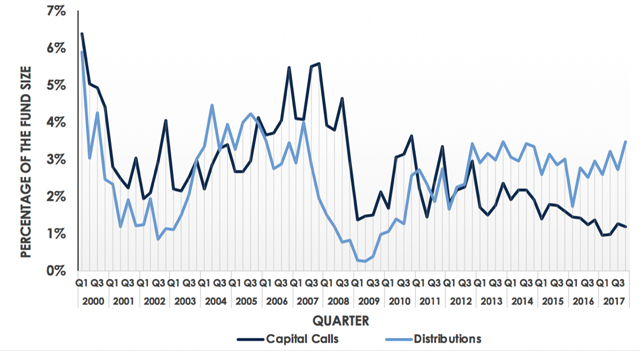

Private equity fund distributions have outweighed capital calls by a significant and striking degree over the past five years, according to data covering 4,000 funds globally.

Research from eFront, one of the world's leading alternative investment management software and solutions providers, reveals that since the start of 2013, distributions from private equity funds have remained at historically high levels, while capital calls have fallen steadily to their lowest level on record, when measured as a proportion of committed capital.

Key research findings:

- Global private equity distributions have exceeded capital calls significantly for the past five years.

- Positive net distributions even accelerated in 2017, possibly leading to significant funds commitments in 2018.

- The current phase is exceptional in its duration and the size of the gap (see graph).

- Strikingly, the pace of capital deployment - measured as a proportion of committed capital - is slower than during the worst of the 2007-09 crisis.

- This slow deployment indicates investment discipline by fund managers, and signifies a build-up of dry powder.

- This could translate into a further extension of investment periods for active funds.

- Since 2014 capital calls have remain below the lowest point of 2009 and are minimal since 2015.

Many analysts insist cash flows are of particular importance in private equity, as they provide an unbiased perspective on the dynamics of the sector. While the balance has shifted between capital calls and distributions over the past two decades, from 2013 onwards distributions have significantly and durably exceeded capital calls.

If net distributions are assumed to be a reliable and valid proxy for short-term fund commitments, then the record net distributions of 2017 foretell significant commitments in 2018. This assumes that fund managers will raise large funds able to accommodate this cash inflow.

Global private equity capital calls and distributions by quarter

Source: eFront INSIGHT, As of Q4, 2017

Source: eFront INSIGHT, As of Q4, 2017

"Capital inflows in private equity are driven by the dynamics of asset allocation, but also by capital distributions that are reinvested in the sector. Net capital distributions could in effect be an early indicator of the future dynamics of fund raising, assuming that fund investors do not divert them to direct investments, secondaries or other asset classes," comments Tarek Chouman, CEO of eFront.

The current phase is exceptional in its duration and the size of the gap: five years of significant net distributions. This has three consequences. First, there is a significant amount of capital distributed that can be reinvested in funds. Second, and even more strikingly, the pace of capital deployment is even slower than during the worst of the 2007-09 crisis. This is clear evidence of discipline in capital deployment by fund managers, and of a build-up of dry powder. This could translate into a further extension of investment periods of active funds, or fund size reductions.

Third, private equity portfolios are actually contracting, a fact that is counter-intuitive and seems to contradict the widely reported increase of assets managed by private equity funds. The reason revolves around 'residual value'. Assets under management are the sum of the dry powder and the residual value of portfolios. These portfolios are largely marked-to-market to reflect their fair market value. Portfolio companies are quarterly assessed in comparison with their listed peers. As listed stocks have seen a continuous increase in value over the course of the last nine years, the value of assets in portfolio also increased. This phenomenon masks a more muted contribution of new assets to the increase of portfolio valuation.

In addition, calls and distributions do not track exactly the same cash flows. Capital calls include management fees, for example. At times, capital calls might give the impression that investments are higher than they are. Distributions embed performance. Therefore, the gap between capital calls and distributions cannot immediately be used to assess the actual shrinkage of private equity portfolios, but the fact that the gap is significant and lasting leads to this conclusion.