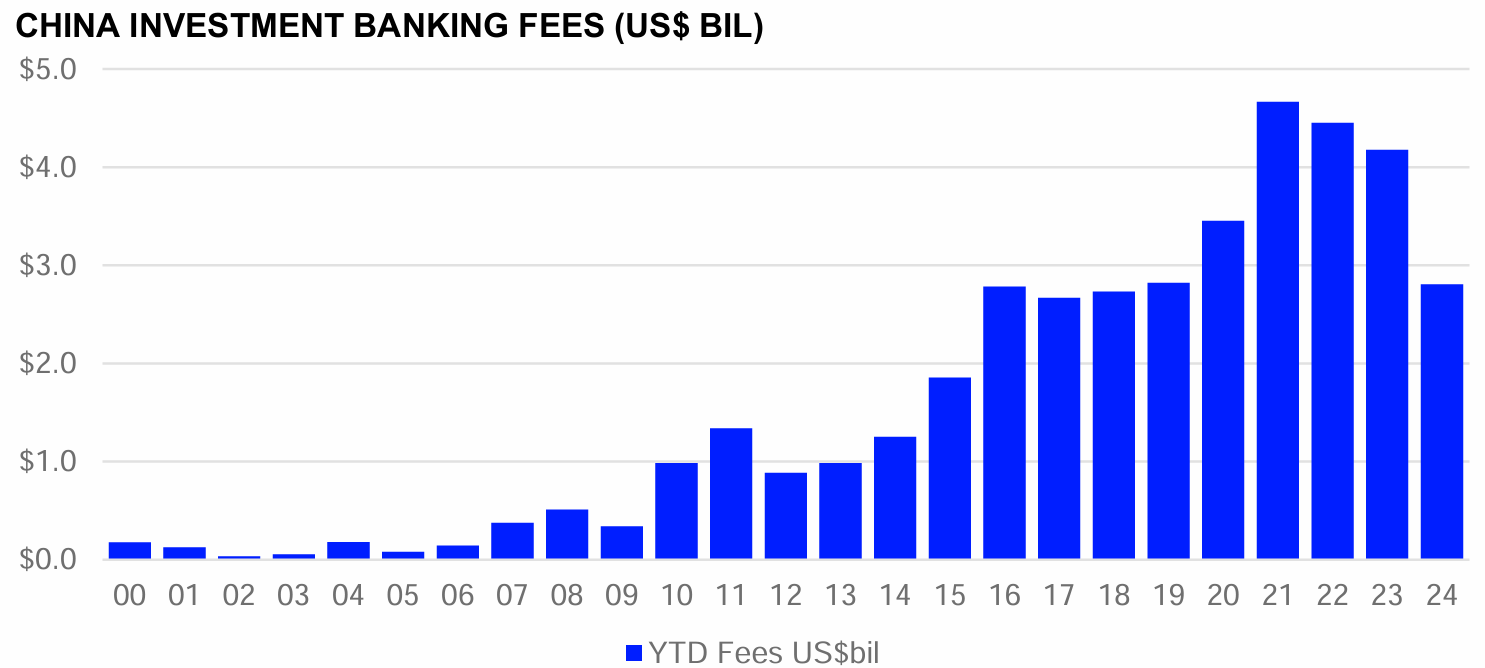

Reflecting the challenges facing China’s economy, investment banking fees generated in the giant market plunged 33% in the first quarter of 2024, compared with a year ago, to US$2.8 billion, a new report finds.

Underwriting fees in China’s equity capital market (ECM) accounted for 11% of the country’s investment banking fee pool and totalled US$301 million, a 77% fall from Q1 2023. Debt capital market (DCM) underwriting fees reached US$2.2 billion, remaining flat from a year ago, according to the London Stock Exchange’s (LSEG) China Investment Banking Review.

Completed advisory fees in the mergers and acquisitions (M&A) segment amounted to US$117.8 million, down 36% from the same period last year. Syndicated lending fees reached US$152.7 billion, down 67%.

CITIC currently leads the China investment banking fee league tables with US$223.1 million in related fees for an 8.3% wallet share during the period.

Source: LSEG, China Investment Banking Review

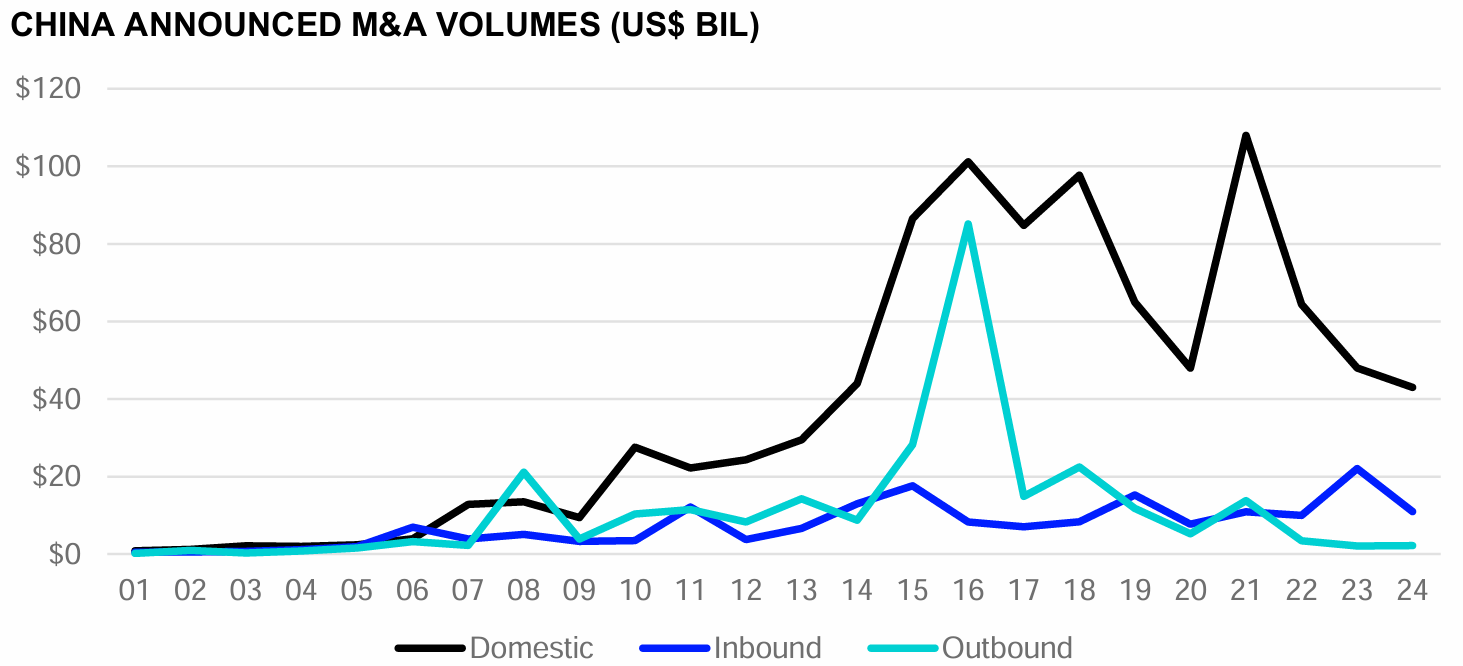

The overall M&A activity involving China fell to a decade-low of US$60.3 billion during the first three months of the year, down 18% year-on-year. The number of announced deals declined 22%, making it the slowest start to a year since 2013.

Target China M&A fell 23% to US$54.0 billion, while domestic M&A declined 10.5% to US$43.0 billion.

Inbound M&A activity was down 50.2% at US$11 billion, but outbound M&A saw a 3.4% uptick with US$2.2 billion worth of deals.

Source: LSEG, China Investment Banking Review

Source: LSEG, China Investment Banking Review

In terms of sectors, consumer products and services captured 23% of the deal-making activity involving China, jumping 156.8% to US$13.9 billion during the period. Industrials accounted saw a 19.1% market share with deals falling 41.1% to US$11.5 billion.

High technology took third place with a 14.5% market share worth US$8.7 billion, up 37.9% compared with the year-ago quarter. China International Capital Corp (CICC) currently leads the M&A league tables covering deals with China involvement, capturing a 9.2% market share with a deal value of US$5.5 billion.

Equity, debt capital markets

China’s ECM raised US$7.4 billion in Q1 2024, down 82.9% from a year ago and the lowest first-quarter total since 2009. The number of ECM offerings fell 59.6% year-on-year.

Traditional initial public offerings from Chinese issuers fell to a decade low of US$3.1 billion, down 78.0% from a year ago, as the number of IPOs dropped 60.7% year-on-year. China-domiciled companies raised US$3.4 billion via follow-on offerings, marking an 84.8% decrease from a year ago. Convertible offerings raised US$934.3 million, down 86.8%.

Chinese issuers from the industrials sector accounted for 29.8% of the ECM market share, with proceeds falling 79.1% to US$2.2 billion during the period. High technology fell 81.5% from a year ago to US$1.8 billion, capturing a 24.4% market share. Materials sector rounded out the top three with 11.02% market share, down 74.3% year-on-year. CITIC leads the China ECM underwriting with US$1.2 billion in related proceeds and a market share of 15.8%.

Primary bond offerings from China-domiciled issuers raised US$742.5 billion in Q1 2024, up 2.7% year-on-year.

Government entities accounted for 43.2% of the market share with proceeds falling 18% to US$320.7 billion. China companies from the financials sector captured a 33.0% market share, and raised US$245.1 billion, up 27.5% from a year ago. Industrials accounted for 10.8% of market share and raised US$80.5 billion, a 30% increase from a year ago.

CITIC takes the lead in the China bonds underwriting league table with US$61.1 billion in proceeds or a market share of 8.2%.