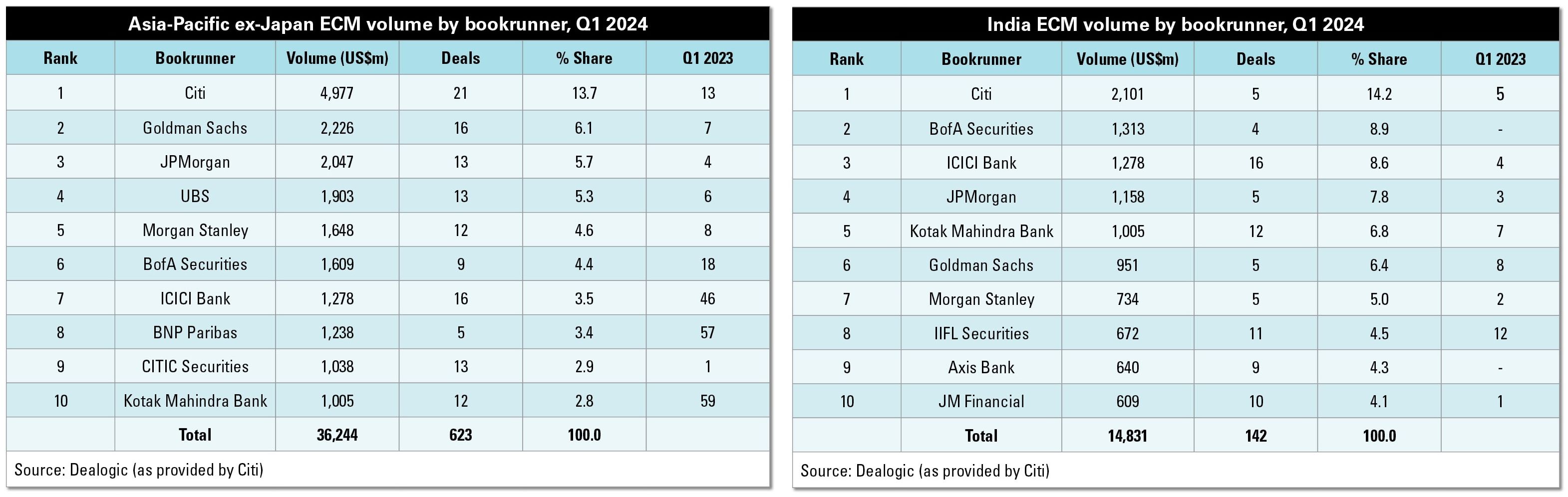

Citi emerged as the top underwriter for equity capital markets (ECM) in Asia ex-Japan for the first quarter of 2024, continuing the strong momentum built in 2023. At the end of Q1, Citi commanded a total issuance volume that was double that of its next closest competitor, according to data from Dealogic.

Citi has led the majority of the largest transactions year-to-date across Asia markets, successfully executing and pricing a combination of domestic and cross-border block trades, real estate investment trusts (Reits), global depository receipts (GDRs), American depositary receipts (ADRs), and convertible bonds.

Notable transactions over this period included the US$ 2.1 billion block trade by British American Tobacco (BAT) in ITC Limited, the US$2 billion combination block trade for Hana Bank, the US$1.1 billion block trade by Tata Sons in Tata Consultancy Services (TCS) and the US$689 million GDR for GlobalWafers.

“We continue to see increased activity levels and have a strong pipeline of transactions waiting for the right windows to come to market,” says Udhay Furtado, head of Asia North/Australia and Asia South ECM origination and solutions at Citi. “Investors continue to pivot to growth, and the Asia region outperforms in this regard across several sectors and thematics.”

In India, ECM issuance activity is at record levels since the beginning of the year, with the country hitting US$14 billion of deal volume in Q1 2024, making it the second busiest country globally after the United States. Citi also took the top spot as the leading ECM underwriter in India during the period.

“Asia-Pacific ECM issuances continue to remain robust, particularly in markets such as India, Korea, and Taiwan which accounted for the bulk of the Asia deal volume in Q1. Citi’s pan-Asia footprint and on-ground expertise and capabilities have helped us stay ahead of the subdued market environment and capture wallet share across the region,” says Kenneth Chow, head of Asia North/Australia and Asia South ECM origination and solutions at Citi.