The oil and gas sector was the sector of choice for two in five Asian G3 bond investors six months ago. Going into the second half of the year, investors still hold this view, however, they do not expect the levels of outperformance that they saw in 2016.

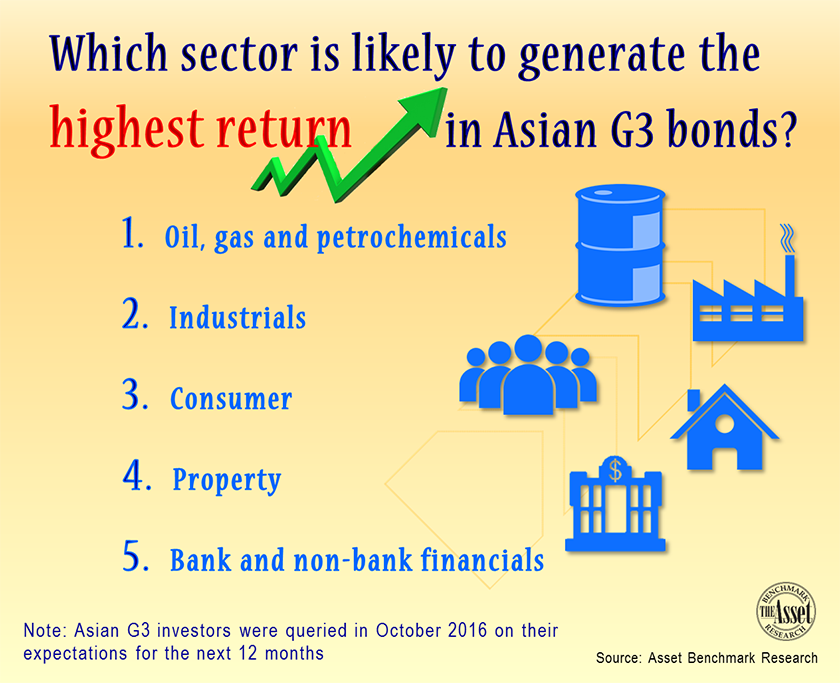

Asset Benchmark Research (ABR) in October of last year asked investors to rank which bonds would generate the highest return in the next 12 months, in terms of sector. Oil, gas and petrochemicals topped the list, followed by industrials, consumer, property and finally bank and non-bank financials.

“It was a reflation trade,” says a Singapore-based fund manager at a global fund house. “If you looked at PPI (Producer Price Index) numbers around Asia, they started to look much better in Q3 2016.” He explains that the positive economic fundamentals drove the interest in oil and gas as well as industrial sectors.

A Hong Kong-based CIO of a China fund house also cited the oil price recovery as a booster. “The oil price was still low at that time, so that would be the focus over the next 1 to 2 years. People thought the oil price would bottom-out.”

On the other hand, Asian investors were bearish on the property sector, which has been a high performer in previous years. “We’re at the peak of the cycle,” a senior portfolio manager at a global investment management firm based in Hong Kong explains, “The Chinese property sector might face some headwinds going forward because of the tightening policies, the capital controls”. She suggests the regulatory constraints could cause property prices to drop this year, impacting developers.

Bank and non-bank financials were also out of favour. The Singapore-based portfolio manager was vocal about the abundant supply. “I still feel the banking paper and financial paper will continue to underperform just because of technicals; that this is the sector that will issue the most paper.”

Going forward Asian investors are still bullish on oil and gas however they expect some moderation in those trades. “I still feel that just because they are the higher yielding bonds, I don’t think that they should be selling off a lot,” says the portfolio manager based in Singapore. The CIO in Hong Kong was also positive: “I think [my choices are] pretty much the same, because the oil price is still pretty low right now. Other sectors are relatively less juicy.”

Despite this, the senior portfolio manager based in Hong Kong was quick to point out that in the current environment of tightening spreads in the Asian G3 bond market, the returns are likely coming from carry trades over capital gains. “Everything is so expensive now. If you find a stable credit, it’s likely coming from carry,” she says.

Methodology

The Asian G3 Bond Benchmark Review, now in its sixteenth year, was conducted in the third quarter of 2016. A total of 352 Asian G3 bond investors including asset managers, hedge funds, private banks, insurance funds and commercial banks from Hong Kong, Singapore, the rest of Asia, UK/Europe and the US took part.

Data sets include market penetration, market share/wallet share, buying criteria/client satisfaction, research content and the top individuals. Follow-up interviews are conducted with a selection of respondents in each market to provide qualitative data. To learn more about the Asian G3 Bond Benchmark Review please click here.

Additional reporting by Jacky Fung