A new HSBC-commissioned report has highlighted high levels of anxiety over lack of financial wherewithal of parents in supporting their children through tertiary education.

Nevertheless, Singaporeans have the highest proportion (on a per capita basis) of tertiary graduates in the world.

HSBC's just-released Value of Education research reveals the attitudes and behaviours towards education amongst more than 10,500 parents and children globally, including more than 500 Singaporeans. HSBC claims the insights gleaned from the research back up the outlay of a new product line to meet the education needs of Singaporeans.

The key findings from the report are:

· Parents in Singapore contribute on average US$26,377 towards their child's tertiary university education - almost double the global average and behind only Hong Kong and UAE.

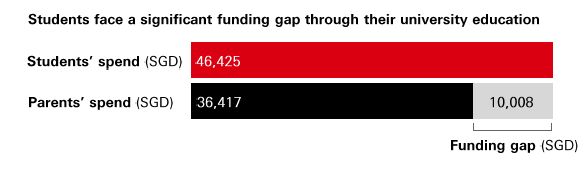

· Singapore students spend on average US$33,625 over the course of a degree which is US$7,248 above what their parents are contributing.

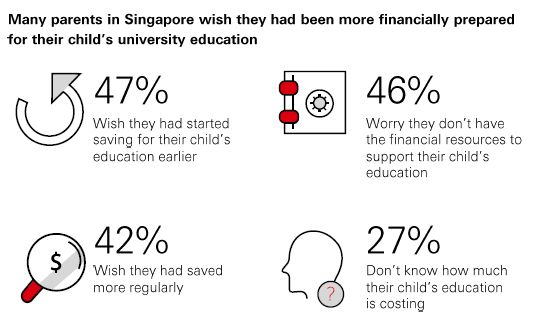

· 47% of Singapore parents (49%-Global) wish they had started saving earlier for their children's education while one in two parents (46% vs 48%-Global) worry they do not have the financial resources to support them.

Anurag Mathur, head of retail banking and wealth management, HSBC Bank (Singapore) comments, "Singaporeans place a premium on their children receiving a university education, and they're prepared to pay for it. We have been building our platforms, solutions and capabilities to help Singapore parents and students fund their future – and more is to come."

In addition to the recently launched endowment savings plan, Savings Protector, which supports the early planning of a university education, HSBC Singapore will soon introduce the following:

· FX App: Enabling parents to actively manage and plan on the go for their mid- to long-term foreign currency and remittance needs. This is particularly important, especially if their children are considering an overseas education.

· Multicurrency Debit Card: Enabling HSBC customers to transact in nine different currencies without being subject to exchange rate margin. Offering cashless and contactless payments, it is particularly useful to those planning to study overseas.

The report also revealed six out of ten Singaporeans between 25 and 29 years old completed tertiary education.